Dear colleagues.

For the EUR / USD pair, the downward structure of November 27 is considered as the main one. For the GBP / USD pair, we follow the formation of the downward structure from December 1. For the USD / CHF pair, we follow the formation of the upward structure from December 1. The key resistance is the level of 0.9880. For the USD / JPY pair, we follow the upward structure of November 27. For the EUR / JPY pair, the price is in a deep correction. The continuation of the movement towards the top is possible after the breakdown of 134.01. For the GBP / JPY pair, we follow the level of 150.14 as the key support for the upward structure. At the moment, the price is in correction.

Forecast for December 6:

Analytical review of currency pairs in the scale of H1:

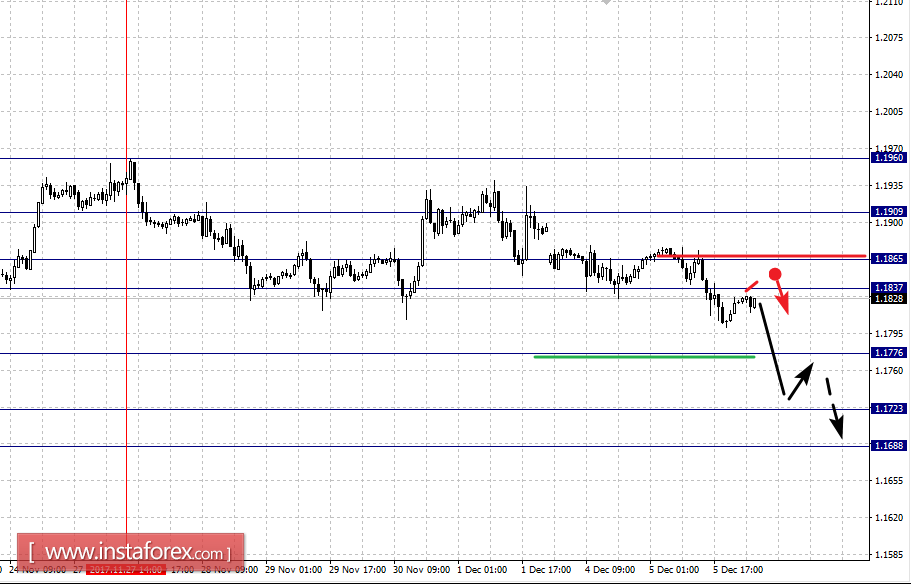

For the EUR / USD pair, the key levels on the scale of H1 are: 1.1960, 1.1909, 1.1865, 1.1837, 1.1776, 1.1723 and 1.1688. Here, we consider the downward structure of November 27 as the main one. Continued downward movement is expected after the breakdown of 1.1776. In this case, the target is 1.1723. The potential value for the bottom is the level of 1.1688, upon reaching which we expect a rollback to the correction.

Short-term upward movement is possible in the area of 1.1837-1.1865. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.1909. This level is the key support for the downward structure.

The main trend is the downward cycle from November 27.

Trading recommendations:

