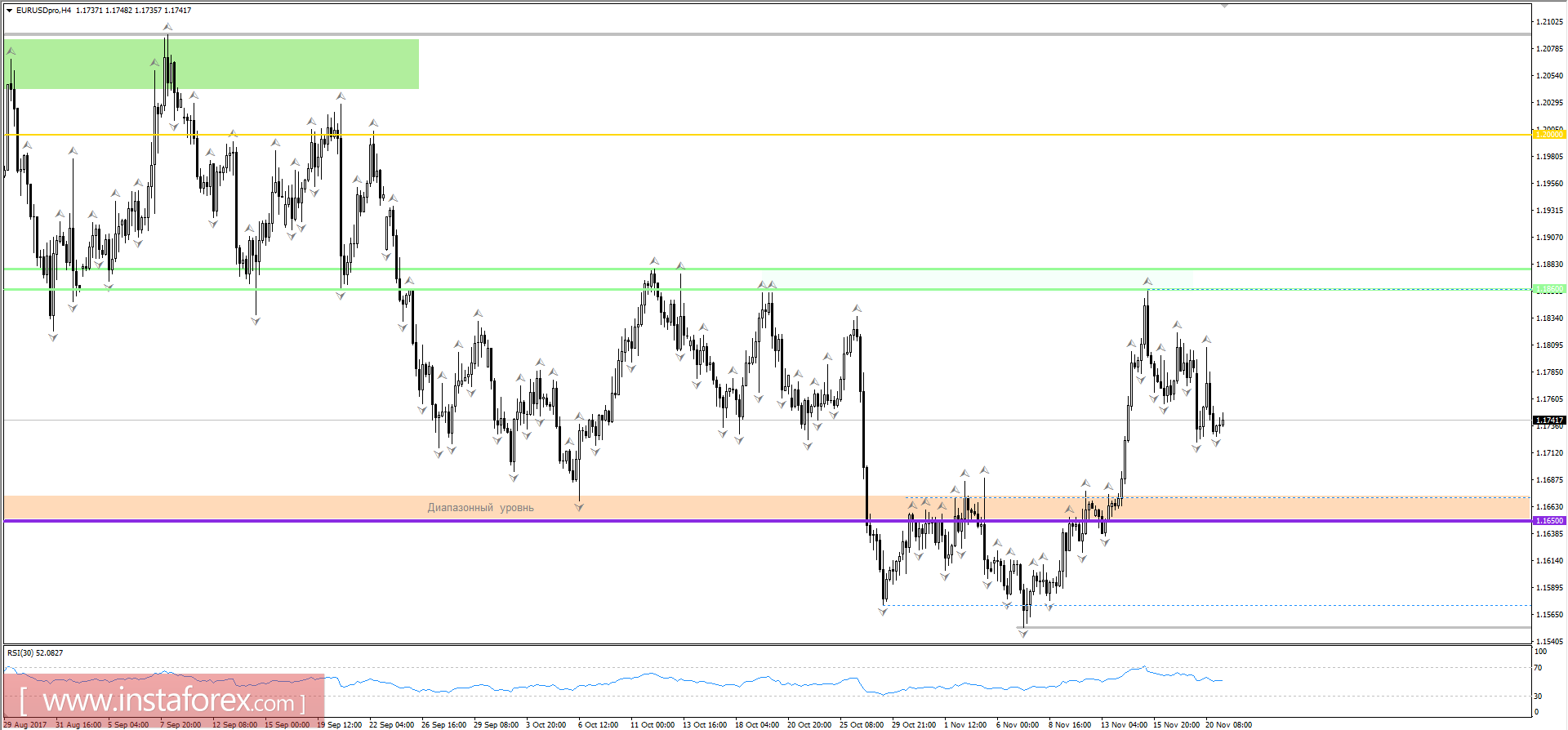

Today, politics will prevail once more in the market. Following the FDP, the "Greens" pulled out of the negotiating process to form the governing coalition. So now, German Chancellor Angela Merkel now has no option but to announce early elections. And today we are waiting for the date of announcement of new elections. And, of course, it will not add to the confidence of the single European currency. Even if the announcement of early elections will be delay, this will not help the euro, as the expectation of the inevitable will stay like a persistent threat. And, naturally, the pressure on the euro, through the dollar index, will be reflected in other currencies, particularly, the pound.

