As expected, the outcome of the Fed meeting was not a decision on the rates. They were left at the previous levels. However, what was important was the confirmation by the American regulator of the desire to further raise interest rates. Another important event to which attention should be paid to is the publication of data on the number of new jobs from ADP, which exceeded all forecasts and expectations.

Financial markets did not actually react to the results of the Fed's meeting on monetary policy. They took it as a necessary, expected event. However, the figures for the number of new jobs came out much stronger than forecasts, showing an increase of 235,000 new jobs against the consensus forecast of growth of 200,000. The previous was adjusted to a downward value of 110,000.

The published data showed that the labor market in the US, at least in its private sector, was not affected by the blows of three hurricanes that hit the States in September this year. Even in October it showed significant growth. It can be assumed that Friday's data from the Ministry of Labor will also prove to be strong. If they show the expected growth, according to the consensus forecast of 310,000, then this will be a strong signal for the US stock market indicating that the labor market has not suffered. On this wave, the upward dynamics of the shares may continue and the US dollar will get support.

Today, the focus of the market will be the result of the Bank of England's meeting on monetary policy. It is expected that the regulator will raise the key interest rate by 0.25% to 0.50%. This will be a positive stimulus for the British currency. However, all this "joy" may stop if the British Central Bank informs in its resolution that they should not expect their further growth in the near future following this rate hike. In his comments, the head of the bank, M. Carney, confirmed this probability. As such, we should expect the sterling to turn down in relation to the major currencies.

However, in this case, it is not advisable to hope for its significant weakening. This is because the possible positive news on solving the Brexit problem, as well as economic recovery, and high inflation will force the Bank of England to keep in mind the decision to further raise the cost of borrowing.

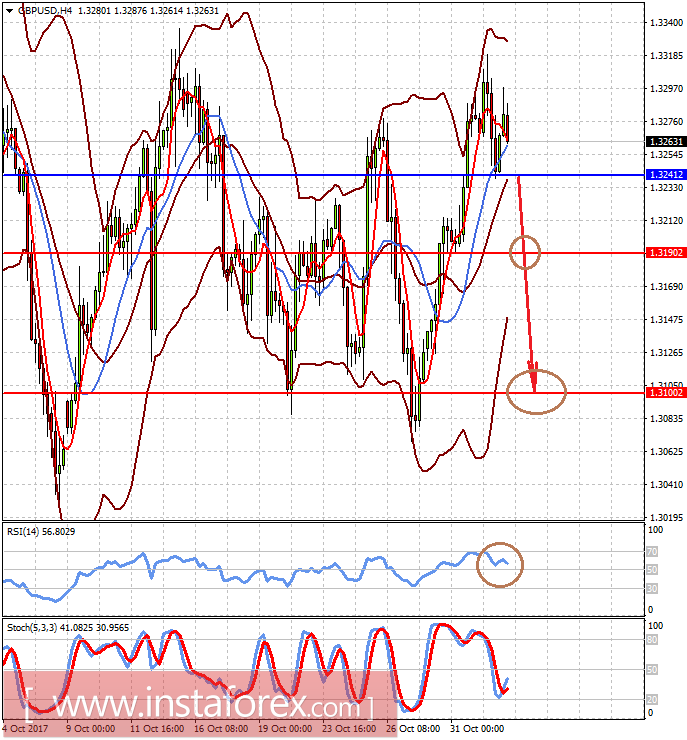

Forecast of the day:

The GBPUSD pair is consolidating in anticipation of the outcome of the BoE meeting on monetary policy. The decision to raise the stake will be the local basis for the pair's growth, and the news that further increase should not be expected in the future will put pressure on the pair. This cause it to turn down and fall first to 1.3190, and then, probably to 1.3100.

The USDJPY pair can continue the upward trend on the expectation of positive data on employment in the US, as well as the appointment of a new head of the Fed. Against this background, the pair may rise to 115.00 after overcoming the level of 114.35.