Buy: 1.1837 Take profit: 1.1862

Buy: 1.1867 Take profit: 1.1907

Sell: 1.1774 Take profit: 1.1725

Sell: 1.1720 Take profit: 1.1690

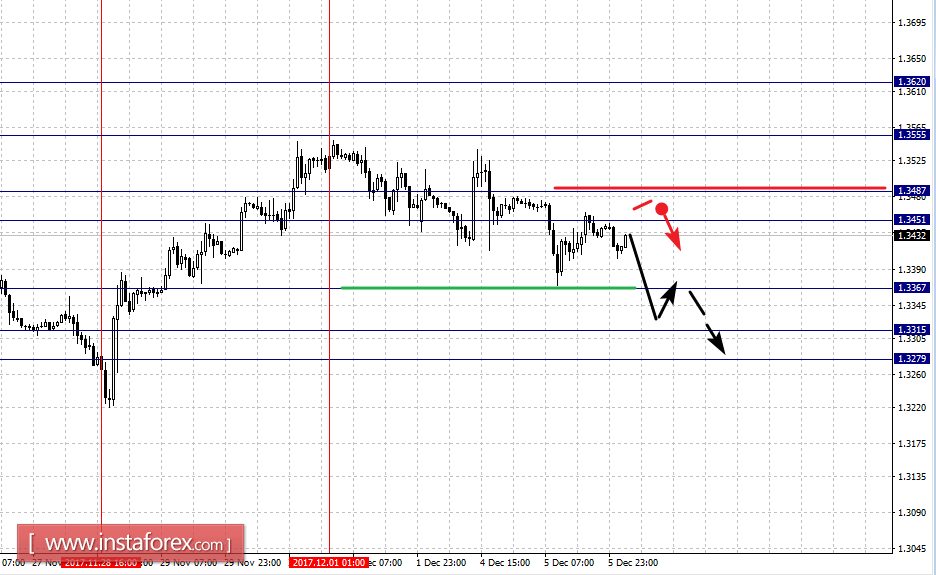

For the GBP / USD pair, the key levels on the scale of H1 are: 1.3620, 1.3555, 1.3487, 1.3451, 1.3367, 1.3315 and 1.3279. Here, the development of the downward structure from December 1 is expected after the breakdown of 1.3365. In this case, the target is 1.3315. In the area of 1.3315 - 1.3279 is the consolidation of the price.

Short-term upward movement is possible in the area of 1.3451 - 1.3487. The breakdown of the latter value will lead to the development of an upward structure. In this case, the target is 1.3555. This level is the key resistance for the development of the upward trend in the scale of H1.

The main trend is the downward structure of December 1.

Trading recommendations:

Buy: 1.3451 Take profit: 1.3485

Buy: 1.3488 Take profit: 1.3555

Sell: 1.3313 Take profit: 1.3400

Sell: 1.3395 Take profit: 1.3280

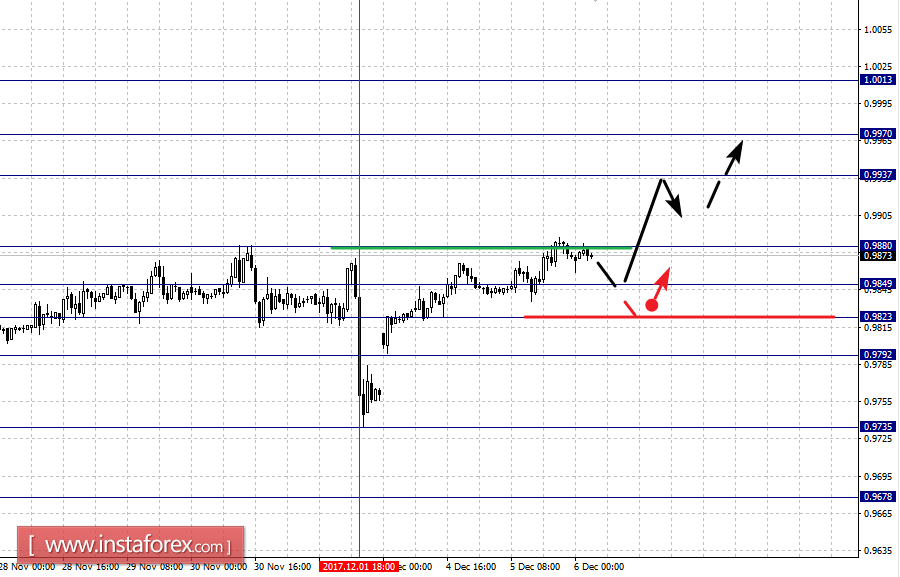

For the of USD / CHF pair, the key levels in the scale of H1 are: 1.0013, 0.9970, 0.9937, 0.9880, 0.9849, 0.9823, 0.9792 and 0.9735. Here, we continue to monitor the formation of the upward structure of December 1. Short-term upward movement is expected in the area of 0.9849 - 0.9880. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 0.9937. In the area of 0.9937 - 0.9970 is the consolidation of the price. The potential value for the top is the level of 1.0013, after reaching which we expect a pullback downwards.

Short-term downward movement is possible in the area of 0.9832 - 0.9792. The breakdown of the last value will lead to the development of the downward structure. Here, the target is 0.9735.

