The foreign exchange market seems to have frozen completely. The lack of fresh economic data, as well as the uncertainty about the tax reform in the US, more precisely, in what form it will be finally adopted, restrains the activity of market participants.

Assessing the prospects for the foreign exchange market, we continue to retain the view that the US dollar, despite the uncertainty surrounding the new tax code, will receive support and at least will not fall, but as a maximum will continue to grow smoothly. This confidence is based on an important factor in the resumption of the discrepancy in the monetary policy between the Fed and the world's largest central banks, as well as the currencies of the developed countries economically and among the top ten.

It was previously pointed out that the Fed is the only regulator that has begun to move towards normalizing interest rates, and this movement continues. While none of the other central bank, with the exception of the Bank of England and the Central Bank of Canada, did not raise rates. But these regulators also made it clear that it is no longer necessary to expect an increase in the cost of borrowing in the wake of a decline in economic growth and inflation in Canada, and the British central bank was concerned about the uncertainty of Brexit's consequences and weak prospects for economic growth.

As for the future course of the US currency, it is much preferable to that of its "counterparts" for currency pairs. The adoption of the new tax code, even if it is largely altered, will attract capital to the American economy. This will facilitate not only repatriation, but also the arrival of foreign capital, which in turn will acquire dollar for investment measures. The unilateral process of raising interest rates, while not so fast, the reduction the balance of the Fed, the lack of any kind of incentive measures, as well as the return of American capital and foreign inflows, will do their part. On this wave, the US dollar will remain an attractive currency for investment, which will be the most important factor supporting it.

Forecast of the day:

EURUSD remains in the range on the backdrop of a lack of new economic data, as well as investors' expectations of the adoption in the United States of a new tax code. Most likely, the pair will remain today in the range of 1.1550-1.1665. It is believed that the pair needs to be sold from the upper limit of this range with the target of 1.1550.

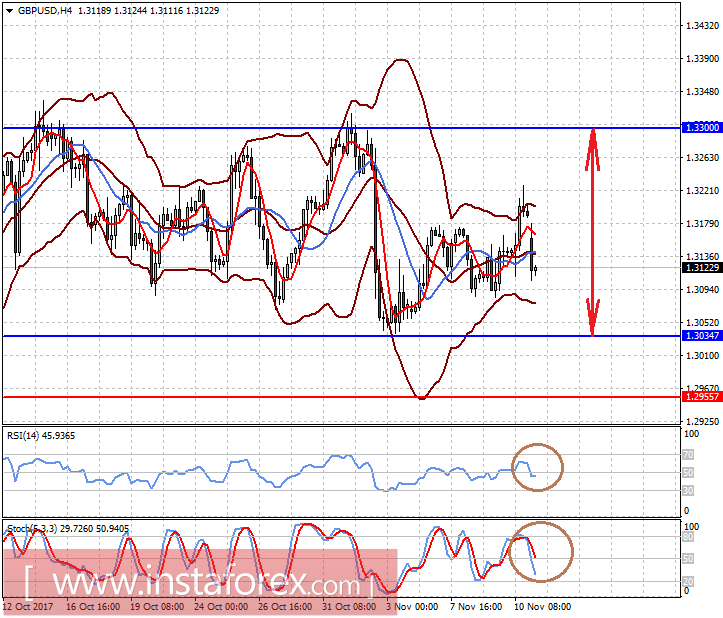

The GBPUSD pair is also consolidating in the range of 1.3035-1.3300. The sterling pound is affected by the uncertainty of the country's exit from the EU, as well as scandals in the government. It is considered necessary to sell the pair on any growth with a local target of 1.3035, a breakthrough which could lead to its further decline to 1.2950-55.