The markets' focus for this week is shifted to the results of the meetings of the Federal Reserve and the European Central Bank (ECB).

The market is waiting for the key interest rate to increase by 0.25% to 1.50% from the Fed, with a 90.2% probability, according to the dynamics of futures on Federal funds rates. It is believed that this event has been taken into account in the dollar quotations, and therefore impossible to strengthened. This can be considered acceptable. It is very important to publish the bankruptcy declaration. In addition, the main thing is the regulator retaining his plans for the future with respect to the continuation of the cycle. If it remained unchanged and does not check out inflation outlook, then raising the borrowing cost will support the dollar.

Jerome Powell, the incumbent head of the Federal Reserve, mentioned earlier in his speech to the Senate Banking Committee about the support from former Fed Chair Janet Yellen to the current course of the bank.

Supporting the overall dynamics of the dollar, the expected growth rates in 2018 will continue, as well as the proposed taxation in the States. This formed predictions about the stimulation of business activity by lowering the tax burden, new jobs, and stimulating the inflation growth.If the Fed is expected to raise rates, the ECB is expected to maintain the status quo despite the revival in November inflationary pressures. which, admittedly, still has the 2.0% target level. Most likely, the European regulator will not do anything about the monetary policy, but the resolution of the bank, as well as the speech of Mario Draghi, will sound positive about the status of the region's economy. But this will not be enough for the euro to develop confidently in the currency markets.

Forecast of the day:

The EUR / USD is trading below the 1.1785 level, remaining in the short-term downtrend. On the wave of expectations about raising rates by the Fed and maintaining the ECB's status quo, the pair could possibly continue to decline to 1.1700.

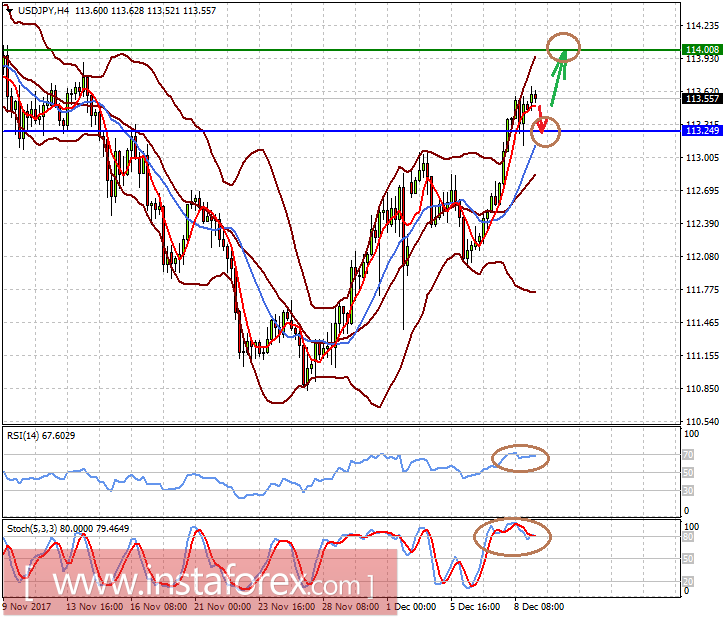

The USD / JPY pair on the wave of the overbought can be adjusted to the level of 113.25. If it holds above that area, there is a possibility of growth resumption to the target level of 11.400.

* The presented market analysis is informative and does not constitute a guide to the transaction.