The euro/dollar pair continues to slowly decline, steadying itself in the area of the 15th figure. Against the backdrop of an almost empty economic calendar, EURUSD bears still found an excuse for the downward momentum - Mario Draghi served as the "trigger", who spoke today at the economic forum on banking supervision in Frankfurt.

The arguments he expressed were ultra-soft. First, he said that negative rates do not have a negative impact on the banking sector - at least at the moment, there is no clear evidence of a cause-effect relationship. Secondly, Draghi commented on the state of the real estate market in the euro area. In his opinion, there is no question of any "overheating" now. In other words, low rates did not provoke the creation of a "bubble" in the housing market. And this, in turn, suggests that the ECB has no acute need to tighten monetary policy.

Mario Draghi also touched on the topic of "bad loans". He noted that this issue has not yet been resolved, which leads to certain problems. In particular, weak credit growth weakens the effect of the stimulus program. Here it is worth noting that the Reuters in March of this year published a number of internal documents of the European regulator. These documents discussed the problem of "bad debts" in the context of the completion of the QE program. Economists of the central bank in their analytical notes warned that the banking sector of the EU could face a significant increase in the risks associated with "bad" loans after the ECB reduced incentive measures. It amounts to about one trillion euros, which burdening the entire eurozone banking system.

Anticipating such outcome, the European regulator published new rules about the handling of overdue loans a month ago. In particular, the ECB "requested" European banks starting next year to allocate more cash to cover non-performing loans. According to documents published by Reuters, starting from January 1, 2018, the banking sector will have a maximum of two years to allocate funds for a 100% coverage of their overdue unsecured debts, and seven years to cover all of their secured debts.

In addition, in the spring of next year, the central bank should announce additional measures in this direction. It should be noted that the analysts did not reach a consensus on the effectiveness of the ECB's already announced measures. For example, currency strategists Morgan Stanley are skeptical about the strategies of the regulator. According to their calculations, only Italian banks will need about 9-10 years in order to reduce the level of "bad" loans to the average European level. But, in addition to Italy, in the "ranking" of the most problematic countries in this regard, there are Greece, and Spain, and Cyprus.

All this indicates that the ECB stimulus program can be extended for 2019 as well. This scenario does not exclude himself Mario Draghi, however, while he focuses on inflation trends. As we can see, inflation is not the only aspect of this issue. If the regulator does not solve the problem of "bad debts", the QE program is unlikely to end in the specified time frame.

Against the background of such prospects, the European currency weakened paired with the dollar, with the pound, and with the Swiss franc. And yet, the EURUSD pair particularly fell due to the general strengthening of the US currency.

From the fundamental point of view, the dollar is growing only on expectations. A contradictory report on the US labor market could not support the greenback, but after a small decline, the dollar index recovered again. This week, there is no important macroeconomic statistics, so the US currency rises "on the rumor".

First of all, there is 100% confidence in a rate increase at the December meeting. Secondly, traders do not give up hope for tax reform. The legislation proposed by the Republicans raises certain questions (in particular, about the tax on the repatriation of capital of American corporations from abroad), but the document is still at the stage of discussion, which fuels the market's interest in this issue.

Another factor that influences the behavior of the dollar is changes in the composition of the Fed. In February of this year, member of the Board of Governors of the Federal Reserve, Daniel Tarullo, resigned, in October, Vice-President of the Federal Reserve Bank Stanley Fischer resigned, in February of the next year Janet Yellen will step down as the head of the regulator, and in the spring or summer of 2018, the head of the New York Fed Bank, William Dudley, will also retire. The successors of the above-listed regulator members can change the ratio of "doves" and "hawks" in the camps of the Fed, and this fact indirectly affects the dynamics of the greenback. Although this fundamental factor is more of a background value, at least for the time being.

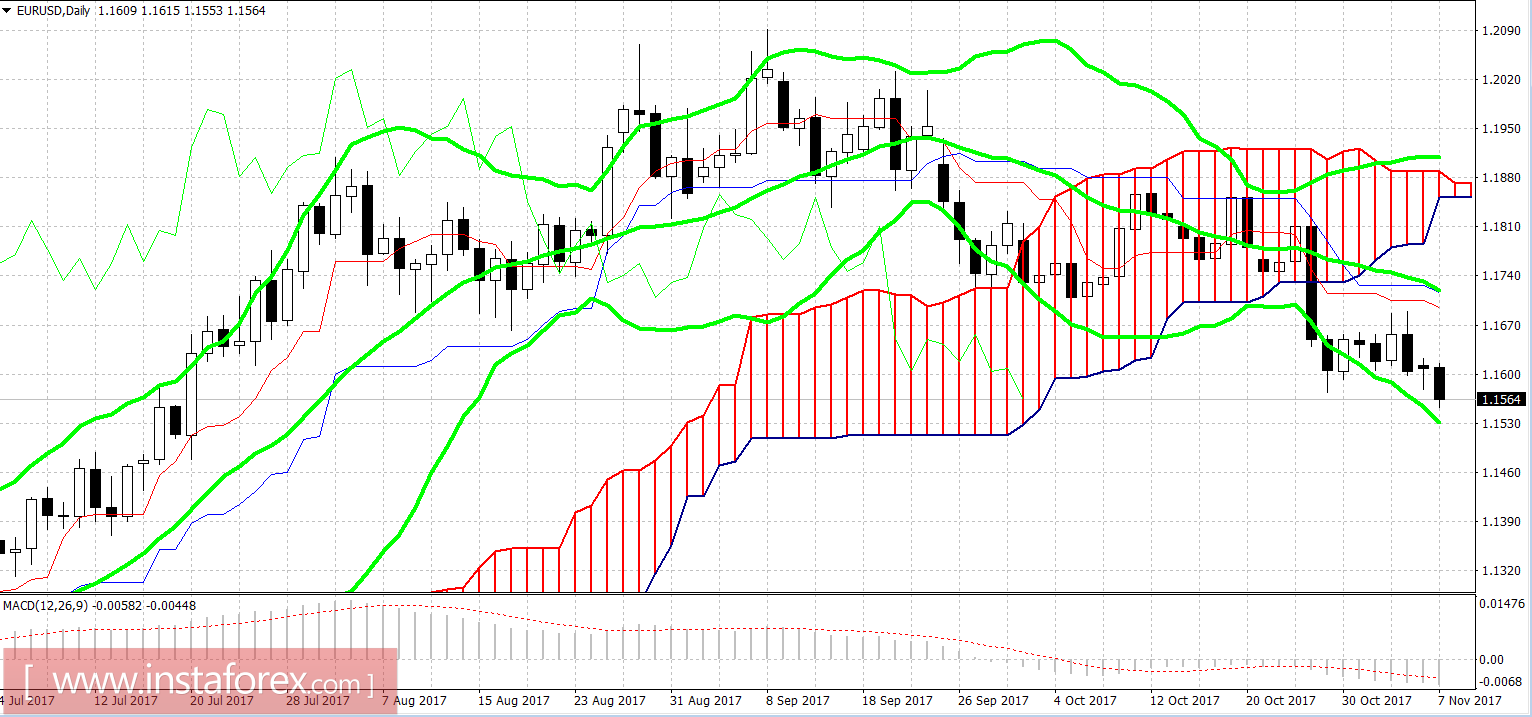

But from the technical point of view, the euro-dollar pair has every reason to decline to the bottom of the 15th figure, at least to resistance level 1.1525 (the bottom line of Bollinger Bands on D1). The likelihood of this movement is indicated by the Ichimoku Kinko Hyo indicator line parade, as well as the price position between the middle and bottom lines of the Bollinger Bands indicator.