It seems that the Senate meeting on the new tax reform on Friday did not give any result since there is no information about it in the news and the media. This had a negative impact on the rate of the US dollar, which has been consolidating in recent years in relation to the main currencies with the exception of the Australian and New Zealand dollars.

The latest strong data on the US economy supported the dollar as well as the expectation of another increase in interest rates at the meeting of the Fed in December. However, the uncertainty about the form in which the new tax reform will be adopted, or the impossibility of its approval by the US Senate in general, calls into question its future. Therefore, the US dollar remains in limbo, despite the release of positive economic statistics.

Published on Friday, the data on the number of building permits issued for October exceeded all expectations. It showed strong growth to 1.297 million permits against the forecast growth of 1.247 million permits and the September value of 1.225 million permits. In percentage terms, the growth showed an increase of 5.9% against the forecast of 2.0% and a September value of minus 4.5%.

Let's just say that in a normal situation when investors' consciousness is not burdened by uncertainty of the future tax reform, the market would react to these data positively and the dollar would receive appreciable support but this did not happen on Friday. It even passed a number of currencies including the major European currencies and the Japanese yen, but managed to add to the Australian, New Zealand, and Canadian dollars.

The "Aussie" and the "Kiwi" remain under pressure on the wave of fears of slowing economic growth in China and a drop in the expectations for growth rates in their respective countries. The Canadian dollar also proved to be a hostage to the stabilization of the consumer price index in annual terms which was at 1.4%. The monthly growth in October was also inexpressive, which was only at 0.1%.

Observing the behavior of the market, you can say that its focus in the near future will be the result of the adoption or not of a new tax code in the States.

Forecast of the day:

The EURUSD pair rose on Monday at the auctions in Europe after the decline in the Asian trading session amid news that A. Merkel failed to form a coalition government. Most likely, the pair, after local and unreasonable growth, will decrease to 1.1675 following the breakthrough at the level of 1.1760.

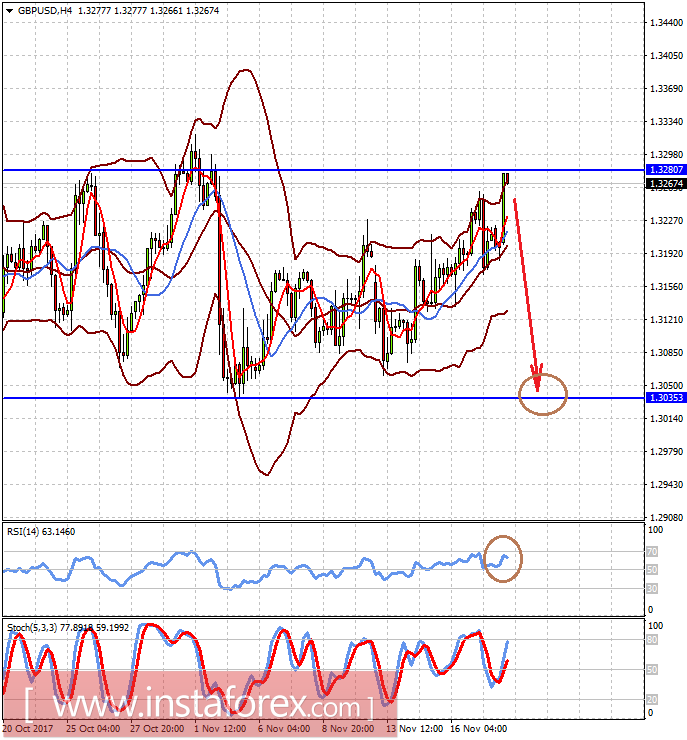

The GBPUSD pair reached a local maximum, but if it does not overcome the 1.3280 mark, we should expect its decline to 1.3035.