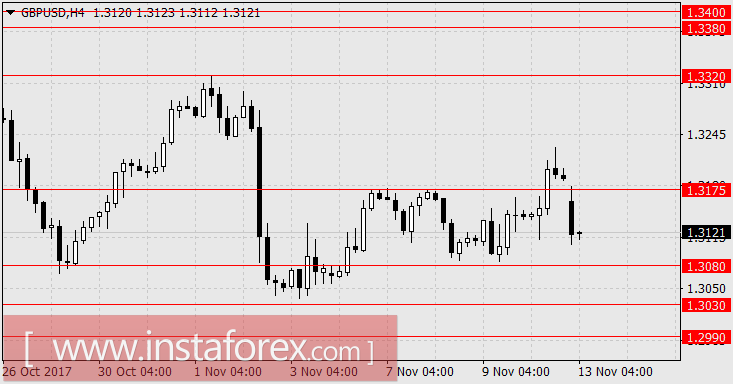

EUR/USD, GBP/USD

The euro and the pound ended last Friday with gains, primarily due to the growth of the British currency by 45 points, as it pulled itself upwards along with the euro. Industrial production in the UK increased by 0.7% in September, the trade balance reduced the negative balance from -12.4 billion pounds to -11.3 billion pounds. The UK GDP forecast from NIESR for October was 0.5% against 0.4 % in September. In the US, the consumer confidence index from the University of Michigan in the preliminary assessment for November had declined from 100.7 to 97.8. However, yields on US government bonds on Friday increased (5-year-olds from 2.012% to 2.055%), and the cryptocurrency market witnessed a sharp drop, which psychologically prompted investors to turn to the traditional currency - the dollar. In the Asian session on Monday, a number of currencies won back Friday's growth.

On Wednesday, Donald Trump will return from Asia. U.S. political observers assess the result of his trip as a failure - Trump did not receive any advantages for the US, and even lost. In particular, shifting the main focus on settling the North Korean conflict on China. Democrats won the local elections in the United States. All these factors provide additional power to the Congressional Democrats in pressuring Trump on any issues. The most important issues are the tax reform and the new deputy heads of the Federal Reserve.

On Thursday, the German parliamentary parties must finally make a decision on the coalition. If the vote turns into a failure, they would have to hold another election.

The report on the implementation of the US federal budget for October, released today, is expected with a deficit of 58.2 billion dollars. For the entire post-crisis period, the October deficit had resulted less only once- in 2016 (-44.2 billion). New developments have strengthened the dollar's position, at least in its current situation. Expectations for the euro will be at 1.1580, further at 1.1510, while the pound sterling in the range of 1.2990-1.3030.

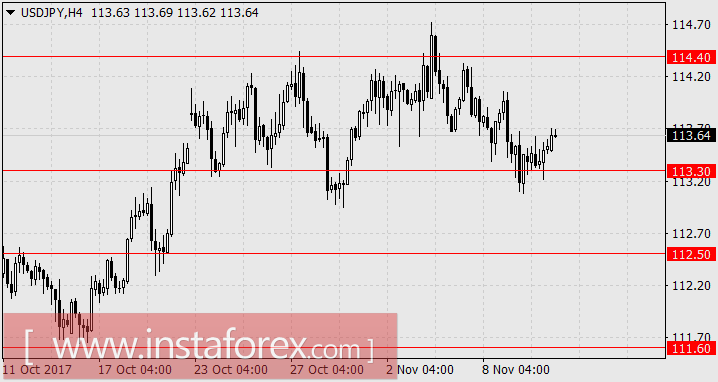

USD/JPY

On Friday, as well as today in the Asian session, the yen managed to stay above the lower boundary of the 113.30-114.40 range even against the decline of the Japanese stock market. On Friday, the Nikkei 225 lost 0.81%, today it is still at -0.56%. Presumably, the head of the Philadelphia Federal Reserve Bank Patrick Harker, who is on a business trip to Japan, influenced the yen, and confirmed that the Fed will likely hike the rate in December. The price index for corporate goods in October rose from 3.0% y/y to 3.4% y/y (0.3% y/y against the forecast of 0.1%).

On Tuesday, significant data on China will be released. The volume of retail sales for October is expected to increase from 10.3% y/y to 10.4% y/y, but industrial production may slow from 6.6% y/y to 6.3% y/y. On Wednesday, data on Japan's GDP for the 3rd quarter in its second estimate will be released - a decrease from 2.5% y/y to 1.3% -1.4% y/y is expected. A continuation of trading of the yen in the range of 113.30-114.40 is expected.