EUR / USD, GBP / USD

On Monday, all eurozone economic indicators came out better than expected, but the single European currency was under pressure throughout the day and closed the day with a symbolic growth. Probably, the accumulated political burden resulted to a critical mass and continues to put pressure on the single currency. The most recent "problem" is the losing party of Matteo Renzi, former Prime Minister of Italy, wherein the elections were held at Sicily. German industrial orders increased by 1.0% in September against the forecast of -1.0%. The final estimate of the Eurozone PMI services for October was 55.0 compared to 54.9 before. The European investor confidence index by Sentix for November increased from 29.7 to 34.0 with the expectation of 31.2. Euro area producer prices increased by 0.6% in September versus expectations of 0.4%.

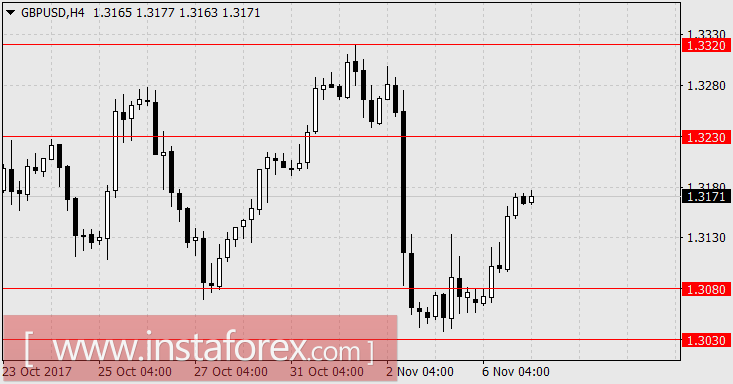

The British pound conducts a full correction using the vague phrases from Theresa May at the beginning of her constructive speech about EU economic sphere. Today, the retail sales data in the euro area for September will be released, with a 0.6% forecast against -0.5% in August. According to the United States, the number of jobs for September is 5.98 to 6.09 million versus 6.08 million in August. The volume of consumer lending for the same month is expected at 18.4 billion dollars, compared with 13.1 billion in August. In the afternoon (9:00 PM London time ), Mario Draghi will have his speech about changing the banking landscape in Europe, while Janet Yellen's brief speech for a social event is scheduled in the evening.

For the rest of the week, important economic data is not expected, except the UK industrial production on Friday. There will be a shorter working day in the US in connection with the national holiday. We believe that the correction of counter-dollar currencies is already complete and we are expecting for the euro in the range of 1.1485-1.1510 and the pound sterling is anticipated at 1.3030.

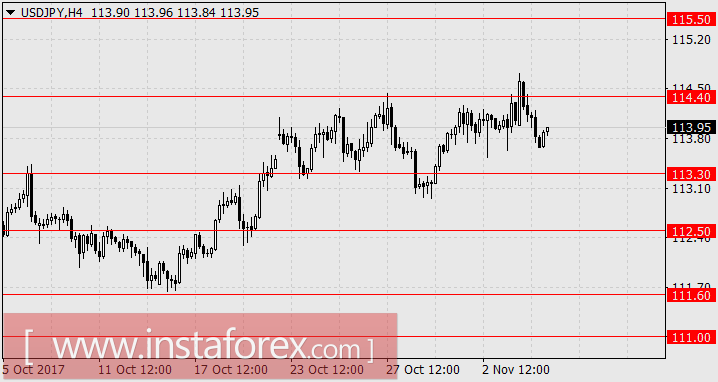

USD / JPY

This morning, Japan's Finance Minister Taro Aso announced Japan's refusal to enter into a bilateral free trade agreement in exchange for the US-backed Pacific Partnership. Outwardly, the matter is all about establishing the United States. The Japanese yen is considered the news with moderate growth. The average wage in Japan increased by 0.9% in September against the forecast of 0.6%. The speech was made by the Bank of Japan Governor Haruhiko Kuroda on Monday, prior to the business leaders, showed a neutral tone. He reiterated the remarkable thesis about the yield curve and target inflation rate. The Japanese Nikkei 225 index shows an impressive growth of 1.29% on the company's good economic reports. The American stock market is moderately optimistic as the growth of S &

Yields on Japanese government bonds went down sharply, hence, 5-year securities declined in three days from -0.097% to -0.127%, while the 10-year period is down from 0.055% to 0.025%. Business media reported sudden interest of foreign investors towards Japanese debt. Either way, you can partly learn from the subsequent report of the Bank of Japan and current trends can raise the yen to the 115.50 level.

* The presented market analysis is informative and does not constitute a guide to the transaction.