The euro rose against the US dollar today during the Asian session after yesterday's the statement of the Fed. Investors and traders did not find a single hint that there will be an interest rate hike in the US for December of this year.

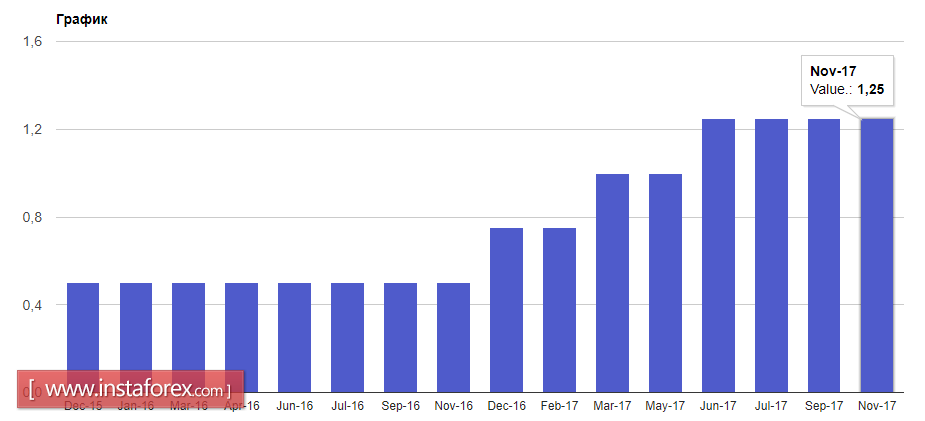

As a result of a two-day meeting, the Federal Reserve System of the USA left the range of interest rates on federal funds unchanged between 1.00% and 1.25%. This decision was taken unanimously. The discount rate was also left unchanged at 1.75%.

As for the statements, the regulator expressed concern over the level of inflation. In their view, inflation in September of this year was under increased pressure due to the hurricane-related rise in gasoline prices. Meanwhile, inflation remained low-key without taking into account food and energy prices.

The labor market continues to provide good support for the country's economy. According to the Fed, the situation on the labor market has continued to improve and household expenditures continue to grow at a moderate pace.

The committee expects that with a gradual increase in the key rate, the economy will grow at a moderate pace. However, the effects of hurricanes and reconstruction work will affect the economy, employment, and inflation in the short term.

As for the technical picture of EUR / USD, we can count on further growth only after a real breakdown and consolidation above the resistance level of 1.1665, which is now being emphasized by many players. A breakthrough of this level will lead to the demolition of a number of stop-orders of sellers, which will be confirmed by an upward impulse in the pair and will allow correction to the area of 1.1700. In case of another unsuccessful attempt to go beyond the weekly highs, the pressure on the euro may increase, which will lead to the return of the trading instrument in the support range of 1.1615.

All attention will be focused on the decision of the Bank of England today. Many experts and traders expect that the regulator will raise the interest rate by 0.25 points, to 0.50. If this happens, the upward movement in the pound may continue, which will lead to the renewal of monthly highs and growth beyond the large resistance boundary of 1.3340 to areas 1.3450 and 1.3560.

If the Bank of England leaves the rates unchanged, then the fall of the British pound is inevitable. It is also important to pay attention to the speech of the Governor of the Bank of England, Mark Carney and the report on inflation.