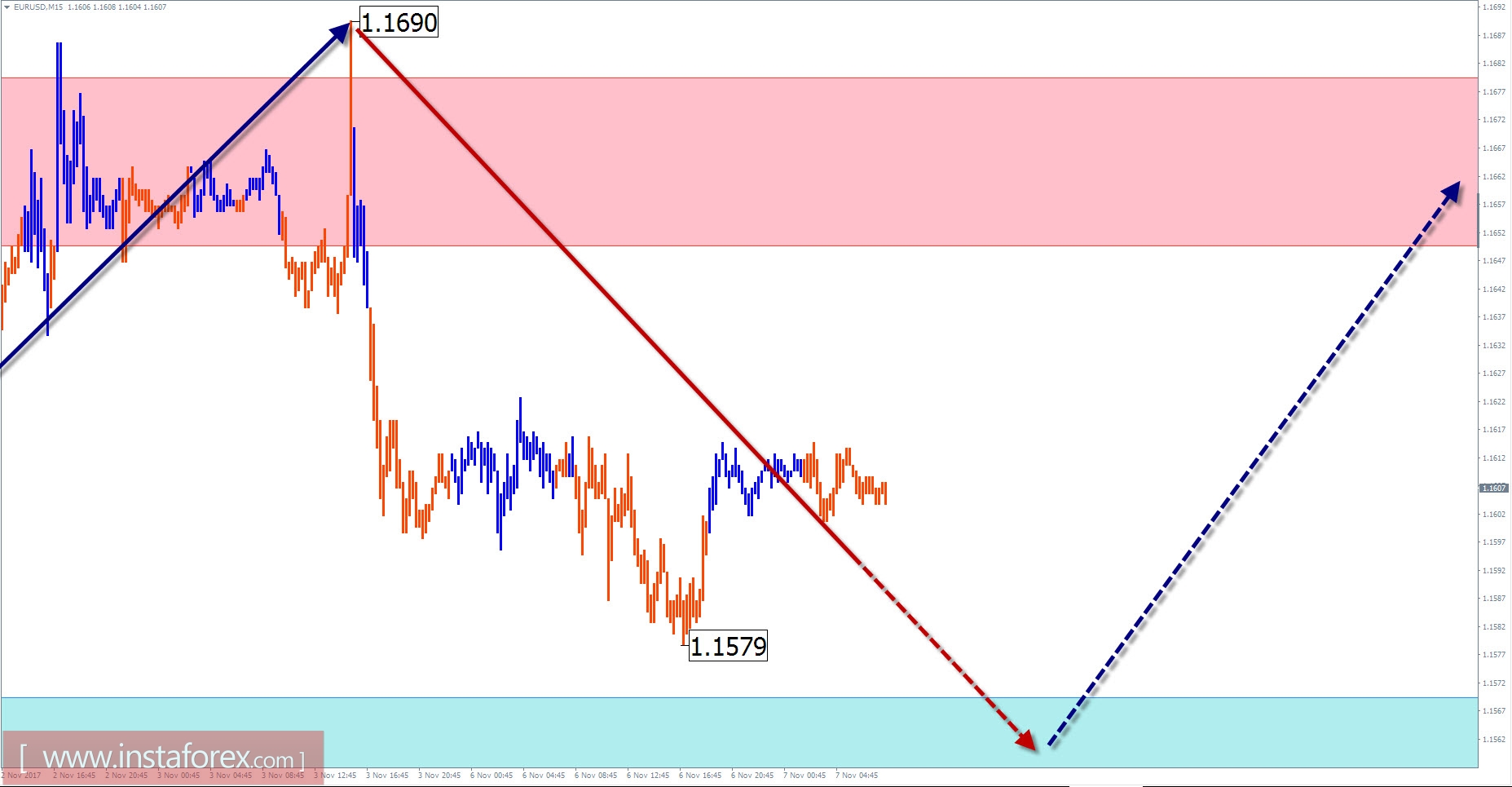

EUR / USD outlook for the current day

The price fluctuations of the major currency euro rate in the past years are determined by the process of developing the increasing expanded flat. Since December last year, the final part of the wave (C) has started to rise and it reached the estimated elongation level by the end of summer. The subsequent decline could become the first part of the reversal zigzag pattern. However, its low wave level indicates that the formation of the next section is lower than the correction.

Calculation of the target zone in the descending wave since September allows an expectation for a downward move before the completion of the price figure. Since October 27, the chart appears to have a small-scale rising wave suitable to the role of reversal zigzag pattern.

The inflation of the price movement is expected today. The price hike is projected at the end of the day. There is a high chance for the renewal of local low at the end of December prior the onset of the final phase of growth.

