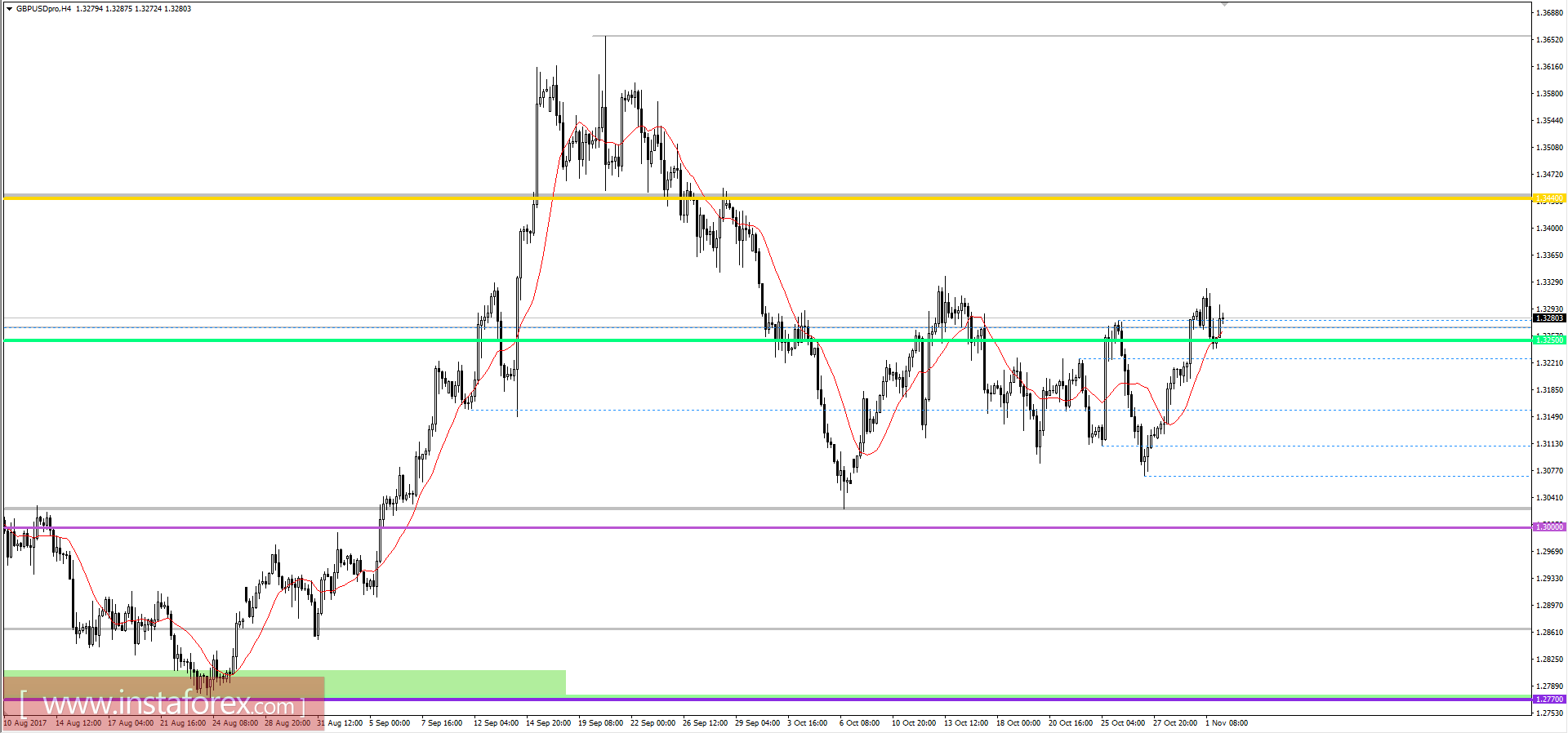

The main event of the day is the BoE meeting on monetary policy. At the moment, everyone expects that the British central bank will raise the refinancing rate from 0.25% to 0.50%. Basically, such forecasts are based on high inflation, which continues to grow and has already reached the level of 3.0%. Also, do not forget about the labor market, since the unemployment rate is at 4.3%, which is a very low indicator. Indeed, if you look at these parameters, the Bank of England needs to hike the refinancing rate. However, do not disregard concerns regarding the impact of Brexit, which is repeatedly expressed by representatives of the Bank of England, and the UK Government. Moreover, last week the ECB extended the program of quantitative easing for another nine months. Therefore, the Bank of England may continue to maintain a very cautious policy with an eye on the European Central Bank, which is not intent on tightening its monetary policy.

