Prior +0.7%; revised to +0.6%

- Industrial production WDA -6.8% vs -5.8% y/y expected

- Prior -7.2%; revised to -6.7%

Factory output missed on estimates towards the end of Q3 and that isn't a convincing signal on how the rest of the region is progressing if you strip out Germany.

As such, the Q4 outlook may look even more dire all things considered but at least for today, the market will still view this as a relatively minor data point.

Further Development

Analyzing the current trading chart of Gold, I found that there is the balancing process for few days due to strong std. Movement in a single day from few days ago.

Anyway, I would still watch for selling opportunities on the rallies with the targets at $1,851 and $1,817.

Key resistance is set at the price of $1,890.

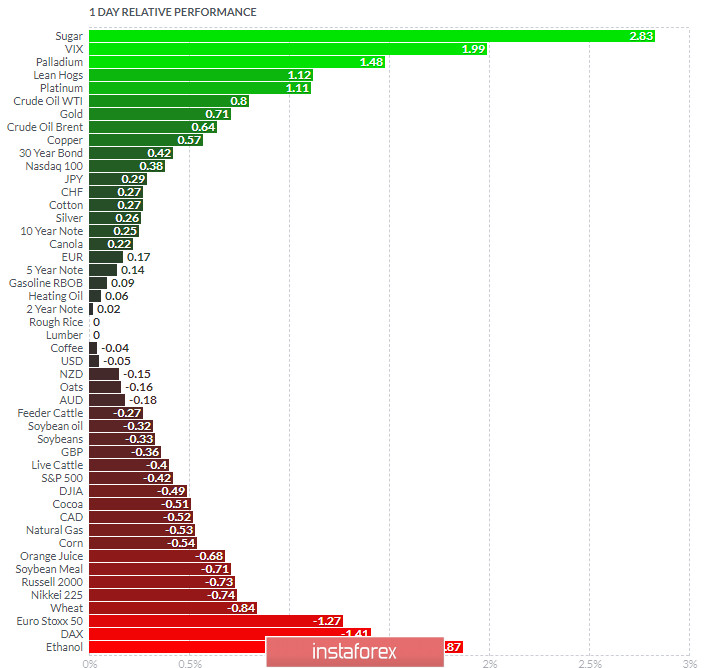

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Sugar and VIX today and on the bottom Ethanol and DAX.

Key Levels:

Resistance: $1,890

Support levels: $1,850 and $1,817