The main trend is the formation of the upward structure of December 1.

Trading recommendations:

Buy: 0.9850 Take profit: 0.9880

Buy: 0.9882 Take profit: 0.9935

Sell: 0.9820 Take profit: 0.9795

Sell: 0.9790 Take profit: 0.9745

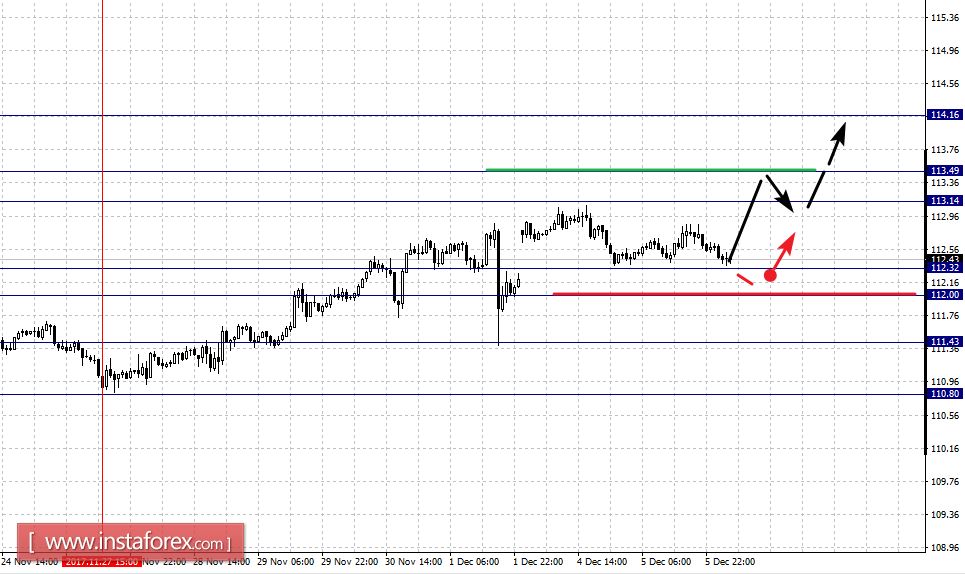

For the USD / JPY pair, the key levels on the scale are: 114.16, 113.49, 113.14, 112.32, 112.00, 111.43 and 110.80. Here, we continue to follow the upward structure of November 27. Short-term upward movement is possible in the area of 113.14 - 113.49. The breakdown of the last value will lead to a movement towards the potential target of 114.16. Near this level, we expect the consolidation of the price.

Short-term downward movement is possible in the area of 112.32 - 112.00. The breakdown of the last value will lead to in-depth movement. Here, the target is 111.43. This level is the key support for the top. Its breakdown will lead to a downward structure. In this case, the target is 110.80.

The main trend is the formation of the upward structure of November 27.

Trading recommendations:

