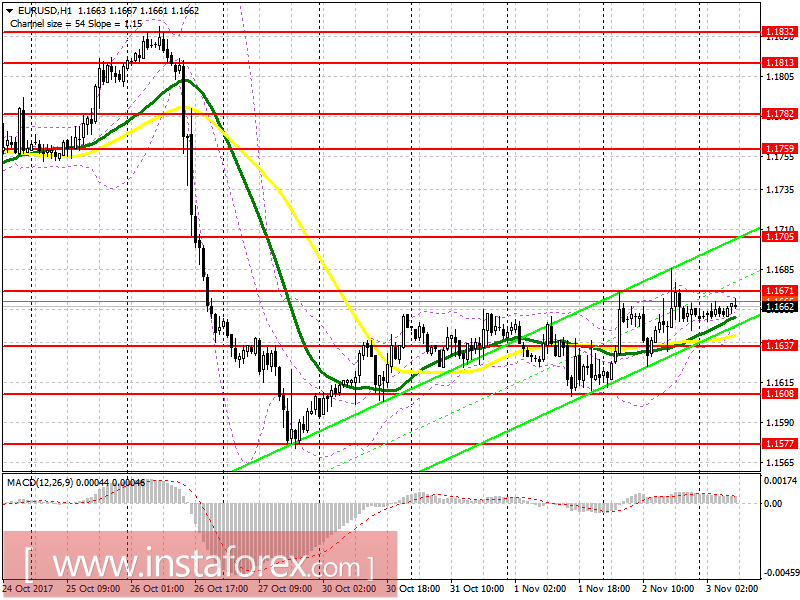

EUR/USD

To open long positions on EURUSD, it is required:

Boundaries changed slightly again, but the picture as a whole did not. The fastening at 1.1671 may prompt buyers to update the highs around 1.1705, where it is recommended to lock in profits in the morning. In the case of unequal growth, the level of 1.1671, and the return under it, it is the best to return to buying the euro after declining to the support area 1.1637, when forming a false breakdown there, or on a rebound from 1.1608.

To open short positions on EURUSD, it is required:

While the trade is below 1.1671, we can expect a decline in the euro. Sellers will also be on the formation of a false breakout and return to the level of 1.1671, which will be an additional sign to increase short positions. This will lead to the sale of the euro with the test 1.1637, and the consolidation below this level will collapse the EUR / USD in the area of 1.1608, where today it is recommended to lock in profits. In the case of growth above 1.1671, returning to selling euro can be done after updating 1.1705 or on a rebound from 1.1759.

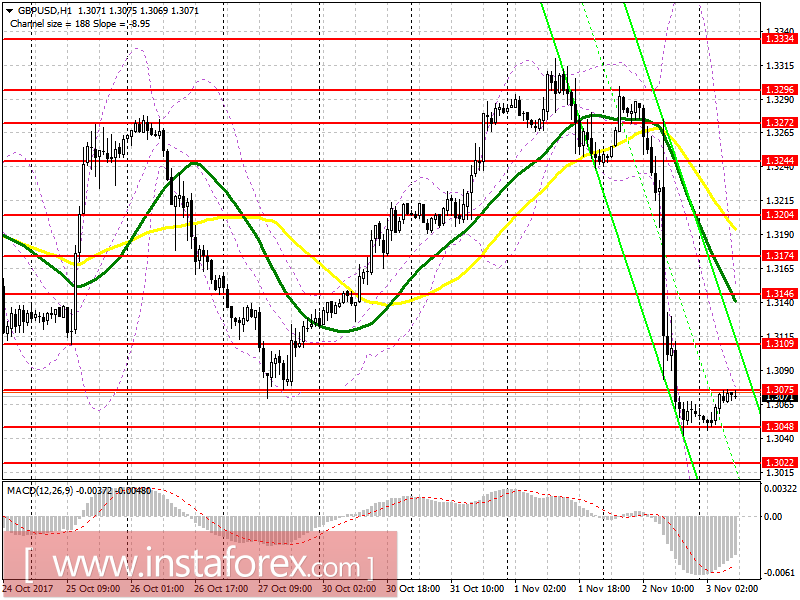

GBP/USD

To open long positions on GBPUSD, it is required:

On the pound, divergence can be formed on the MACD, so it is advised to closely monitor the update level of 1.3048, the formation on which a false breakdown will be a signal to buy for an increase above 1.3075 and return to 1.3109, where it is recommended to record profits. In the case of a break below 1.3048, it is best to go back to buying after upgrading 1.3022 or on a rebound from 1.2996.

To open short positions on GBPUSD, it is required:

The steadying below is 1.3048 and 1.2996, where it is recommended to lock in profit. Unsuccessful increase above 1.3075 with a return to this level will also be a signal to the pound's selling. Otherwise, one can open short positions at once on a rebound from 1.3109.

Descriptors

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20