Overview :

The British pound closed last week up at the price of 1.3184 against the US dollar, as Brexit fears continued and data released on Friday showed that the UK's economy contracted for the first time since a long time.

The British pound rallied significantly during the week, reaching towards 1.3184 handle. At this point in time, it looks like we are running out of momentum.

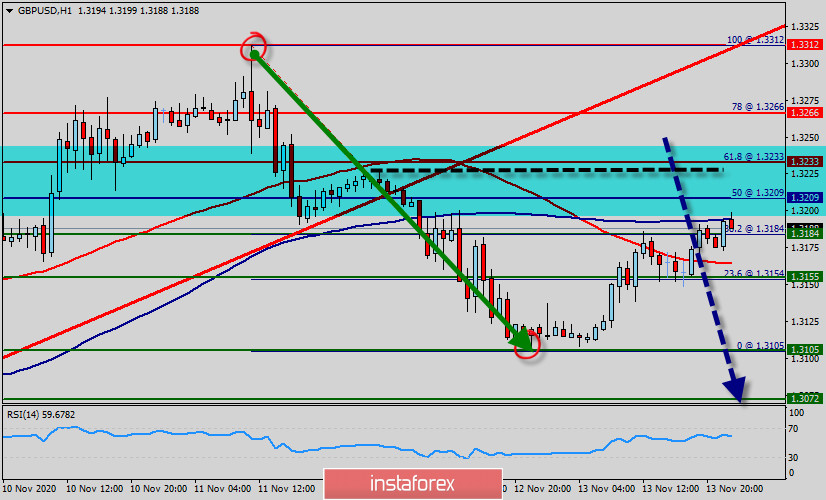

Last week, the GBP/USD pair fell from to top point of 1.3312 to the bottom of 1.3105 to rebound toward 1.3184 (close price)

The market is likely to continue to be very sharp if we do pull back from here, but it surely looks as if we are running out of a lot of the momentum.

As the current rebound is pushing the cable close to this level once again, price action is trading below the 1.3209 handle.

As long as the 1.3209 level holds, the GBP/USD pair is likely to trade subdued. There is a risk of falling further down to the 1.3155 handle.

The hourly chart shows strong consolidation taking place as price whipsaws back and forth.

As a result, there is currently no clear trend defined within the short term.

We are starting to see the market focused on Brexit and coronavirus at the same time, so that probably puts the British pound in the crosshairs of a lot of traders in both directions.

Now, the price is set at 1.3209 to act as a daily pivot point. It should be noted that volatility is very high for that the GBP/USD pair is still moving between 1.3312 and 1.3105 in coming days.

Furthermore, the price has set below the strong resistance at the levels of 1.3233 and 1.3105, which coincides with the 61.8% and 00% Fibonacci retracement level respectively.

Additionally, the price is in a bearish channel now. Amid the previous events, the pair is still in a downtrend. From this point, the GBP/USD pair is continuing in a bearish trend from the new resistance of 1.3233/1.3209.

Moreover, the RSI is becoming to signal a downward trend, as the trend is still showing strong above the moving average (100). Thus, the market is indicating a bearish opportunity below the area of 1.3233/1.3209.

Thereupon, the price spot of 1.3233/1.3209 remains a significant resistance zone. Therefore, a possibility that the GBP/USD pair will have downside momentum is rather convincing and the structure of a fall does not look corrective. In order to indicate a bearish opportunity below 1.3233/1.3209.

If the pair fails to pass through the levels of 1.3233 or/and 1.3209, the market will indicate a bearish opportunity below the strong resistance levels of 1.3233 or/and 1.3209.

In this regard, sell deals are recommended lower than the 1.3233 or/and 1.3209 level with the first target at 1.3150. It is possible that the pair will turn downwards continuing the development of the bearish trend to the level 1.3105.

The trend is still calling for a strong bearish market from the spot of 1.3312 - sellers are asking for a high price (1.3312 : double top).

However, stop loss has always been in consideration thus it will be useful to set it above the last double top at the level of 1.3312 (notice that the major resistance today has set at 1.3312).

Forecast :

Accordingly, the market is likely to show signs of a bearish trend. In other words, sell orders are recommended below the resistance levels 1.3312, 1.3266 and 1.3233 with the first target at the level of 1.3155. If the trend is be able to break the major support at the level of 1.3155, then the market will continue rising towards the weekly resistance 1 at 1.1305.