Buyers of the US dollar started to leave the market, while buyers of risky assets exhaled with relief after the chairman of the Federal Reserve Board, Janet Yellen, did not comment on the current state of the American economy.

The data that lead the growth of US consumer lending in September this year came out during the second half of Tuesday.

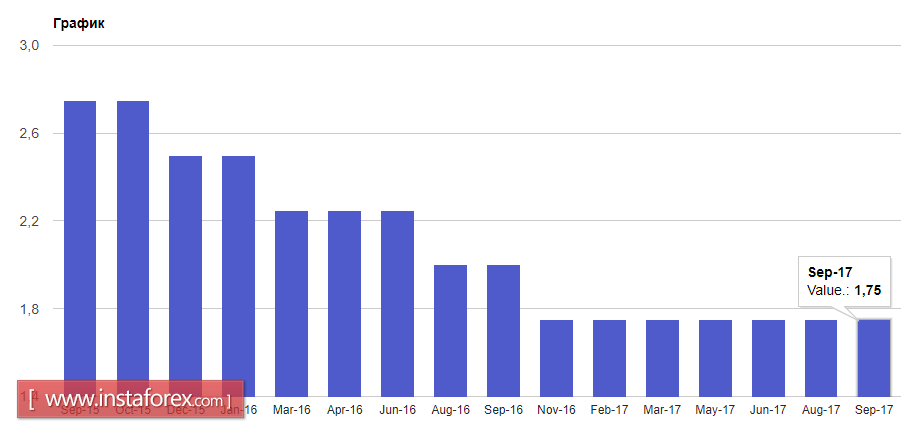

According to the report of the Federal Reserve System, unsecured consumer lending grew by $ 20.83 billion in September compared with August. The annual increase was 6.6%. The economists' expectation towards lending growth in September is at $ 19.0 billion.

The data for the month of August were revised. Thus, consumer lending in the US increased in August by $ 13.14 billion compared with July, showing an annual growth of 4.2%.

Fed Chairman Janet Yellen did not comment on the economic state or monetary policy on Tuesday, saying only that the effectiveness of the Fed's policy is partly based on the belief that it acts in the public interest.

Given that many traders and experts expected to hear more stringent statements about the interest rate increase this December, the demand for the US dollar fell by the end of the day which supported the single European currency to win back some of its positions.

As for the technical picture of the EUR/USD, it is most likely that the trade for today will be conducted mainly in the side channel. The lower boundary is seen in the area of 1.1560-65, whereas the upper one starts from 1.1620-1.1615. It is recommended to trade in opposite directions from these levels within this day.

Raw currencies ignored the data on China's export growth.

According to the report of the China's Main Customs Administration, China's exports grew by 6.1% in October this year compared with the same period last year, after rising by 9.0% in September. Imports added 15.9% after growth of 19.5% in September. The positive balance of China's trade balance in October was 254.47 billion yuan, compared with 193 billion yuan in September.

Given that today there are no scheduled publication of important macroeconomic statistics, many traders will focus their attention on the Reserve Bank of New Zealand's decision on interest rates.

It is expected that the RBNZ will keep the key interest rate unchanged at 1.75%. However, the report of the RBNZ on monetary policy will be more important, as well as the accompanying statement focused on the further development of interest rates.