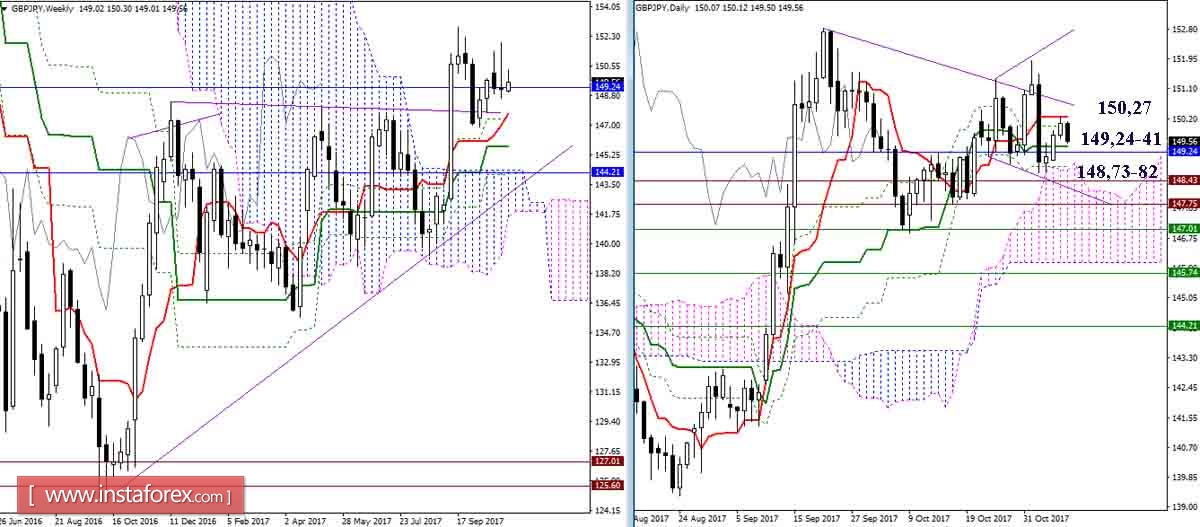

GBP / JPY

The resistance of the day Tenkan (150.27) did not allow players to grow and to take over the short-term advantage. The pair continues to remain at the bottom of the expanding formation. The remarkable among the nearest supports are 149.41-24 (day Kijun + month Fibo Kijun) and 148.73-82 (daytime Senkou Span A and Fibo Kijun).

The situation did not have any significant changes. All major and significant levels of support and resistance are located in their previous locations. Impulses and opportunities for players to raise remain situated on the resistance of the cloud of H4, currently supported by the daily short-term trend (150.27). The breakdown of the cloud will form a new upward target. The role of supports still belongs to 149.24-41 and 148.73, the existing advantage of the bears can help to test the support data quickly enough. While the goal for the downside target on breaking down the H4 cloud will have further value.

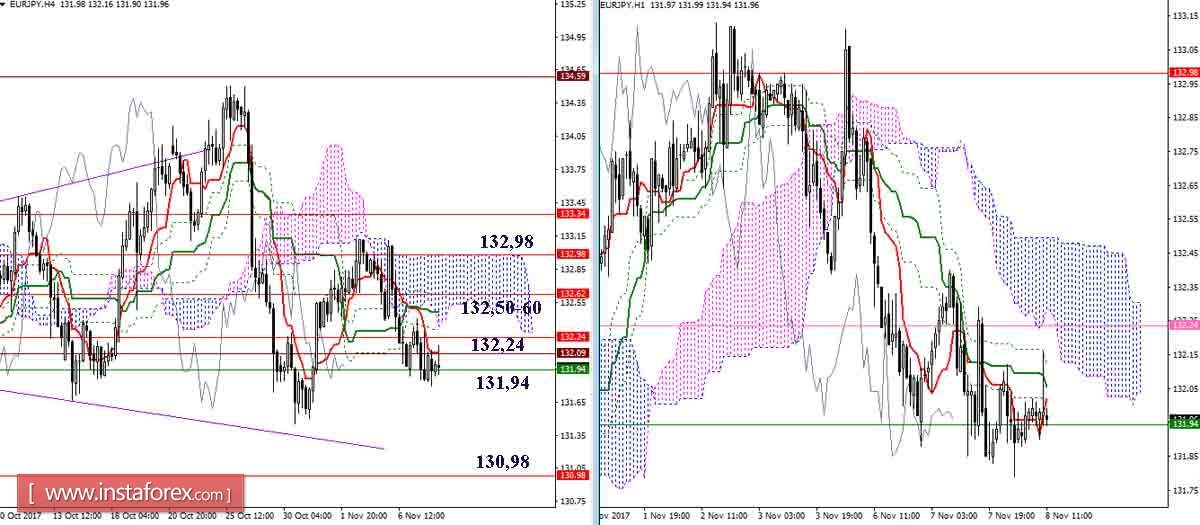

EUR / JPY

The pair remained in the daytime cloud. The weekly Tenkan on Monday slightly changed its location (132.24), which turned to be a resistance. However, the pair failed to close the pair below the historical support level of 131.94. Fixing the pair in the daytime cloud increase chances of decline to its lower limit (Senkou Span B 130.98). The exit from the cloud to the bull zone can push the euro/yen pair again to the center of the expanding formation (daytime Kijun 132.98).

Support for the indicator of Ichimoku is currently on the players' side to decline, but they failed to overcome 131.94. A change in mood may become more relevant after switching to the side of Tenkan bulls H4 (132.09) and cross H1. Furthermore, the resistance that can be noted for today are 132.24 and 132.50-60, but the most important remain in the area of 132.98 (daytime Kijun + Senkou Span B N4).

Indicator parameters:

all time intervals 9 - 26 - 52

The color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chinkou is gray,

clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

The color of additional lines:

support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

horizontal levels (not Ichimoku) - brown,

trend lines - purple.

* The presented market analysis is informative and does not constitute a guide to the transaction.