The Australian dollar reacted with a slight decrease to the decision of the Reserve Bank of Australia on interest rates, as well as on statements made by them.

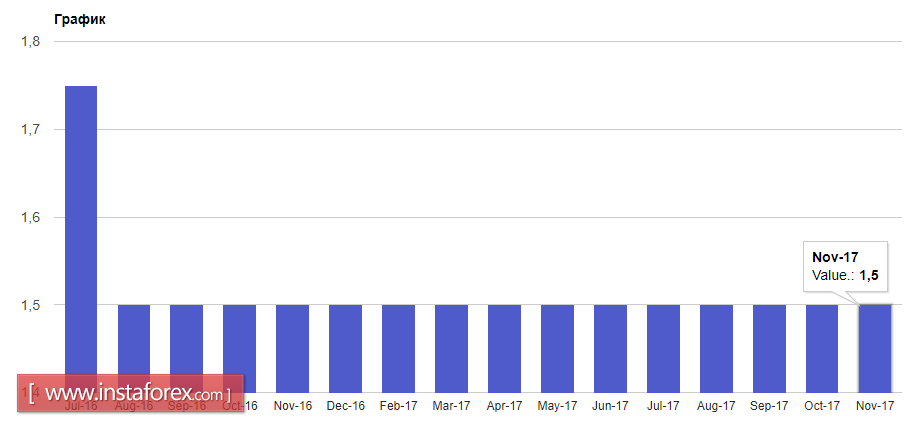

Today, it became known that the Reserve Bank of Australia will leave the key interest rate unchanged at 1.50%, saying that the current monetary policy corresponds to the target rate of inflation and economic growth.

The forecasts for GDP growth in Australia remained practically unchanged. Economists of the RBA expect an average annual GDP growth of about 3% in the next few years.

The low level of interest rates will continue to support the economy further, which will positively affect the conditions for doing business in Australia as well as lead to an increase in the utilization of production capacities.

As for the high rate of the Australian dollar, the RBA is still confident that the strengthening of the national currency will continue to restrain price pressure. A strong Australian dollar worsens the outlook for GDP and employment growth.

The regulator is concerned about the growth rates of wages, which are still low. It indicates that they remain uncertain about the prospects for consumer spending.

In general, the technical picture of the AUDUSD pair shows the likelihood of further decline in the trading instrument. A break at the lower limit of 0.7650 may lead to another quick sale of the Australian dollar with a test at the level of 0.7575 and an exit at 0.7520, where large buyers can return to the market. If it is below 0.7650 in the near future and does not gain a foothold, then there is an option for AUDUSD to rebound up and consolidation above 0.7740. This can strengthen the presence of large buyers and put the return of the Australian dollar in the areas of 0.7795 and 0.7905.

Today, the attention of traders and investors will be focused on the speech of European Central Bank President Mario Draghi. The comments of the head of the ECB can have a serious impact on the market, since any statements about the likelihood of a tightening monetary policy or further reduction of the asset buy-back program will lead to a sharp demand for the euro.

Near the end of the day, the head of the Federal Reserve Janet Yellen, will make a speech. This could clarify the further prospects of raising interest rates in December of this year. Given that in February of next year, the position of the head of the Fed will be taken by another person, Yellen may announce another tightening of monetary policy before her departure.

As for the technical picture of the EURUSD, the bears continue to push the euro down. A repeat test at the level of 1.1580 could lead to a breakthrough of this level and a fall in risk assets to new monthly lows in the area of 1.1540 and 1.1500.