Today we are waiting for a very busy day. First, data on housing prices in the UK will be released, where its growth rates might accelerate from 4.0% to 4.5%. This will allow the pound to gain a foothold on the levels it has reached. Afterwards, the publication of data on retail sales in Europe, whose growth rates should increase from 1.2% to 2.7%. Such a rapid growth will allow the single European currency to slightly improve its position.

Nevertheless, in the second half of the day the dollar can resume its growth. On the one hand, this can be supported by data on the number of open vacancies, which might increase from 6,082 to 6,091 thousand. Furthermore, consumer lending should increase from $13.1 billion to $18.0 billion. On the other hand, the market anticipates Janet Yellen's speech for today, who will soon leave her post. Her speech can become parting words for the next head of the Fed and will be perceived as an instruction for action for the near future. Most likely, with a new head of the Fed, the policy of the regulator will not change in any way, which will add confidence to investors, and given that it is a matter of gradually tightening monetary policy, this will positively affect the dollar.

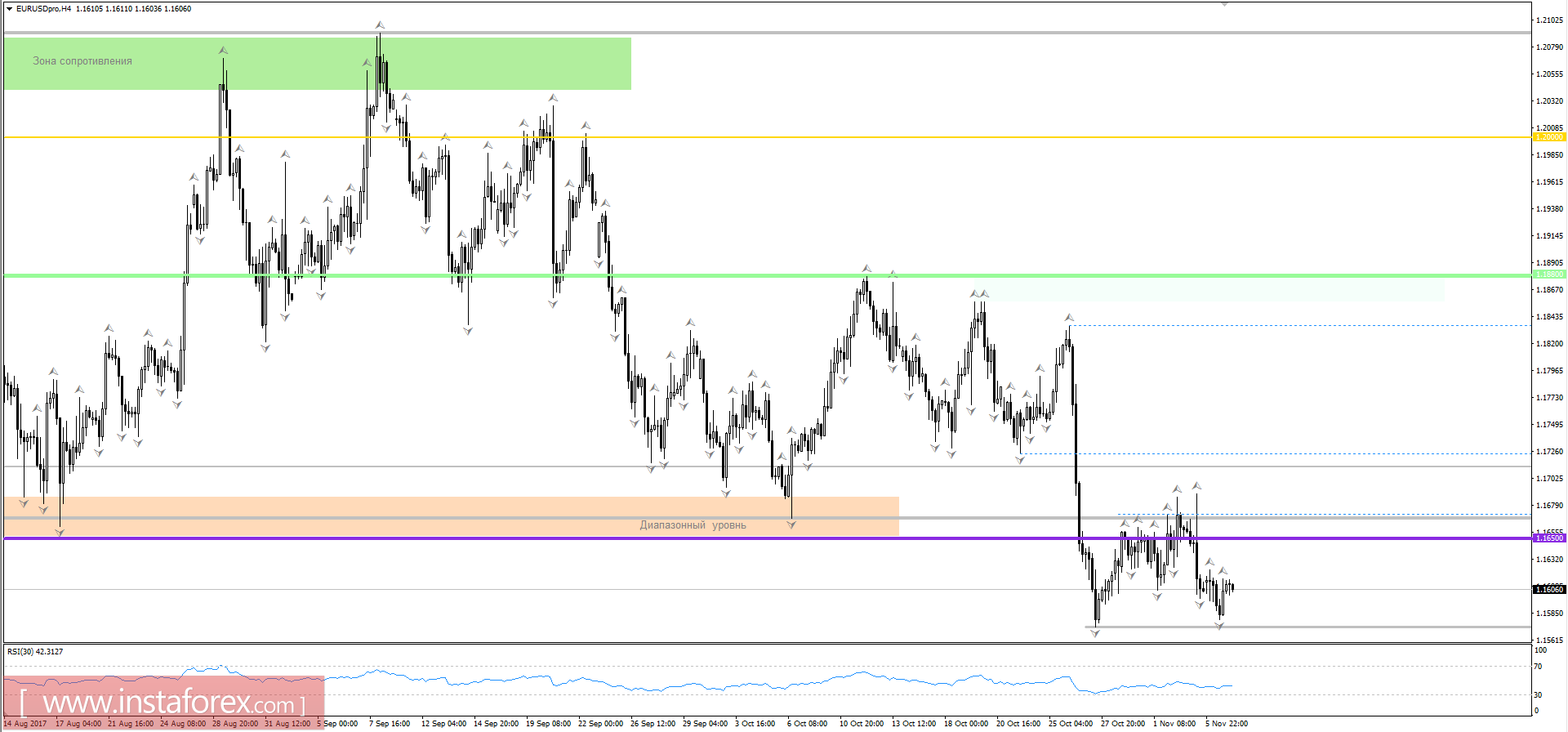

The euro/dollar currency pair, having approached the local low at 1.1573, experiencing temporary support, allowed the bulls to return to the market. However, the bearish potential remains on the market, which could result in the movement of 1.1553/1.1650 with the subsequent accumulation at the lower border (1,1573).

