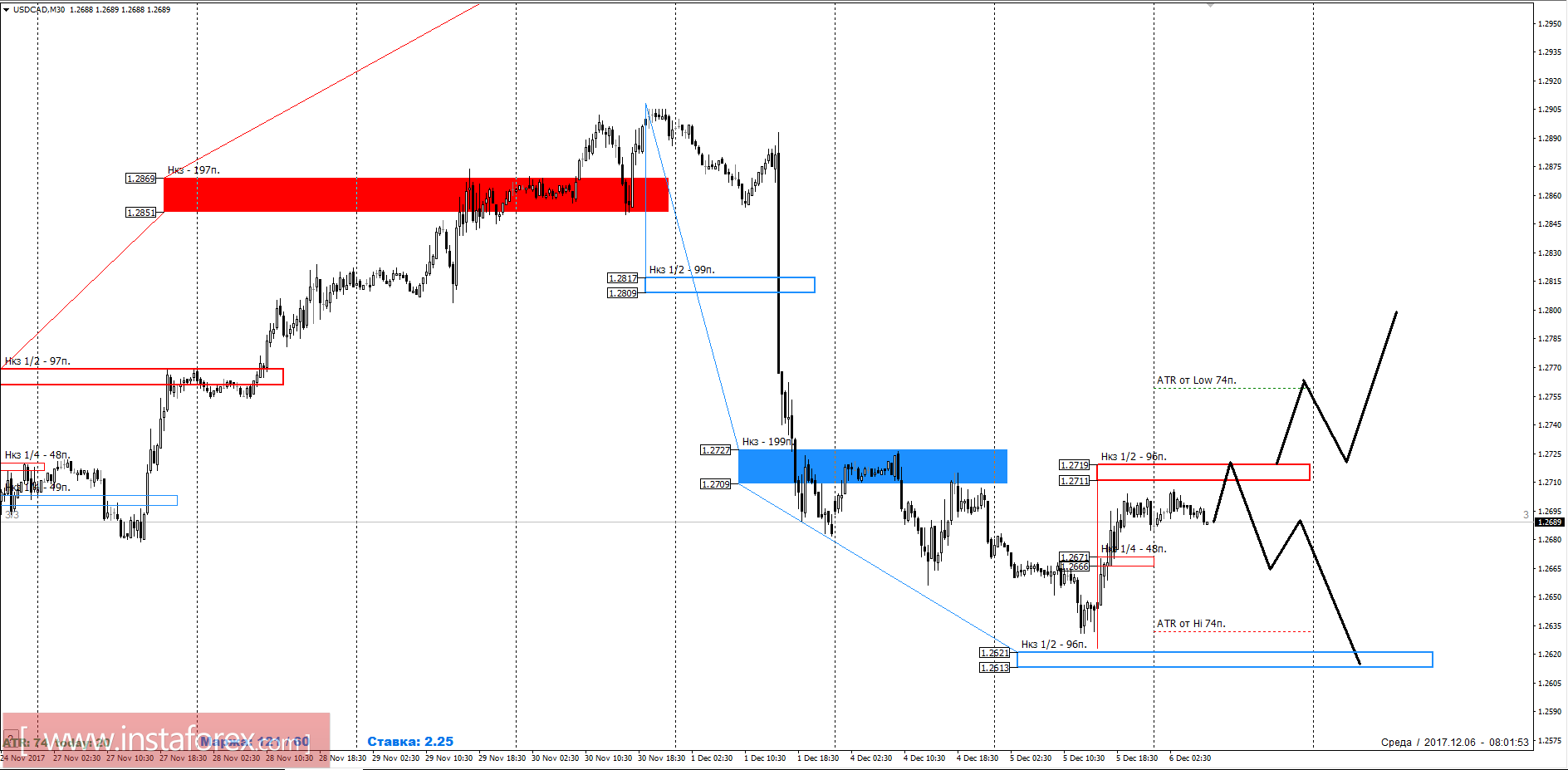

Yesterday, the pair reached the target support level for weekly control zone (NKZ) 1/2 1.2621-1.2613, which led to an increase the demand and growth in the exchange rate. It should be noted that the downward movement remains impulsive, which allows us to consider growth to find favorable prices for the sale of the instrument.