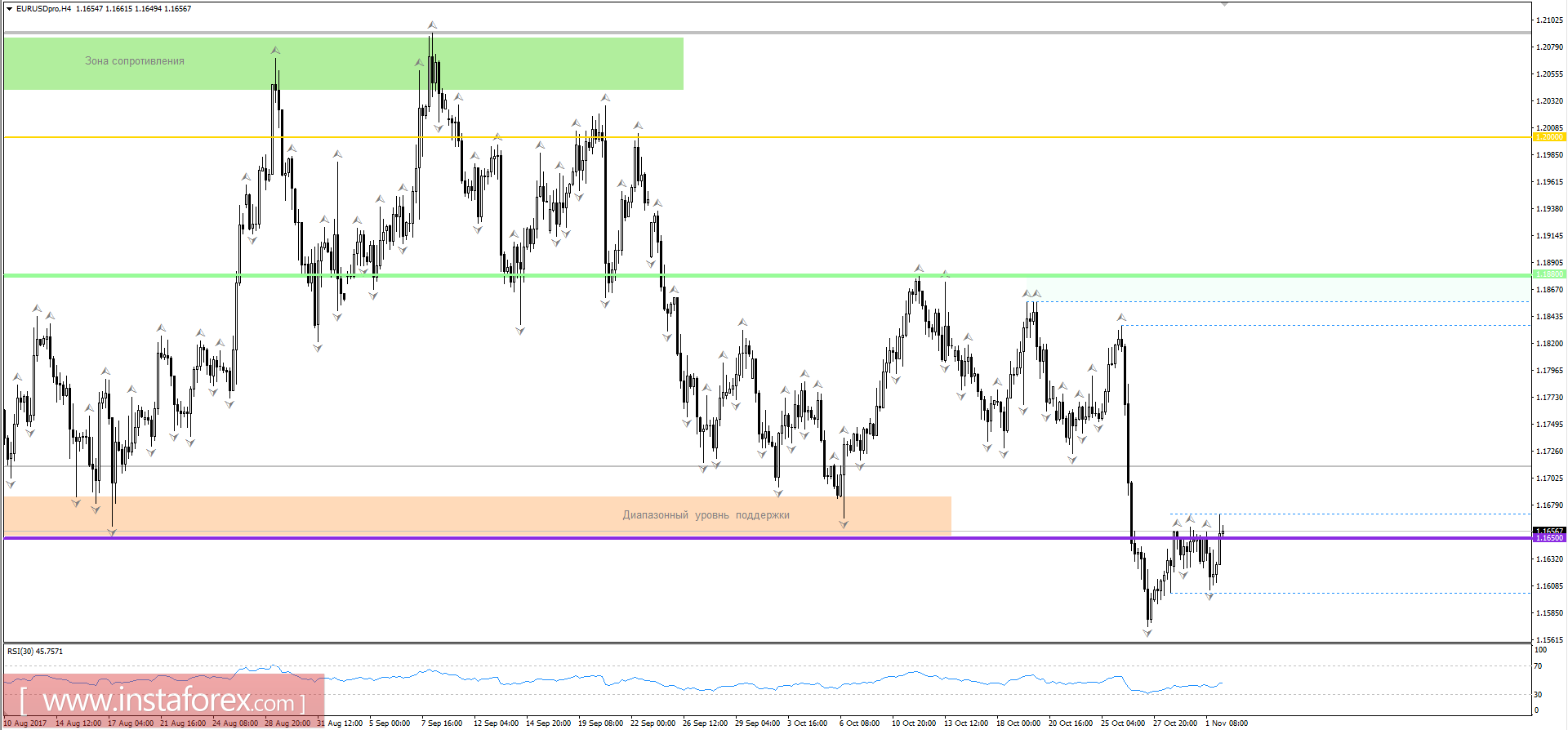

If the Bank of England raises the refinancing rate, then the pound/dollar pair will rush towards the 1.3440/1.3480 range. The pound will pull itself along with the single European currency, which will lead to its growth towards 1,1700.

If the Bank of England continues to waver at a higher rate, then the pound's price will fall to 1.3150. However, in this case, the euro will not be too affected, since it was significantly affected by the recent decision of the ECB to extend its quantitative easing program and as a result we will continue moving in the range of 1.1670/1.1610.