On Wednesday the foreign exchange market activity was noticeably lower than usual and only the British pound, who remains as hostage to the situation around the UK's exit from the EU, fell under sell-off against the news that Prime Minister T. May might dismiss the Minister of International Development, Priti Patel, who met with officials from Israel while on vacation. The story turned out to be scandalous with erotic overtones.

However, let's return to the pound, which is already under considerable pressure in the wake of a lack of progress in the "divorce" of the United Kingdom with the European Union. Brexit's theme is not coming off the pages of the press and television channels. In the present situation of the sterling's weakness, especially after the Bank of England made it clear last week that it does not make sense to wait for the continuation of the cycle of raising interest rates on the wave of weak prospects for the national economy, any more or less significant negative news from the "United Kingdom" has led to a depreciation of the British currency.

We can assume even further that despite its technical attractiveness, the pound sterling will remain to be a "whipping boy", especially in tandem with the US dollar. Most likely, the markets will take into account another important reason which is the discrepancy between monetary policy rates of the Federal Reserve and the Bank of England. As expected, the former will continue to strive for normalization of monetary policy and raising interest rates while the latter will be forced to maneuver between the prospects of high inflation and low economic growth against the background of the Brexit factor.

In general, the idea that the factor of discrepancy between monetary policy rates of the Federal Reserve and other major Central Banks, including the Bank of England, is beginning to play again on the market which begs, as they say, by itself. It's so obvious that it does not even require solid evidence. The Fed continues to tighten its monetary policy and regulators such as the Bank of England, the ECB, and the Central Bank of Japan still do not risk taking that path. Therefore, in the short term, we expect the continuation of the smooth strengthening of the dollar's position in the world market.

Forecast of the day:

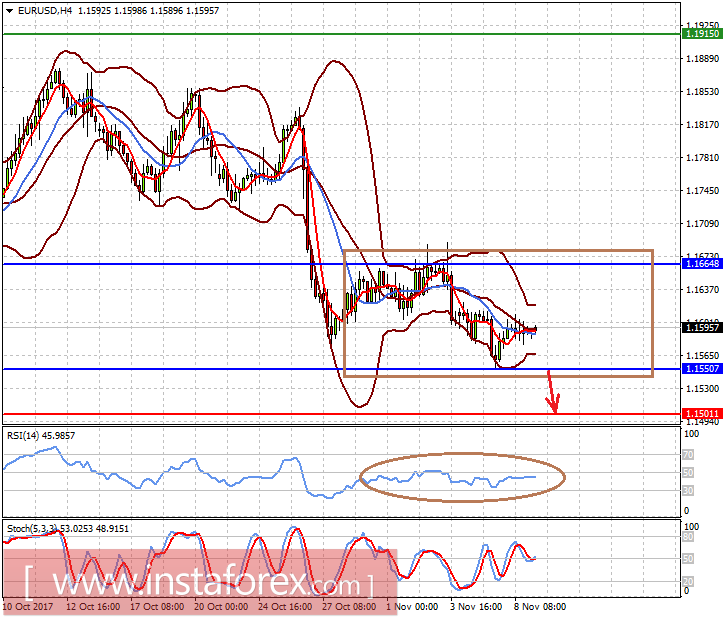

The EURUSD pair is consolidating in the range of 1.1550-1.1665 on the wave of absence of new economic statistics and important events this week. However, we still hold the view that the pair has all chances to further decline to the level of 1.1580 with the prospect of falling further to 1.1500.

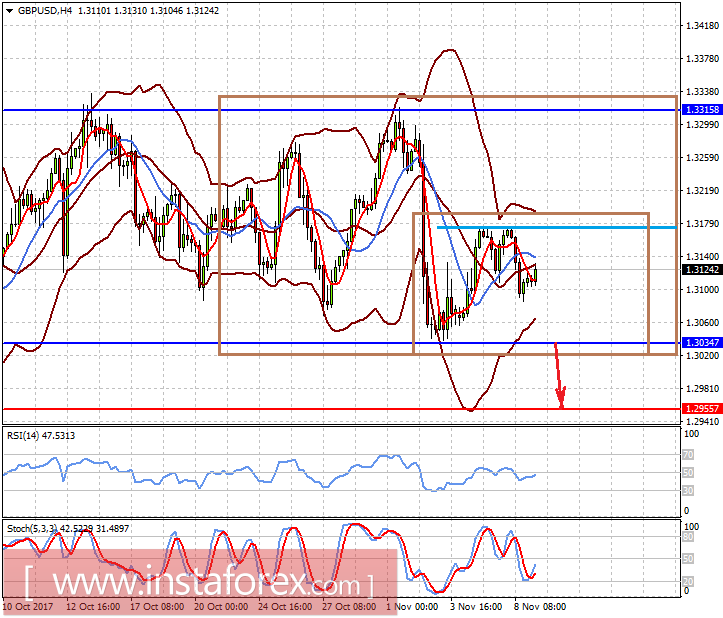

The GBPUSD pair is consolidating in the range of 1.3035-1.3315 or in its narrower version at 1.3035-1.3180. It is likely that until the end of the week, the lull in the currency markets will continue but next week, the pair may fall to the level of 1.2950-55.