The euro continues to remain under pressure in tandem with the US dollar amid weak data on industrial production in Germany as well as the expectation of an increase in the Fed interest rates in its upcoming meeting next week.

According to the report of the German Ministry of Economy, industrial production in October showed a decline and was worse than expected.

Thus, industrial production fell by 1.4% compared with the previous month against economists' expected growth of 0.7%. Manufacturing output fell by 2.0% while production in construction fell by 1.3%. Growth was noted only in the energy sector where the increase was 5.1% compared with the previous month.

Despite the drop in the overall indicator, some leading economic experts are confident that the decline in October was directly related to Germany's long holidays and public holidays which were quite a lot in October this year.

The trade deficit of France rose in October. This happened directly because of the increase in imports over exports.

According to the French Customs Office, the foreign trade deficit in October 2017 was at the level of 4.96 billion euros against 4.64 billion euros in September. The current account deficit in the balance of payments in October amounted to 2.2 billion euros against 3.3 billion euros in September.

According to the Bank of France, the deficit in trade in goods fell to 3.3 billion euros while the surplus in trade and services rose to 0.3 billion euros.

Data on the number of Americans applying for unemployment benefits did not support the US dollar in the afternoon and were generally ignored by the market.

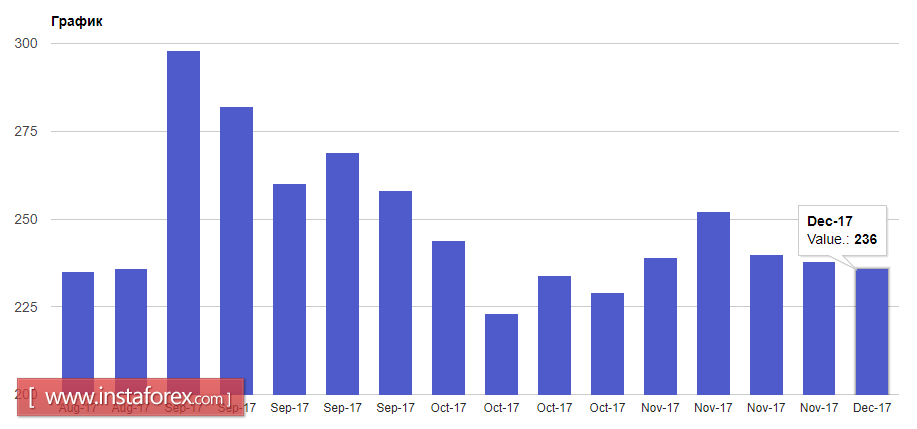

According to the report of the US Department of Labor, the number of initial applications for unemployment benefits for the week starting from November 26 up to December 2 decreased by 2000 to 236 000, which fully coincided with the forecasts of economists.

Meanwhile, the pressure on the euro remains.

A breakthrough in the technical level of support at 1.1780 could lead to a larger sale of the euro with the renewal of lows from November 20-22 in the area of 1.1735 and 1.1710. If the bulls hold the support area at 1.1780, then we can talk about a very likely upward correction of the trading instrument in the resistance range 1.1805 and 1.1840.