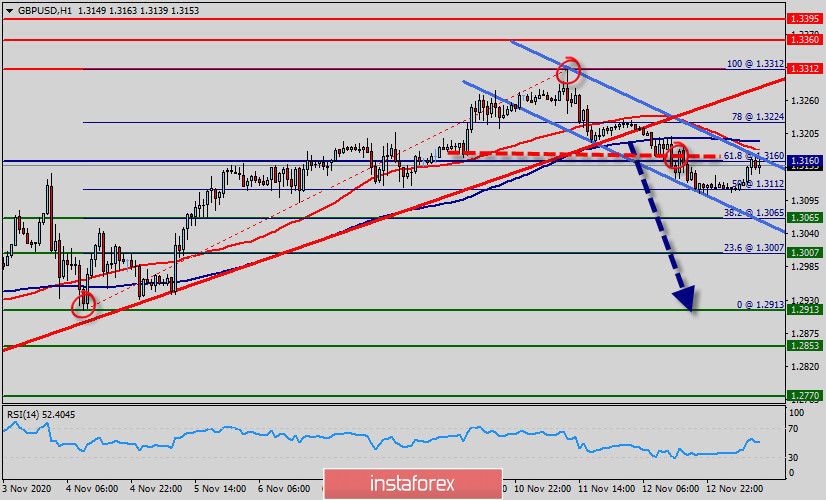

The GBP/USD pair broke 1.3224 level strongly and settled below it, which turns the intraday track to the downside, on its way to reach 1.2913 before resuming the bullish trend again. So, the expected trend for today - Bearish Market.

The GBP/USD pair shows some bearish bias to approach testing the key support 1.3065. The expected trading range for today is between 1.3224 support and 1.2913 resistance.

However, on the downside, firm break of 1.3160 minor support support will turn bias back to the downside for 1.3065 support instead.

Therefore, the bearish bias will be expected for today, noting that breaching 1.3224 and holding below it will stop the negative scenario and push the price to regain the main bearish trend that its next main target located at 1.3065.

Equally important, the RSI and the moving average (100) are still calling for a downtrend. Hence, the market indicates a bullish opportunity at the level of 1.3065 in the H1 chart.

Also, if the trend is buoyant, then the currency pair strength will be defined as following: GBP is in an uptrend and USD is in a downtrend.

Sell below the minor support of 1.3160 with the first target at 1.3065 (this price is coinciding with the ratio of 38.2% Fibonacci), and continue towards 1.3007.

The price will fall into the bearish market in order to go further towards the strong support at 1.2913 to test it again. Furthermore, the level of 1.2913 will form a double bottom.

On the other hand, if the price closes above the major resistance, the best location for the stop loss order is seen above 1.3312.