The Australian dollar fell sharply against the US dollar during today's Asian session. One of the reasons why the quotes went down sharply could be a report on more than restrained growth of wages in Australia, which could significantly affect the country's already weak recovery, which will force the Reserve Bank of Australia to maintain an even more long period of monetary policy without changes.

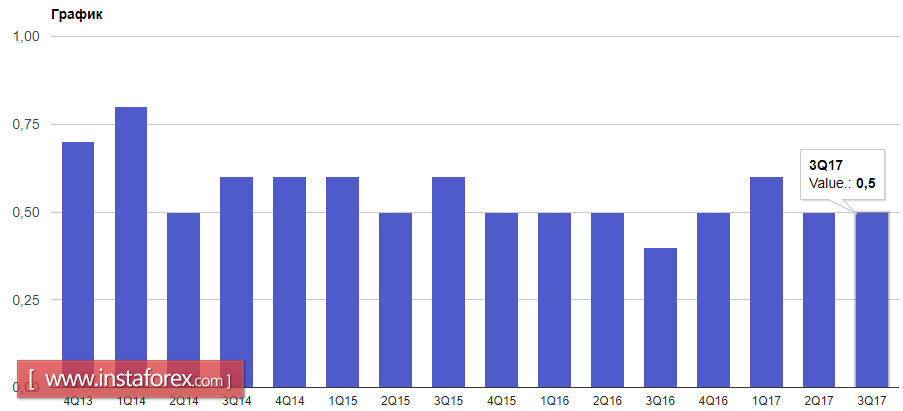

According to data, wage growth in Australia in the 3rd quarter of this year was 0.5% compared to the previous quarter, while many economists and analyst forecast an increase of 0.7%.

Compared to the same period last year, wages in Australia grew by only 2.0%, while economists expected the growth rate of 2.2%.

As for the technical picture of AUD/USD, the movement continues to the significant support levels of 0.7580 and 0.7535, where large buyers can once again return to the market. Counting on a more powerful upward momentum will be possible only after successfully consolidating above 0.7620, which will lead to an immediate rise in the Australian dollar to areas 0.7675 and 0.7735.

Good data on the growth of the Japanese economy in the third quarter of 2017 led to a sharp drop in the USDJPY pair, which approached the rather significant levels of support.

According to the data, in the third quarter of 2017, annualized GDP of Japan grew by 1.4%. As noted in the report, growth was driven by increased global demand. Economists also expected Japan's economy to grow by 1.4%. Export on an annual basis grew by 6% compared to the previous quarter.

As for the technical picture for the USDJPY, the pair again returned to the lower boundaries of the channel 113.00. Only its breakthrough will lead to a larger downward movement and the return of the trading instrument to 112.25 area with the purpose of updating 111.50 in the short term. If sellers fail to push this level, USDJPY can already climb to 114.00 and 114.75.

The British pound remains under pressure paired with the US dollar amidst the political problems of Britain. Yesterday, the British Parliament began to work on laws on the basis of when the country's withdrawal from the EU should begin. However, even at the very beginning of the discussion, problems arose even in minor issues, such as a specific release date.