EUR / USD, GBP / USD

The euro and pound declined slightly due to lack of importance. European indices came out mixed, as the Eurozone retail sales for September increased from 0.7% against expectations of 0.6%, but the business activity index in the retail sector for October fell from 52.3 to 51.1, and German industrial production in September shrank by -1 , showing 6% against expectation of -0.7%. The ECB President Mario Draghi once again stood up for the soft monetary policy in Frankfurt, stating that he does not see any side effects.

In the United States, the number of September job vacancies in the labor market was for 6.09 million versus the forecast of 5.98 million, while the volume of consumer lending in the same month increased from 13.1 billion dollars to 20.8 billion.

Today, economic data is practically not published, except that the September trade balance of France is expected to increase the negative trade balance from -4.5 billion euros to -4.7 billion. Tomorrow, the Trade Balance in Germany will be issued as the forecast is also pessimistic.

In the US, an auction is planned for a 10-year government bond with a volume of 23 billion dollars. Tomorrow, the Treasury will place 30-year bonds for $ 15 billion. The American debt continues to grow rapidly, reaching $ 20,474,850 trillion on Monday. In the absence of macro statistic investors, we can focus on this matter and continue to buy the dollar as a demand tool in the short term.

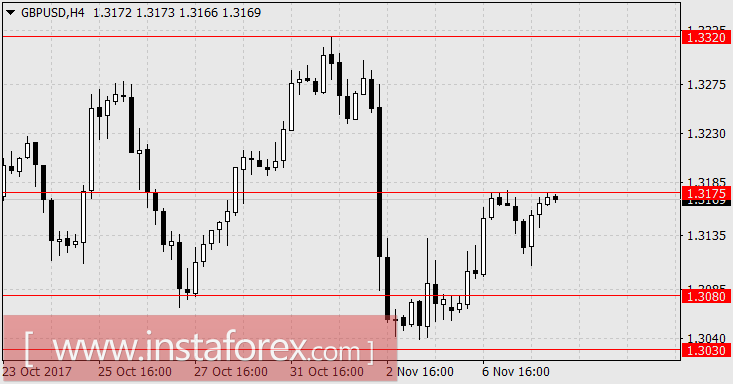

We are expecting the euro in the range 1.1485-1.1510, while the pound sterling is expecting at 1.3080 and 1.3030.

AUD / USD

Yesterday, the Australian dollar lost about 50 points after the overall strengthening of the US currency. Strengthening of the dollar is bolstered by raw materials prices that decrease in all sectors, particularly in oil by -0.8%, iron ore -1.1%, copper -2.1%, aluminum -1.8%, gold -0.5%. Also, agricultural futures are widely declining, as the live cattle is down to -0.4%, wheat -0.3%, coffee-0.7%.

The main event yesterday could be the Reserve Bank of Australia's decision on monetary policy. Since there are no any changes, the regulator does not have any optimistic economic outlook. RBA Head Philip Lowe said that low interest rates have a stimulating effect on the economy. Meanwhile, the market did not react to the RBA statements. The assessment for the Chinese trade balance in the October failed to meet expectations. The balance reached 38.17 billion dollars against the forecast of 39.50 billion. The export showed an annual increase of 6.9% against the expectation of 7.2%, while imports gained 17.2% YoY against expectations of 16.0% YoY. Nevertheless, the growth of the trade balance takes place in September, showing the balance obtained 28.61 billion dollars. The Chinese Shanghai Composite Index rose to 0.54%.

We are expecting for further reduction of the "Australian" to 0.7580 and lower to 0.7540.

* The presented market analysis is informative and does not constitute a guide to the transaction.