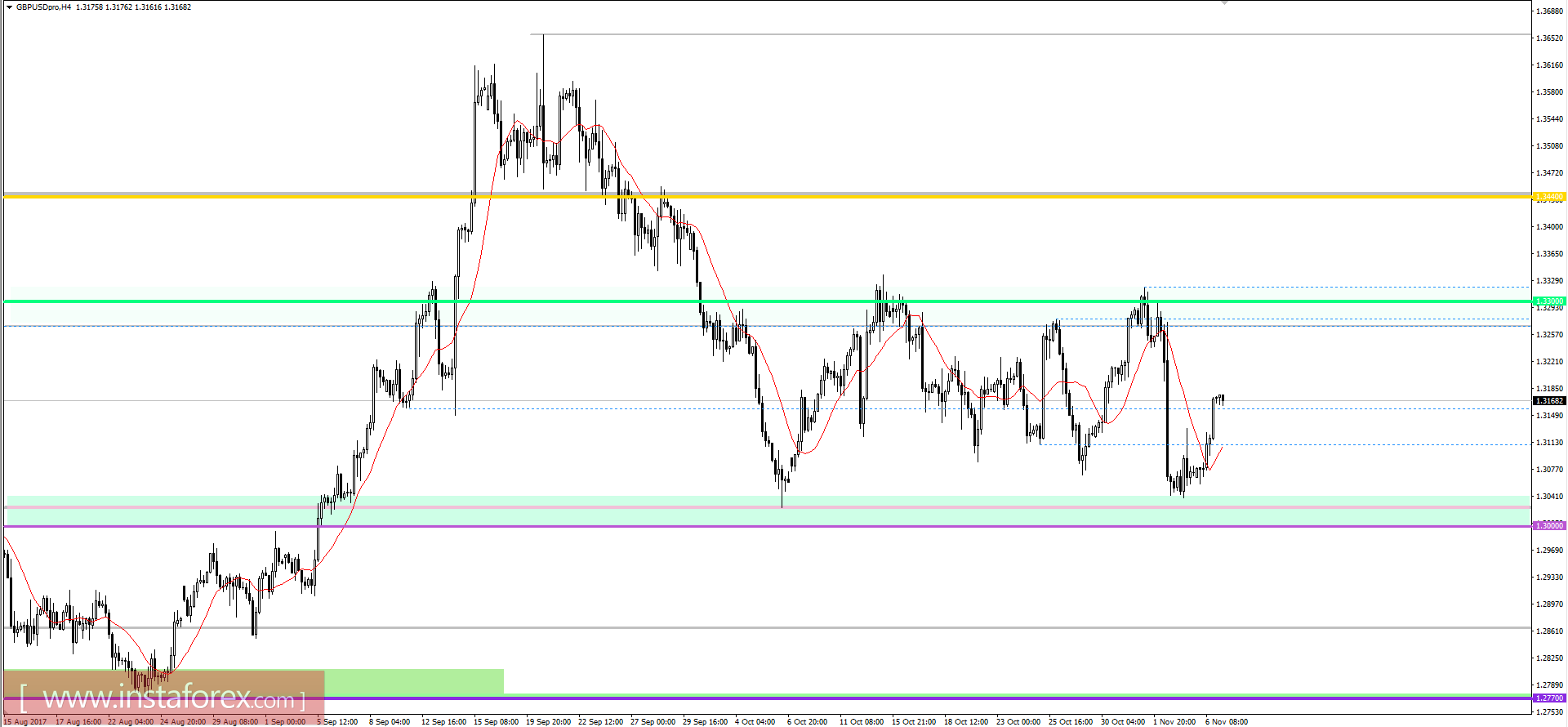

Since the beginning of the week, the pound/dollar currency pair has managed to adjust well, forming a crucial candle. It is possible to assume that the "bullish" potential will gradually decrease and is in the values of 1.3180/1.3200. We can expect a descending path of the direction at 1.3125 -> 1.3100.