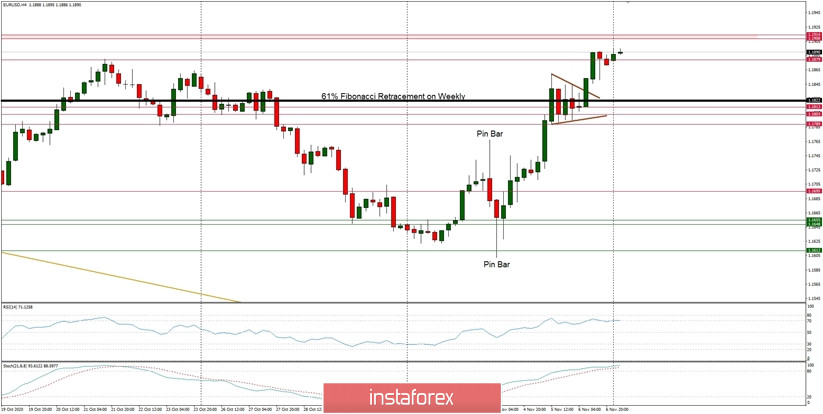

Technical Market Outlook:

The EUR/USD pair has violated the 61% Fibonacci retracement level located at 1.1822 again and made a local high at the level of 1.1895. It looks like the bulls wants to test the key technical resistance located at the level of 1.1908 - 1.1914.

If there is a daily candle close above this level, then the road towards the level of 1.2005 is open. The local support for intraday traders is seen at the levels of 1.1850 and 1.1838.

Weekly Pivot Points:

WR3 - 1.2308

WR2 - 1.2092

WR1 - 1.2015

Weekly Pivot - 1.1812

WS1 - 1.1717

WS2 - 1.1522

WS3 - 1.1441

Trading Recommendations:

Since the middle of March 2020 the main trend is on EUR/USD pair has been up, which can be confirmed by almost 10 weekly up candles on the weekly time frame chart and 4 monthly up candles on the monthly time frame chart. The recent correction towards the level of 1.1612 seems to be completed and now market is ready for another wave up. This means any local corrections should be used to buy the dips until the key technical support is broken. The key long-term technical support is seen at the level of 1.1445. The key long-term technical resistance is seen at the level of 1.2555.