EUR/USD, GBP/USD

The beginning of the week presented new vivid political events. On Monday, 40 MPs of the Conservative Party of the UK signed a letter of no confidence to Prime Minister Theresa May, only 8 signatures remain. Additional pressure on investors was caused by the statement of the Minister for Brexit Affairs David Davis, who said that if the parliament does not pass the Brexit law within two weeks, the exit of the country from the EU will take place without a deal.

The wholesale price index in Germany for October remained unchanged against expectations of +0.4%. The report on the US federal budget for October showed a larger than expected deficit: -63.2 billion dollars against the forecast of -58.2 billion.

Today, investors are waiting for the speeches of the four heads of the world's central banks: J. Yellen, M. Draghi, M. Carney, H. Kuroda at the ECB conference "At the core of politics: challenges and communication opportunities of the Central Bank" (9:00 GMT). At 8:30 London time, inflation figures in the UK for October will be released. The base CPI is expected to grow from 2.7% y/y to 2.8% y/y, the total CPI is expected to increase from 3.0% y/y to 3.1% y/y, retail prices may rise from 3.9% % y/y to 4.1% y/y, housing prices are expected to grow by 5.2% y/y against 5.0% y/y earlier. In the euro area, the ZEW sentiment index is expected to increase, but the decline in industrial production: ZEW Economic Sentiment is expected to reach 29.3 in November against 26.7 in October, while Industrial Production in September is expected to be -0.6%. The eurozone's GDP for the 3rd quarter in the 2nd estimate is expected to be unchanged at 0.6% (2.5% y/y).

In the US, the Index of Small Business Optimism may show a growth in October from 103.0 to 104.2, the basic producer price index is expected to grow by 0.2%.

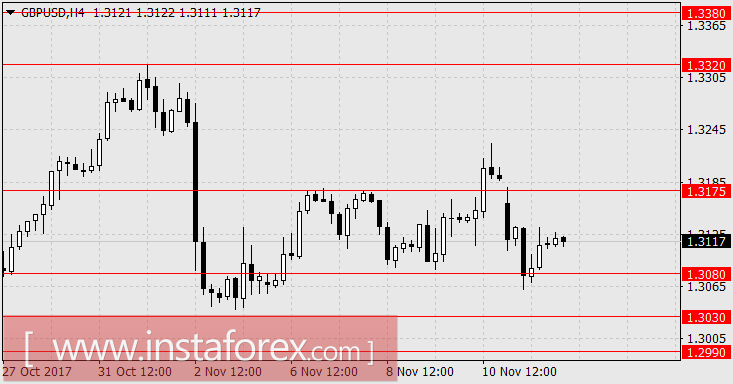

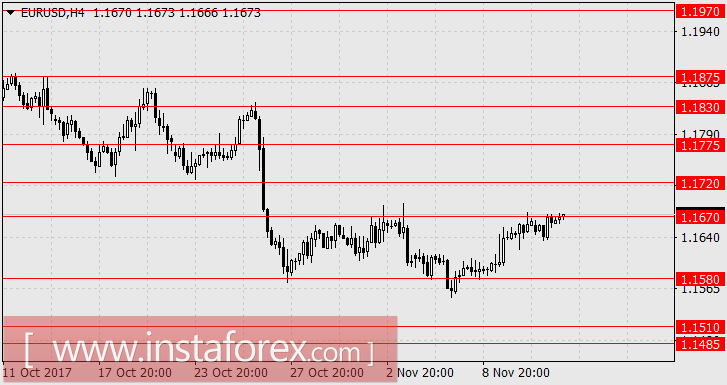

Presuming that the heads of the Central Bank do not say anything new at the conference in Frankfurt, the pound will continue to drift in the range of 1.3080-1.3175 under the influence of inflation data. When the effect of these indicators is excluded, expectations of a decline in the British currency under increasing political pressure, the target is in the range of 1.2990-1.3030 and further towards 1.2880. For the euro, we expect a decline in the range of 1.1485-1.1510. On Thursday, the US expects good data on industrial production, and on Wednesday and Friday weakened data on the trade and payment balance of the eurozone.

AUD/USD

On Monday, the Australian dollar lost 35 points, due to pressure from the New Zealand dollar, a moderate decline in raw material prices, as well as new talks of discrepancies in monetary policy between the Federal Reserve and the RBA. Oil fell by 0.5%, iron ore by 0.7% (on the Chinese stock exchange it went up by 0.8%). Furthermore, in China, the rate of an increase in the volume of new lending fell from 1.27 trillion yuan to 663 billion and the M2 monetary aggregate decreased from 9.2% y/y to 8.8% y/y.

This morning, Chinese data continued a pessimistic tone: retail sales in September slowed from 10.3% y/y to 10.0% y/y, investment in fixed assets slowed from 7.5% y/y to 7.3% y/y , industrial production also disappointed: 6.2% y/y against 6.6% y/y earlier and the forecast was at 6.3% y/y. However, it saved the "Aussie" indicator of business confidence NAB for October, which increased from 7 to 8. On Wednesday, there might be a slight increase in wages in Australia, but on Thursday, pressure on the labor market is expected.

Taking into account the fundamental tendency of a strengthening in the US dollar, we await a decline in the "Aussie" towards 0.7580 and further lower to 0.7540.