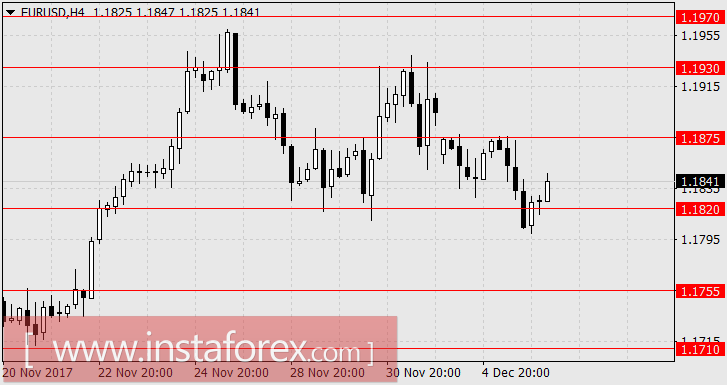

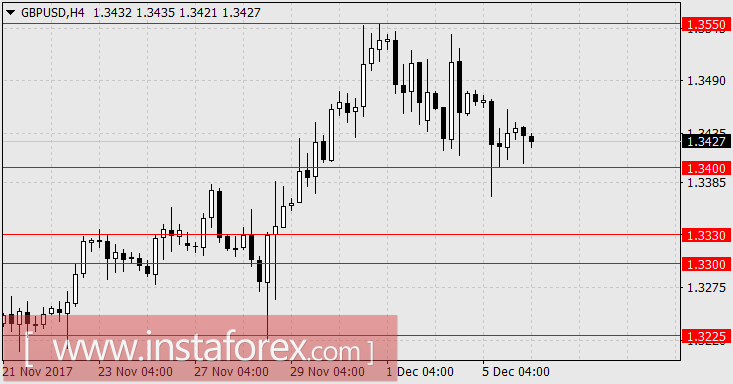

EUR / USD, GBP / USD

On Tuesday, economic data came out worse than expectations for both the euro area and the US. However, it was noteworthy that the dollar was still able to redeem itself against negative data on the US. This is a good sign of investor's determination to stop the excessive growth of the euro. In the euro area, October retail sales decreased by 1.1% and Services PMI in the final estimate for November remained at 56.2 while German Services PMI was revised down to 54.3 from 54.9. In the US, the trade balance for October was -48.7 billion dollars against the forecast of -46.2 billion. Services PMI for November from the company Markit was lowered to 54.5 from 54.7 with an the expectation of growth to 55.4. Meanwhile, ISM Non-Manufacturing PMI fell from 60.1 to 57.4. The stock market lost 0.37% on the data while the dollar index increased by 0.25%. Mueller, who is the leading lawyer in the "Trump case", asked Deutsche Bank for documents on the 300 millionth loan of the future president in order to identify the guarantors, primarily from the Russian side. This did not prevent the dollar from strengthening.

Today, economic indicators may again be on the side of the dollar. The volume of production orders in Germany for the month of October is expected to be reduced by 0.2 / 0.3%. In the US, the main factor will be the change in the number of jobs in the private sector from ADP for the month of November. The forecast for it is 185-190 thousand after the data of 235 thousand in October. The output of the indicator at the forecast level will mean strong non-pharma on Friday with a forecast of 200 thousand. Labor costs in the third quarter are projected to grow by 0.2%. In the previous period, it was 0.5%.

We are waiting for the euro at 1.1755 and 1.1710. The decrease in the pound sterling is expected in the range of 1.3300 / 30.

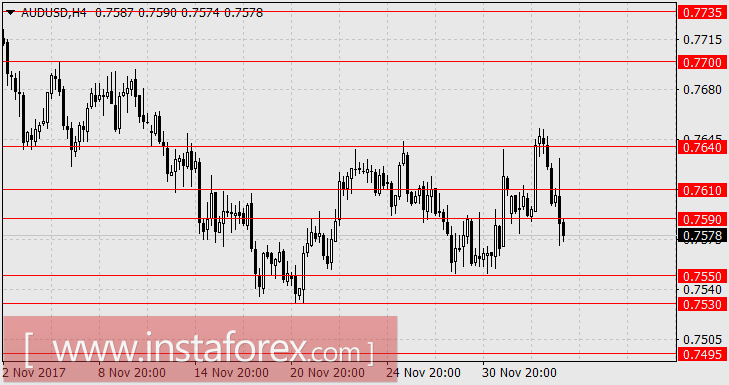

AUD / USD

Yesterday, the "Aussie" was able to close the day stronger against a decline in European currencies on the decision of the Reserve Bank of Australia to maintain the current rate of 1.5% and a moderately optimistic accompanying statement of the head of the Central Bank, Philippe Lowe. However, he once again stated about the undesirability of the high rate of the national dollar. The economic data was good. The balance of payments for the third quarter improved from -9.7 billion dollars to -9.1 billion with the forecast at -9.2 billion dollars. The volume of retail sales for October increased by 0.5% against expectations of 0.3%. The service activity index in the AIG valuation for November increased from 51.4 to 51.7. This brought the export indicator to 0.0% for the 3rd quarter against the forecast of 0.3%.

However, optimism was short-lived. Today, the GDP data disappointed. For the third quarter, the economy grew by 0.6% against expectations of 0.7% with a year-on-year growth of 2.8% against the forecast of 3.0%.

Close to the "Aussie", the commodity markets also fell under the strengthening of the US dollar: iron ore -1.3%, copper -4.2%, aluminum-0.8%, and gold -1.1%. In the Asian session, the AUD / USD pair lost 25 points. We expect the pair to fall further to 0.7495.