Today, the focus of the markets will be on two events. The first is the release of data on employment in the US for the month of November, and the second is the likely conclusion of agreements on the details of the withdrawal of the UK from the EU.

According to the consensus forecast from the Bloomberg agency, the US labor market in November should receive 190,000 new jobs against the October value of 261,000. The possible range of values is from 153,000 to 250,000. The unemployment rate should remain at the same level, 4.1%, with the possible range from 4.0% to 4.3% being determined for it.

It can be assumed that if the data does not disappoint and will still turn out to be higher than the forecasts, and figures that were published on Wednesday about employment in the private sector from ADP would allow this to be expected, then on such a wave of optimism, the dollar will certainly receive appreciable support against major currencies. Its position is so good because of the almost 100% likelihood that the Fed will hike interest rates next week following the meeting. As well as the positive hope that the tax reform in the United States will support economic growth and the labor market, which will be an incentive for increasing inflationary pressures. This in turn, will stimulate the Fed and continue the cycle of raising interest rates.

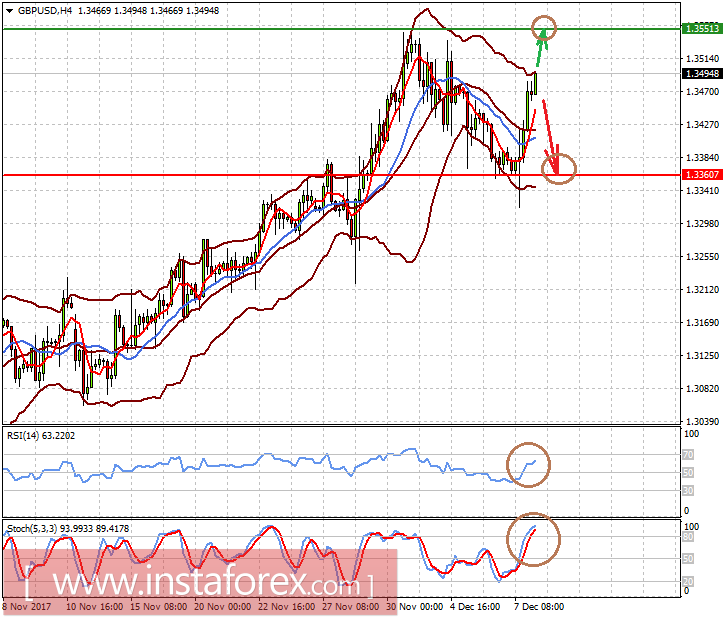

Today, the market will also focus on the possible conclusion of an agreement on Brexit between the UK and the EU. On Thursday, late in the evening, there was a ray of hope that it would already happen before the weekend. Against this background, following the results of volatile trades, the sterling has received support and will likely continue to grow, but only if the agreement is reached in a form that is acceptable to Britain. However, if this does not happen, the British currency will also easily decline, as it has recently grown.

Forecast of the day:

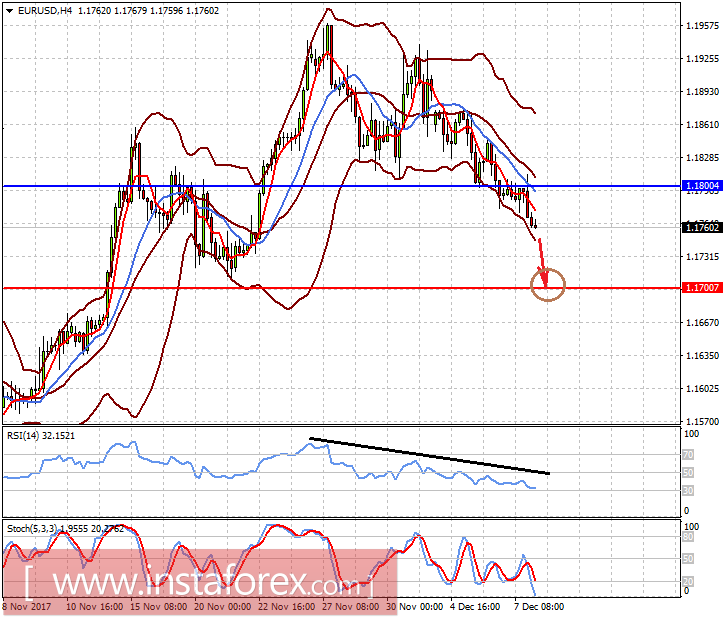

The EURUSD pair is trading below the 1.1800 level, remaining in the short-term downward trend. On the wave of positive data on the number of new jobs in the non-agricultural sector of the US economy, we can assume that it will continue to decline to the level of 1.1715, and possibly even 1.1700.

The GBPUSD pair remains at a crossroads. Everything will depend on whether an agreement is reached on the details of the UK's withdrawal from the EU. If it does follow, we expect the pair to grow towards 1.3550 or even higher, despite, perhaps, positive data from the US. However, if no agreement follows, we can expect it to fall to 1.3360.