The European currency continued to decline against the US dollar on Tuesday, November 7.

Pressure was already formed at the beginning of the European session due to the release of weak data on industrial production in Germany, which could significantly hurt the indicators of economic growth in the future.

According to the report of the Ministry of Economy of Germany, industrial production in September of this year declined by 1.6% compared to August. Economists expected a decline in production, but only by 0.8% compared with the previous month.

However, as noted by the ministry, the growth rates of industrial production as a whole remain quite good, and we can expect that in the coming months a rise in production will continue.

Data on retail sales slightly helped the European currency.

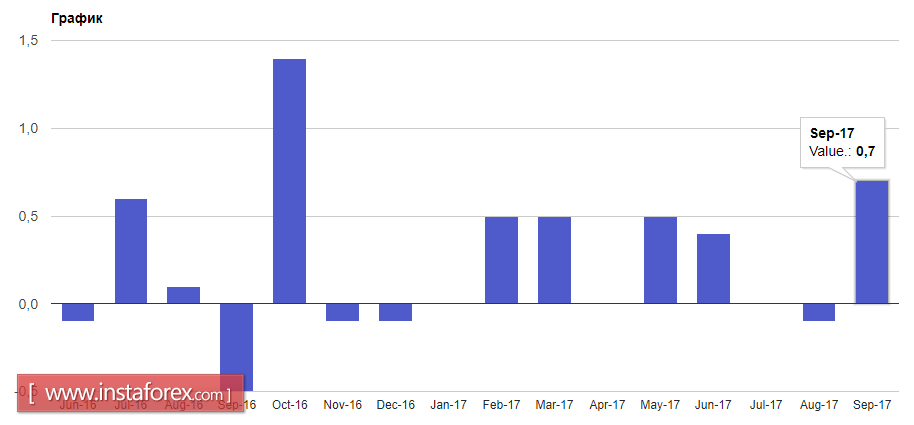

According to the report, retail sales in the euro area in September this year increased by 0.7% compared with August. Data for August was also revised downwards, as it dropped to -0.1%. Economists had expected a 0.6% increase in retail sales in September of this year.

Compared to the same period in 2016, retail sales in the euro area grew by 3.7%.

In the course of his speech, European Central Bank President Mario Draghi, did not touch on the subject of monetary policy and a tapering of the bond-buying program. Basically, his speech was focused on the problem of overdue loans.

Let me remind you that quite recently the central bank introduced new rules for handling overdue loans, which provoked a contradictory reaction.

During the course of his speech, ECB Governor Mario Draghi said the joint efforts of all participants will be needed in order to solve the problem of overdue loans. He paid special attention to the key problem of banking supervision. According to the president of the ECB, joint efforts of banks, supervisors, regulators and authorities of the countries will significantly affect the problem of loans.

As for the technical picture of the EURUSD pair, the bears are gradually moving towards their goal in the support area of 1.1540 and 1.1500, which can be achieved in the near future. As the main trade is unfolding below the level of 1.1580, we can expect that the European currency will continue to be under pressure.

It is worth recalling that the chairman of the Federal Reserve Janet Yellen will make a speech at the end of Tuesday, which can clarify the further prospects of hiking interest rates in December this year.