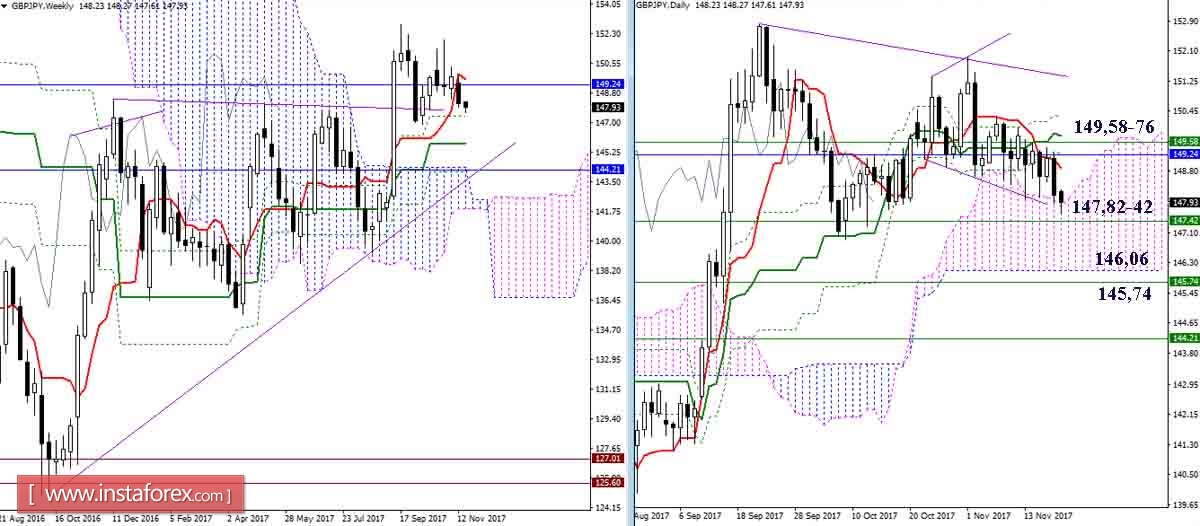

GBP / JPY

Players on the slide gradually reverse the trend while preserving the advantages. At the moment, the pair again tests the upper boundary of the day cloud for strength (Senkou Span A 147.82), strengthened by the support of the weekly Fibo Kijun (147.42). Fixing the cloud and overcoming the supports open up new prospects for the bears, with the nearest support at the daytime Senkou Span B (146.06) and the weekly Kijun (145.74). Failure to manage the supports will return the pair towards the resistance of day cross (Tenkan 148.87 + Kijun 149.76) and weekly Tenkan (149.58).

The resistance of the H4 cloud, strengthened by the entire cascade of levels at higher periods, did not allow players to increase the current balance of power. In that event, bears dominate which resulted in the continuous formation of new lows. Apparently, there is a current interaction within the support zone at 147.82-42. Among the resistances, 148.45-55 (cross H4 + cross H1) - 148.90 (cloud H4 + cloud H1 + day Tenkan) - 149.24 (Senkou Span B N4 + monthly level) should be primarily noted today.

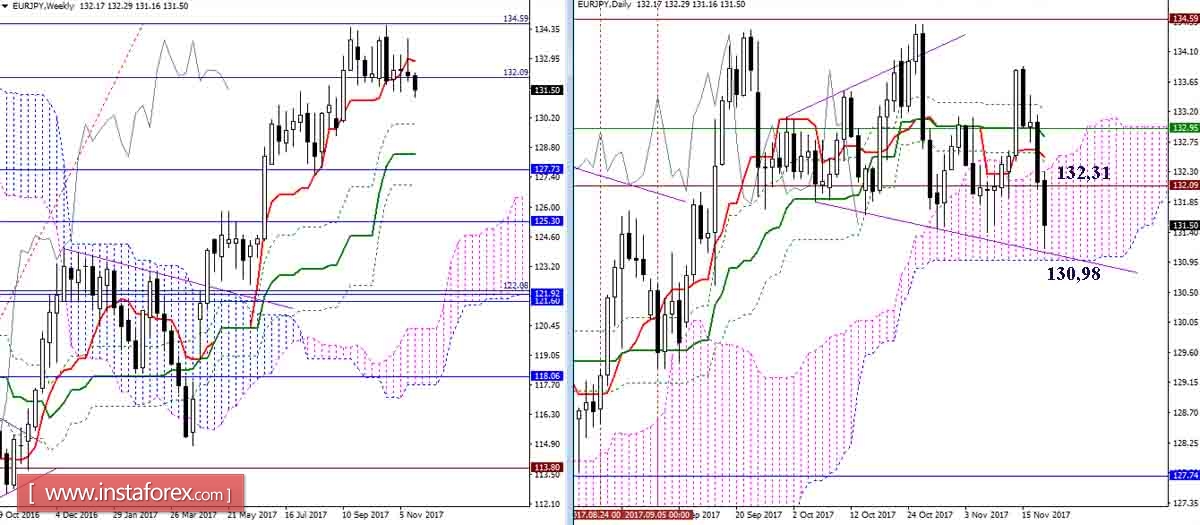

EUR / JPY

Last week, the pair closed in a daytime cloud (Senkou Span A 132, 31). The new week opened with a new mood, while the bears did not weaken and currently continue to decline through the lower boundary of the daytime cloud (Senkou Span B 130.98).

In this situation, the Indicator Ichimoku supports the bears. The benchmarks for the decline are now at 130.98 (daytime Senkou Span B) and 130.36-71 (target for the breakdown of the cloud H4). A change in moods may be indicated today in case of an increase in the area of 132.05-31 (Tenkan N4 + Kijun N1 + upper boundary of the day cloud). Fixing above will offer initial advantages to the players on the rise, creating the most important benchmarks levels combined with the resistance of the upper and lower halves, 132.51 - 132.83 - 133.24.

Indicator parameters:

all time intervals 9 - 26 - 52

The color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chinkou is gray,

clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

The color of additional lines:

support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

horizontal levels (not Ichimoku) - brown,

trend lines - purple.

* The presented market analysis is informative and does not constitute a guide to the transaction.