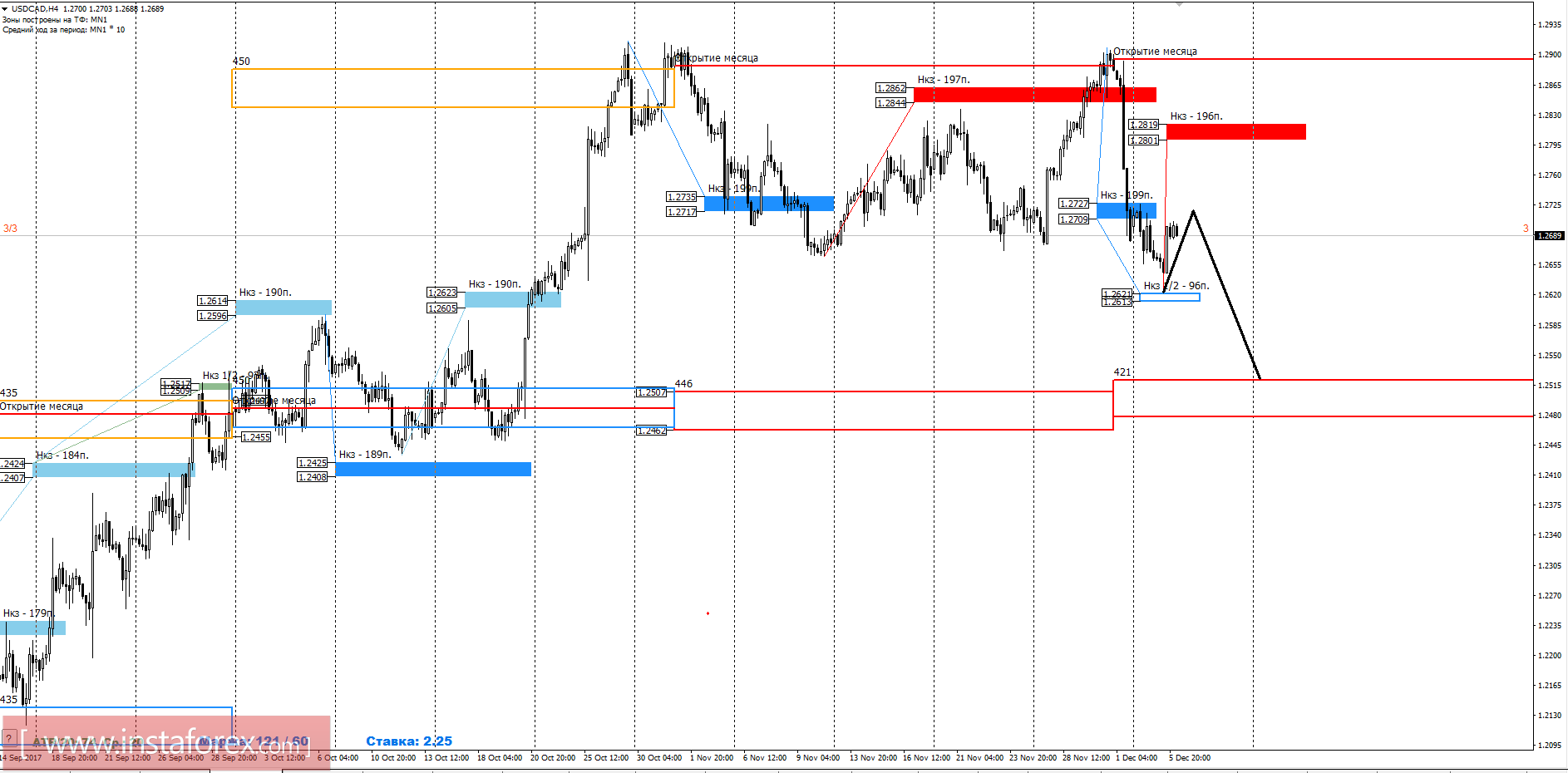

Medium-term plan.

There is a consolidation below the weekly KZ 1.2727-1.2709 for this week, which indicates a high probability for the continuation of the downward movement. Exceeding the limits of the flat range formed in November has failed, hence, some portion of the sales can be secured in order to obtain more favorable prices in selling the instrument. The maximum correction zone is the weekly KZ 1.2819-1.2801. While the pair is trading below this zone, the downward movement will remain a medium-term bearish impulse.

The alternative model will be developed if the pair was able to gain a foothold on top of 1.2727 level. This will consider working in the range of flats, where intraday purchases become possible.

Intraday plan.

Today, the pair is trading near the determined resistance NKZ 1/2 1.2719-1.2711. If the rate continues to trade below this zone, the downward movement will continue with 70% probability. In case the pair will consolidate above 1.2719 during the US session today, this will lead to the formation of a reversal pattern. The framework of the average daily movement for this day allows us to consider both the continuation pattern and the reversal pattern. The most favorable prices for selling can be seen within the limits of the NKZ 1/2.

Daytime CP is the daytime control zone. The zone formed by important data from the futures market, which change several times a year.

Weekly CP is the weekly control zone. The zone formed by important futures market marks, which change several times a year.

Monthly CP is the monthly control zone. The zone is a reflection of the average volatility over the past year.

* The presented market analysis is informative and does not constitute a guide to the transaction.