EUR / USD, GBP / USD

On Thursday, European investors have had a good respite with the pressure on the euro weakening noticeably. Germany's trade balance for September amounted to 21.8 billion euros against the forecast of 21.1 billion. However, the August figure was revised down from 21.6 to 21.3 billion euros. The economic forecast of the European Commission for the current year has been raised: the new estimate for 2017 for the euro area is now 2.2% compared to 1.7% in May. The forecast for the EU was 2.3% compared to 1.9% earlier. Yesterday, a new round of talks on Brexit began and the EU made concessions in the amount of compensation. Now, the talk is about 30 billion pounds. If an agreement on this matter is reached, the parties will start developing a trade agreement which will encourage British investors.

A common background of pressure on the dollar was the danger that the tax reform in the US will be curtailed. There is a struggle for the main position of D.Trump on the tax change in corporate profits. It is not known how this fight will end but so far, one can expect that there will be a lateral trend in the market until Trump returns from Asia on November 14.

Toda, despite the Veterans Day in the US, all trading floors are open. Positive news is expected on the euro area. Industrial production in France can show an increase of 0.6% while in Italy, there is a decline of 0.3%. In the UK, September industrial production is projected to grow by 0.3% while production in the construction sector is expected to add 0.6%. The trade balance is predicted to grow from -14.2 billion pounds to -12.9 billion pounds. In the US, consumer confidence index from the University of Michigan for November is expected to grow from 100.7 to 100.8.

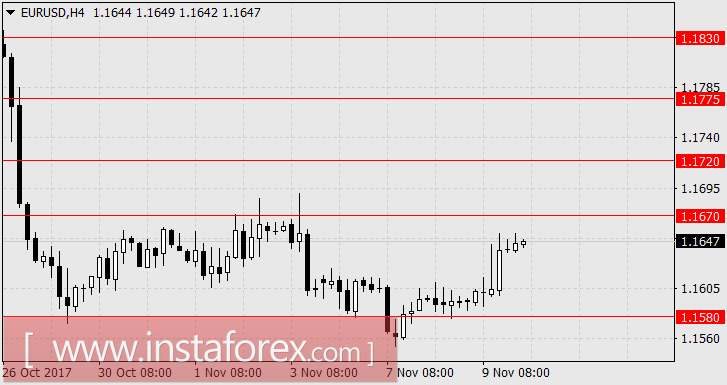

We expect the continuation of the lateral trend. For the euro, it will stay in the range of 1.1580-1.1670 while the pound will be in the range of 1.3080-1.3175.

AUD / USD

In Australia, weak indicators came out yesterday. Only Chinese data, with a general weakening of the US dollar, allowed the "Aussie" to close the day with a growth of 3 points. Housing loans in September decreased by 2.3% against the forecast of growth by 3.0%. The volume of investment in real estate decreased by 6.2%. In China, the CPI for October rose from 1.6% y / y to 1.9% y / y. Producer prices remained at 6.9% y / y against expectations of a decline to 6.6% y / y.

Today, in the Asian session, the Australian dollar cheered up on the moderately positive report of the RBA on monetary policy. The RBA's forecast for GDP for the current year is 2.50% but next year it will be 3.25%. The unemployment forecast is 5.5% by mid-2019. The hope for market growth is the intention of the APR leaders to conclude the Trans-Pacific Trade Partnership without the participation of the US, as a new step in using the APEC platform for this.

Commodity prices slightly increased (oil added 0.8% and iron ore increased by 0.1%), creating a favorable neutral-positive background. Asian stock indices is in the red zone. We are looking forward to the continued consolidation of AUD / USD in the range of 0.7640-0.7700.