Trading on the world currency markets was fairly calm on Monday in the wake of the lack of important data in economic statistics and events.

Investors fully realized that the Fed will raise rates next month. This is clearly shown in the futures of the federal funds rates, which traded at a probability of 96.7% on Monday. This, in turn, is the actual absolute certainty.

Now, all the attention of bidders is emphasized on the new head of the Federal Reserve J. Powell. Markets are awaiting approval of his candidacy in the Senate. It will most likely be accepted, despite the fact that Powell is a Republican. This is because he, as a whole, reflects the aspirations and democracy of the American establishment.

Watching the development of the situation, we suppose that the US dollar will continue to receive support, primarily against the British currency, the European currency, and the Japanese yen. This is due to the fact that the Bank of England, the ECB, and the Central Bank of Japan made it clear that they are not considering the option of a radical change in monetary policy against the backdrop of the economic situation in Britain, Japan, and the euro area. This is based on their respective recent meetings.

The ECB's summer intrigue about the possibility of ending the incentive program next year has collapsed. The regulator and its president, M. Draghi, made it clear that they will follow the path of a smooth change in the economic course. Even then, it is only if the situation in the economy goes on the mend and inflation begins to grow. The Bank of England and its leader M. Carney also signaled that there is no reason to hope for a rate hike in the short-term or even medium-term after deciding to raise rates by a quarter of a percentage point. This outlook is due to the weakness of the economy and risk from the Brexit negotiations. In Japan, S. Abe's victory along with his party confirmed the stability of the course of a soft monetary policy.

The likelihood of such a scenario is very high, which should have a negative impact on the euro, the British pound, and the Japanese yen in the short term.

Forecast of the day:

The EURUSD pair is consolidating above the level of 1.1580. Overcoming this mark will lead to a further decline of the pair to the level of 1.1580 with the prospect of falling to 1.1500.

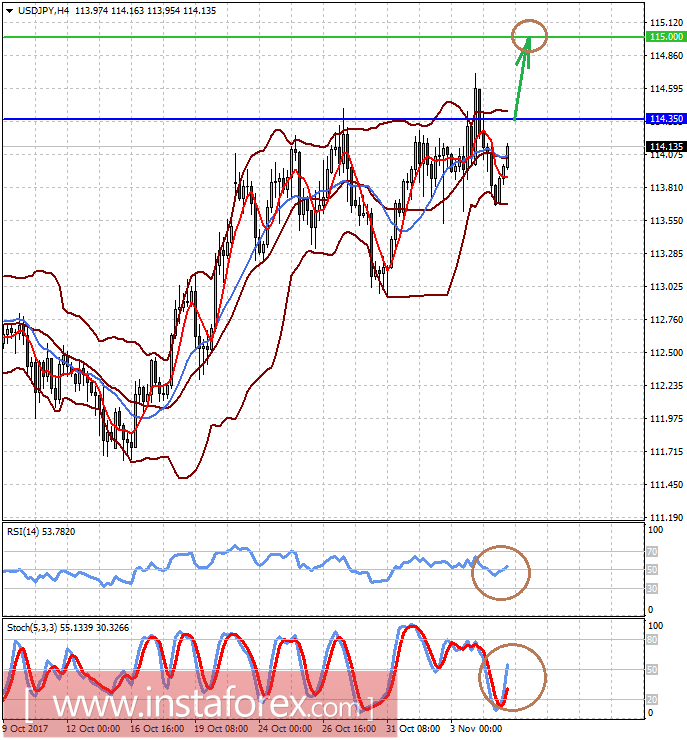

The USDJPY pair rolled back down on a wave of rising tensions in the Middle East, as well as requests from D. Trump for support from the local Parliament to fight against North Korea. However, easing tension can lead to an increase to 115.00 after overcoming the level of 114.35.