Meanwhile, in the US, home sales in the secondary market is expected to grow by 0.7%, which, given the recent slowdown in retail sales, will be perceived as a positive signal.

The euro/dollar currency pair, showing an active downward momentum, halted near the value of 1.1720, forming a double-digit candlestick. It is likely that the downward movement will continue in the direction of the range support level 1.1650/1.1670. Positions for selling should be considered after steadying the price below the value of 1.7120.

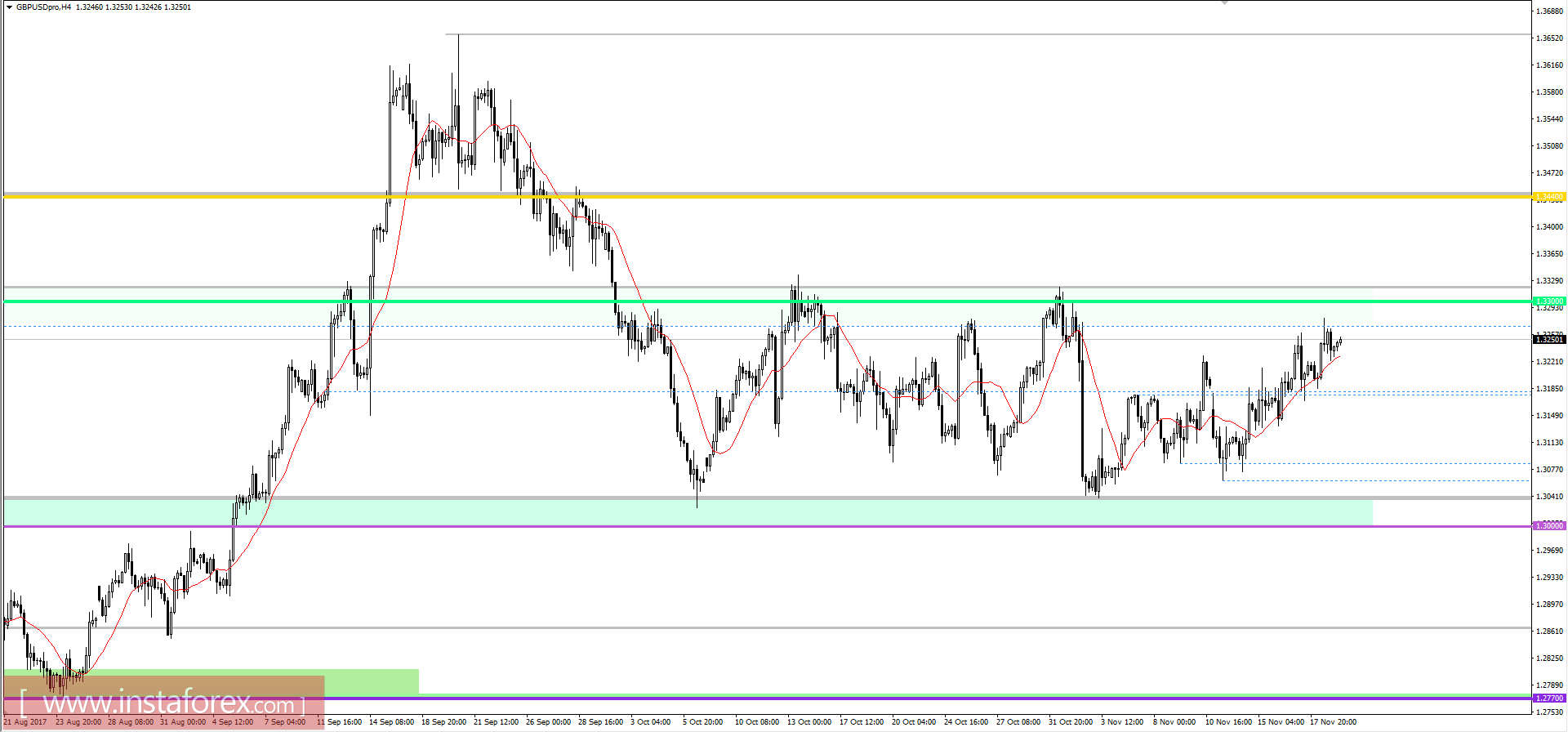

The pound/dollar currency pair is also under pressure, but also because public debt is expected to grow by 6.6 billion pounds, which is not very encouraging for conditions of the not-so-stable economic environment. So the pound has every chance to decline to 1.3175, which is the middle of the current side channel.