Buy: 113.14 Take profit: 113.47

Buy: 113.52 Take profit: 114.14

Sell: 112.30 Take profit: 112.02

Sell: 111.98 Take profit: 111.50

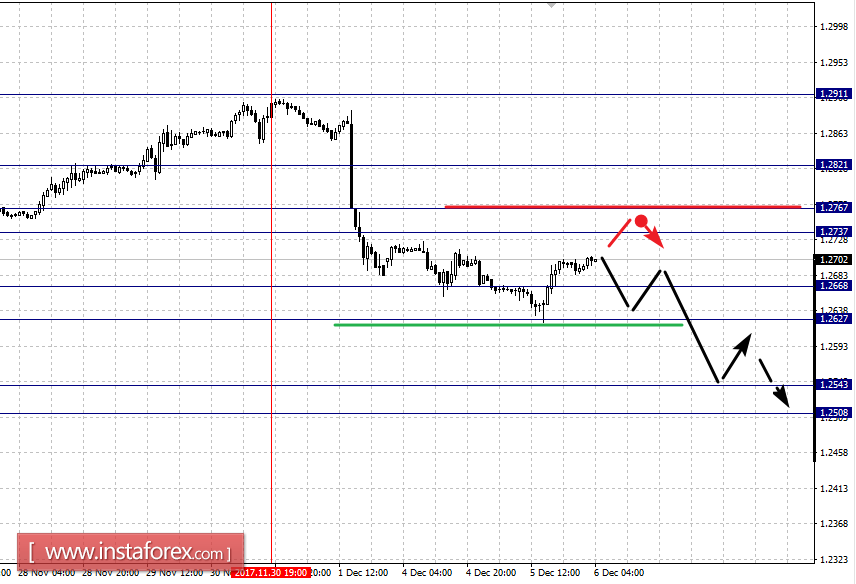

For the CAD / USD pair, the key levels on the H1 scale are: 1.2821, 1.2767, 1.2737, 1.2668, 1.2627, 1.2543 and 1.2508. Here, we follow the formation of a downward structure from November 30. Short-term downward movement is possible in the area of 1.2668 - 1.2627. The breakdown of the latter value will lead to the development of pronounced downward movement. Here, the target is 1.2543. We still consider the level of 1.2508 as a potential value for the downward movement, after reaching which we expect consolidation and a rollback to the top.

Short-term upward movement is possible in the area of 1.2737 - 1.2767. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.2820. This level is the key support for the bottom.

The main trend is the formation of a downward structure from November 30.

Trading recommendations:

Buy: 1.2738 Take profit: 1.2765

Buy: 1.2769 Take profit: 1.2820

Sell: 1.2666 Take profit: 1.2630

Sell: 1.2625 Take profit: 1.2548

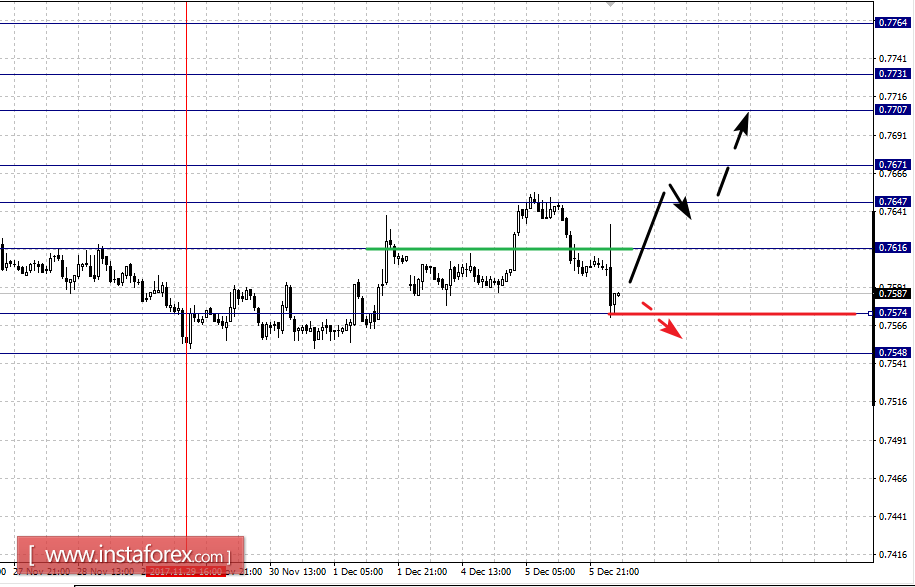

For the AUD / USD pair, the key levels on the scale of H1 are: 0.7764, 0.7731, 0.7707, 0.7671, 0.7647, 0.7616, 0.7574 and 0.7548. Here, the upward structure of November 29 is still relevant for setting targets. The level of 0.7574 is the key support for these initial conditions. Its breakdown will lead to a movement towards the first goal of 0.7548. The continued development of the upward structure is expected after the breakdown of 0.7616. In this case, the first target is 0.7647. Short-term uptrend is possible in the area of 0.7647 - 0.7671. The breakdown of the last value should be accompanied by a pronounced upward movement towards the level of 0.7707, after reaching which we expect consolidated movement in the area of 0.7707 - 0.7731. The potential value for the top is the level of 0.7764, from which we expect a rollback to correction.

The main trend is the upward structure of November 29.

