EUR / USD, GBP / USD

The US dollar strengthened as it gains momentum. On Tuesday, investors bought the dollar against economic data which happened the same thing yesterday. If this is the case, even the Friday nonfarm payroll data came in below forecasts, the dollar can continue to grow calmly as the news reported that the data is generally good, and they will not prevent the Fed from raising the rate next week. This fundamental pattern (currency redemption against news) worked mainly on the euro and seems unnoticed for a long time. But this week, the situation has radically changed. Taking into account the above-stated reasons, the rate increase, the balance reduction of the Federal Reserve System, the attraction of record volumes of external debt, the strategic reduction of raw materials, and the general policy of the United States to strengthen the national currency (including its usual strengthening in the market, coupled with the policy of reverse capital flow in the US through payment transactions and stimulation of production). Therefore, the dollar "should" fall below the 1.0339 level from which the euro began to climb in January this year. We consider the long-term goal of reducing the euro to the area of 0.9770-1.0000 but does not limited to that range.

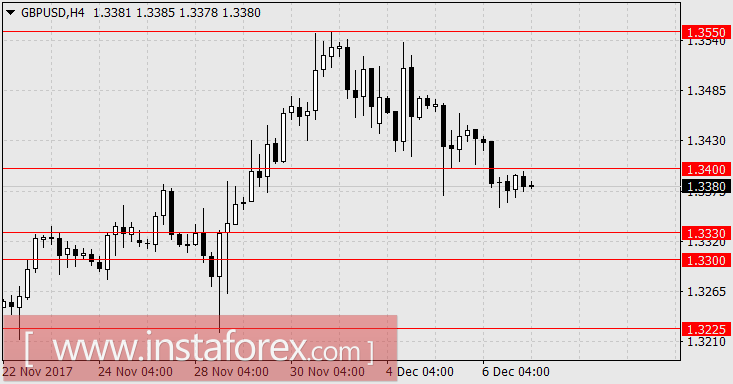

With respect to the British pound, there are several differences. The closing level for the week of Brexit referendum was reached in September at 1.3656 level, and from the voting day today which is 76 weeks after, the pound decreased by only 1100 points (14 points per week). Hence, the British currency fundamentally restored its entire losses after the referendum and prepared to decline against the background of strengthening the dollar. All the positive aspects of negotiations with the EU are currently insignificant compared with the factors that prevent the pound from falling further. The conclusion of a trade deal with the EU during and after the transitional period is taken as a circumstance that is bound to happen, simply because trading conditions will not be stable without it. And Britain is regarded to be worse than the EU.

,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,. In the United States, the final estimate of labor costs for the third quarter brought a preliminary optimism, showing -0.2% against 0.5% earlier versus the 0.2% forecast. The change in job figures in the private sector from the ADP is at a level of 190 thousand against 189 thousand compared with 235 thousand in October. This gives the premise that Nonfarm Payrolls will come out good with a forecast of 200K. These important expectations indicate that the data for today appears to be less important. The industrial production volume in Germany for October is expected to increase by 0.9%, While, France's trade balance for October is projected to reach the level of -4.7 billion euros. The second assessment of GDP in the euro area for the 3rd quarter is expected to remain unchanged at 0.6%. According to the US, the data of the initial application for unemployment benefits. Consumer lending in October shows a forecast of 16.8 billion dollars against 20.8 billion in September.

We are expecting for the euro in the range of 1.1710 / 20 and further move in the range of 1.1650 / 65, while the pound sterling is expected at the level of 1.3225.

USD / JPY

In the recent days, the world has received another controversy which is the expansion of the Palestinian conflict, this arises after the Donald Trump. This decision resulted from a sharp protest from Turkey, Palestine, Iran, and criticism from the UN, as in 1967, the eastern part of the city was captured by Jews in the war with Palestine. The American stock market closed mixed, as Dow Jones fell to 0.16% and Nasdaq gained 0.21%. Despite this increase, the Japanese Nikkei 225, however, shows growth of 1.19% today, and the yen grows by 15 points with the support of the dollar. The Reuters Tankan business confidence index in December remained at the previous level of 27 points.

Against the background of continued strengthening of the dollar, the yen is expected to rise to 113.00, 113.90 and further to the range of 114.70 / 90.

* The presented market analysis is informative and does not constitute a guide to the transaction.