EUR / USD, GBP / USD

As a result of last Friday, the exchange rate of major currencies remained virtually unchanged even with the release of optimistic data on employment in the US. The British pound lost 92 points after vetoing the DUP with an agreement on the status of Northern Ireland. However, this only blocked the speculative growth of Thursday which actually means that currencies are in the same standing with only with a one-day shift. The same minimal dynamics was shown by oil and gold. The stock market added 0.55%. In the non-agricultural sector of the US. 228,000 new jobs were created in November against expectations of 200,000. The data for October were revised downward to 244,000, down 17,000, and thus the November growth slightly bridges the fall of October. At the same time, the September indicator was revised upward from 18,000 to 38,000 which makes the picture more optimistic. The hourly wage increased by 0.2% with expectations at 0.3%. The index of consumer confidence in December from the University of Michigan was 96.8 against the forecast of 99.0. The subindex of inflationary expectations in consumer confidence rose from 2.5% to 2.8%. Wholesale stocks decreased by 0.5%. The Federal Reserve Bank of Atlanta lowered the forecast for GDP for the fourth quarter from 3.2% to 2.9%. Markets expect an increase in the rate this Wednesday with a probability of 98.3%.

Uncertainty among investors is caused by political factors. The Merkel bloc's negotiations with the Schulz party (PSD) on the coalition will begin tomorrow. The US Congress must approve the budget for the next year with a deadline on December 22 or by the end of next week. On Thursday and Friday, the EU summit will be held on the terms of the Brexit transition without including discussions on the trade agreement. On Thursday, the ECB and the World Bank will make decisions on monetary policy. However, all attention is on the Fed.

Today, Italy's retail sales may drop by 0.1%. The number of open vacancies in the US is projected at 6.03 million versus 6.09 million in October.

We are waiting for the euro in the range of 1.1710 / 20, then in the range of 1.1650 / 65. For the pound sterling, we are waiting in the range of 1.3300 / 30.

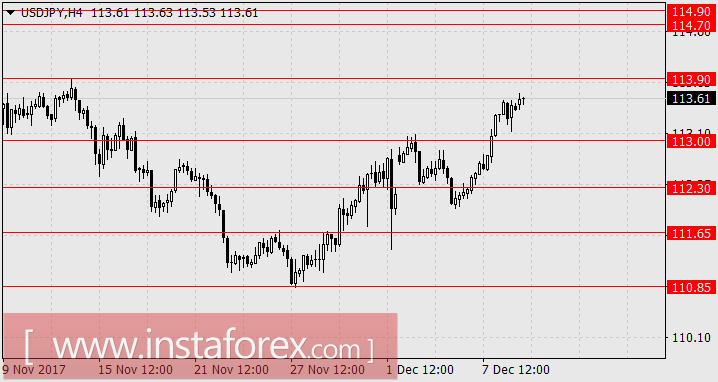

USD / JPY

Japanese investors are trying as quickly as possible and as far as possible to move away from the dangerous level of 111.00. This is favored by external and internal circumstances. On Friday, the Dow Jones grew by 0.49% while EuroStoxx50 added 0.63%. Japan's GDP in the final assessment for the third quarter was raised from 0.3% to 0.6% while waiting for 0.4%. The balance of payments for October increased from 1.84 trillion yen to 2.44 trillion while waiting for 1.93 trillion yen. The index of assessment of the current economic situation in Japan Eco Watchers for November jumped from 52.2 to 55.1. Wages in October increased by 0.6% although the forecast was 0.8%. However, this is a very good growth. Another positive was from China, whose trade balance in November amounted to 40.2 billion dollars against the forecast of 34.9 billion and 38.1 billion dollars in October.

Today, the BSI index of business sentiment in major industrial companies in Japan for the 4th quarter showed an increase from 9.4 to 9.7 points. The forecast was 10.1 but in this case, we see growth. The stock index Nikkei 225 adds 0.22%, the Chinese Shanghai Composite grew for the second consecutive day by 0.40% after falling from November 22 to 5.13%.

Tomorrow, the producer price index of Japan will come out in November. The forecast is 3.3% y / y against 3.4% y / y in October. The tertiary index of business activity in the service sector for October is expected to increase by 0.2. On Wednesday, domestic orders for machine-building products may grow by 2.8% in October. We are looking forward to the growth of the yen in the range of 114.70 / 90.