Trading recommendations:

Buy: 0.7616 Take profit: 0.7645

Buy: 0.7648 Take profit: 0.7670

Sell: 0.7572 Take profit: 0.7550

Sell: Take profit:

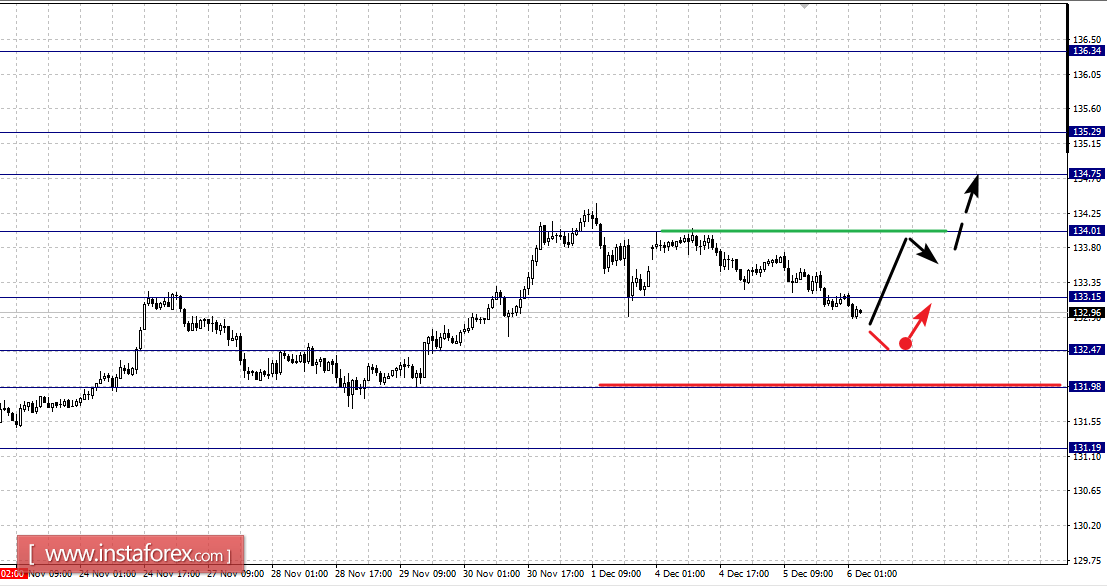

For the EUR / JPY pair, the key levels on the scale of H1 are: 136.34, 135.29, 134.75, 134.01, 133.15, 132.47, 131.98 and 131.19. Here, we continue to follow the upward structure of November 23. Continued upward movement is expected after the breakdown of 134.05. The target is 134.75. In the area of 134.75 - 135.29 is the consolidation of the price. The potential value for the top is the level of 136.34, the movement towards which is expected after the breakdown at 135.30.

We expect movement after the correction at 133.15. Here, the target is 132.47. The range of 132.47 - 131.98 is the key support for the top. Passing the price will lead to the development of the downward structure. In this case, the target is 131.20.

The main trend is the formation of an upward structure from November 23, the correction stage.

Trading recommendations:

Buy: 133.35 Take profit: 134.00

Buy: 134.05 Take profit: 134.75

Sell: 132.45 Take profit: 132.00

Sell: 131.95 Take profit: 131.25

For the GBP / JPY pair, the key levels on the scale of H1 are: 153.98, 153.02, 152.49, 151.68, 151.05, 150.14 and 149.10. Here, we follow the development of the upward structure of November 28. At the moment, the price is in correction. Short-term upward movement is possible in the area of 152.49 - 153.02. The breakdown of the last value will allow us to count on the movement towards the potential target of 153.98. From this level, we expect a pullback downwards.

Short-term downward movement is possible in the area of 151.05 - 150.14. The breakdown of the last value will lead to the lifting of the upward structure. In this case, we expect the initial conditions for the subsequent development of the movement downwards to be formed. Here, the potential target is 149.10.

The main trend is the upward cycle from November 28, the correction stage.

Trading recommendations:

Buy: 152.05 Take profit: 152.50

Buy: 153.05 Take profit: 153.95

Sell: 151.00 Take profit: 150.20

Sell: 150.10 Take profit: 149.10