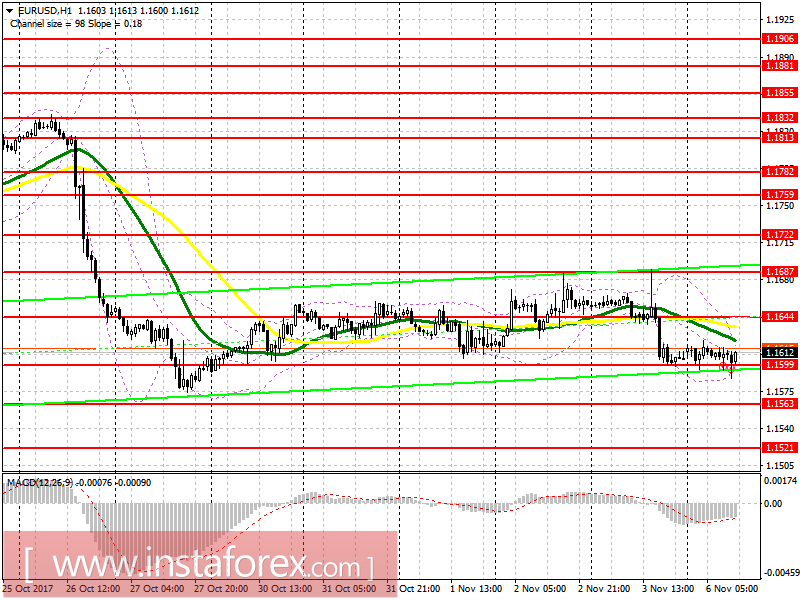

EUR/USD

To open long positions for EURUSD, it is required:

Buyers managed to get ahold of the level of 1.1600, but a sharp demand for the euro has not been seen. The main goal continues to be a restoration of the area of 1.1644, where I recommend locking in profits. An output higher than this level can lead to a larger upward correction to the range of 1.1687. In case of a decline below 1.1600, I recommend to go back to the rebound from 1.1563 for buying.

To open short positions for EURUSD, it is required:

Sellers need to break below 1.1600, which will lead to further movement along the trend towards the lower border area of the channel at 1.1563 with an update of 1.5121, where I recommend locking in profits. If the euro rises in the second half of the day, selling would be best considered after an unsuccessful fastening to 1.1644 or a rebound from 1.1687.

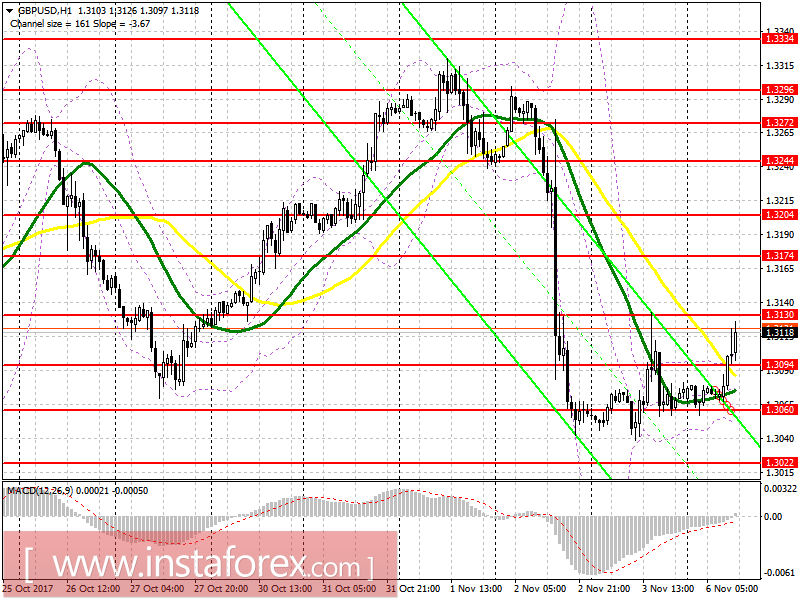

GBP/USD

To open long positions for GBP/USD, it is required:

Buyers completed the morning plan for the move towards the area of 1.3130. At the moment, it is best to consider new long positions after a decline and re-test at 1.3094 or after steadying at 1.3130, which will open a good opportunity to restore the GBP/USD pair in the resistance area of 1.3174.

To open short positions for GBP/USD, it is required:

Sellers will try not to allow growth above 1.3130, and the formation of a false breakdown in this area can return large players to the market. This will lead to a downward correction of the GBP/USD pair in the support area of 1.3094 with an exit at 1.3060 by the end of the day, where I recommend locking in profits. In case of growth above 1.3130, you can sell the pound for a rebound from 1.3174.

Indicator description

- Moving Average (average sliding) 50 days - yellow

- Moving Average (average sliding) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA

- Bollinger Bands 20