Boundaries of resistance zones:

- 1.1650 / 80

Boundaries of support zones:

- 1.1570 / 40

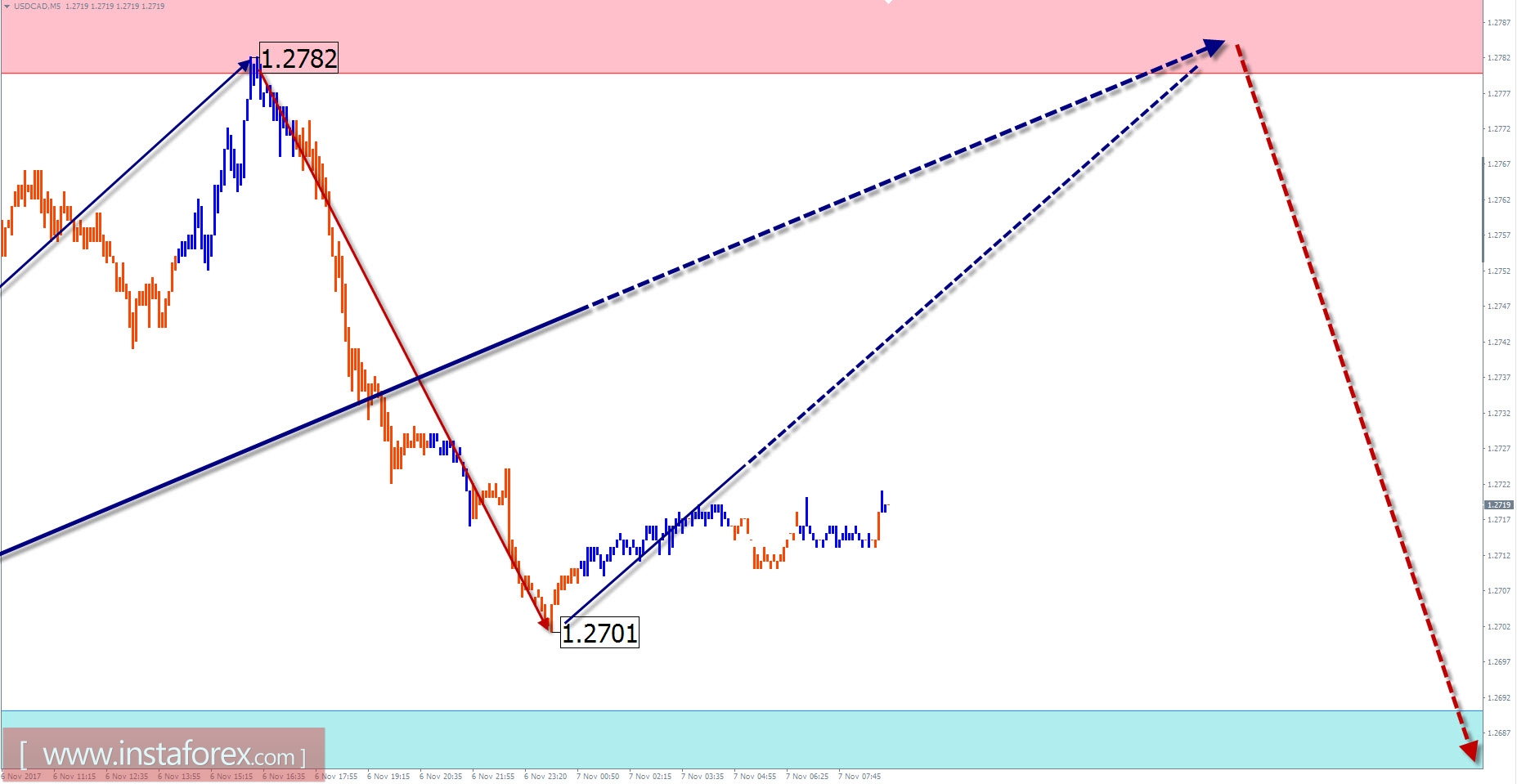

USD / CAD review with current day forecast

As shown in the daily scale chart of the major Canadian currency, the major trend of price movement is set by the bearish wave since January last year. Analysis of the wave pattern indicates an incomplete structure. The upper boundary of the preliminary target zone is in ten price figures below the current price level.

Since September 8, the ascending price segment formed the correction of the final trend wave expansion. The upside potential is close to exhaustion. The price in the past couple of weeks lies within the boundaries of large potential reversal zone. The price reduction last week could possibly be the first part of the reversal structure, before reversing the price of the descending rate.

Today, the most likely scenario of the movement will be "outset". Moreover, there is a high probability of an upward movement in the morning. Further price is predicted for a reversal and a decline.

Boundaries of resistance zones:

- 1.2780 / 1.2810

Boundaries of support zones:

- 1.2690 / 60

Explanations to the figures: For simplified wave analysis, a simple waveform is used that combines 3 parts (A; B; C). Of these waves, all kinds of correction are composed and most of the impulses. On each considered time frame the last and incomplete wave is analyzed.

The areas marked on the graphs are indicated by the calculation areas in which the probability of a change in the direction of motion is significantly increased. Arrows indicate the wave counting according to the technique used by the author. The solid background of the arrows indicates the structure formed, the dotted one indicates the expected wave motion.

Attention: The wave algorithm does not take into account the duration of the tool movements in time. The forecast is not a trading signal! To conduct a trade transaction, you need to confirm the signals of your trading systems.

* The presented market analysis is informative and does not constitute a guide to the transaction.