The euro made another attempt at growth against the US dollar after the release of data on the labor market, which did not meet the expectations of economists. However, the US dollar suddenly returned to its positions, not allowing itself to get out for key weekly resistance levels.

According to the report of the US Department of Labor, the growth rate of employment rose in October this year following the weak data for September. The revised data for the first month of autumn indicated that the labor market was better in enduring the consequences of natural disasters than initially expected.

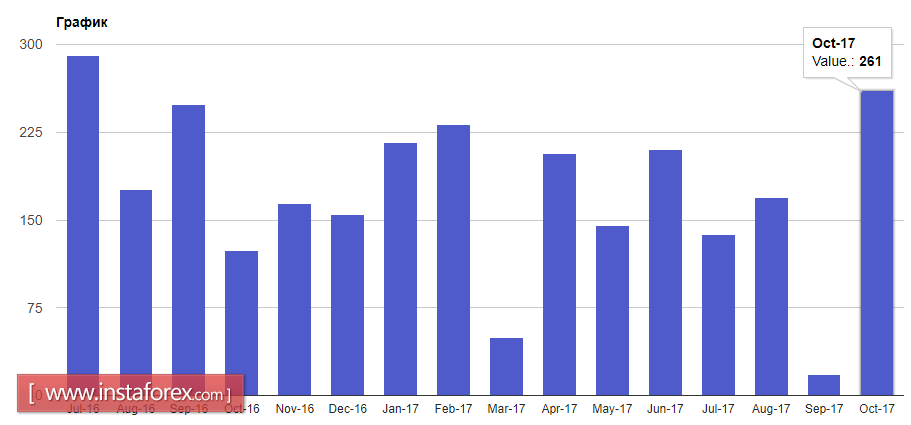

Thus, the number of jobs outside of US agriculture in October 2017 increased by 261,000, while economists expected that the number of jobs in October would increase by 315,000. The unemployment rate fell to 4.1%, while economists expected it to remain unchanged at 4.2%.

In regards to wages, compared with the previous month, there has been a slowdown, but compared to October 2016, the growth was 2.4%.

The deficit of US foreign trade grew in September this year. The jump occurred due to the growth of imports to the highest level since January this year.

According to the report from the US Department of Commerce, the deficit of foreign trade in goods and services in September increased by 1.7% compared to the previous month and amounted to 43.50 billion dollars. The data fully coincided with the forecasts of economists.

As I mentioned above, growth was due to an increase in imports of 1.2%, while exports rose by only 1.1% compared to August.

As for the current technical picture of the EUR/USD pair, it remained unchanged from the morning forecast.

However, it remains a problem for buyers of risky assets to get beyond the level of 1.1665, which was not possible even after the release of a weak report on the labor market. Only a breakthrough in this range will allow an upgrade of 1.1705 and 1.1750. A break in the middle of the channel around 1.1640 could lead to a quick selloff of the trading instrument with a return to weekly lows to 1.1600 and 1.1570.

The British pound managed to slightly strengthen its positions against the US dollar on Friday following the release of good data, which indicated the growth of activity in the service sector of the UK.

According to a report by IHS Markit Ltd., the purchasing managers' index for the services sector rose to 55.6 points in October from 53.6 points in September. Economists predicted a decline in the index to 53.4 points.