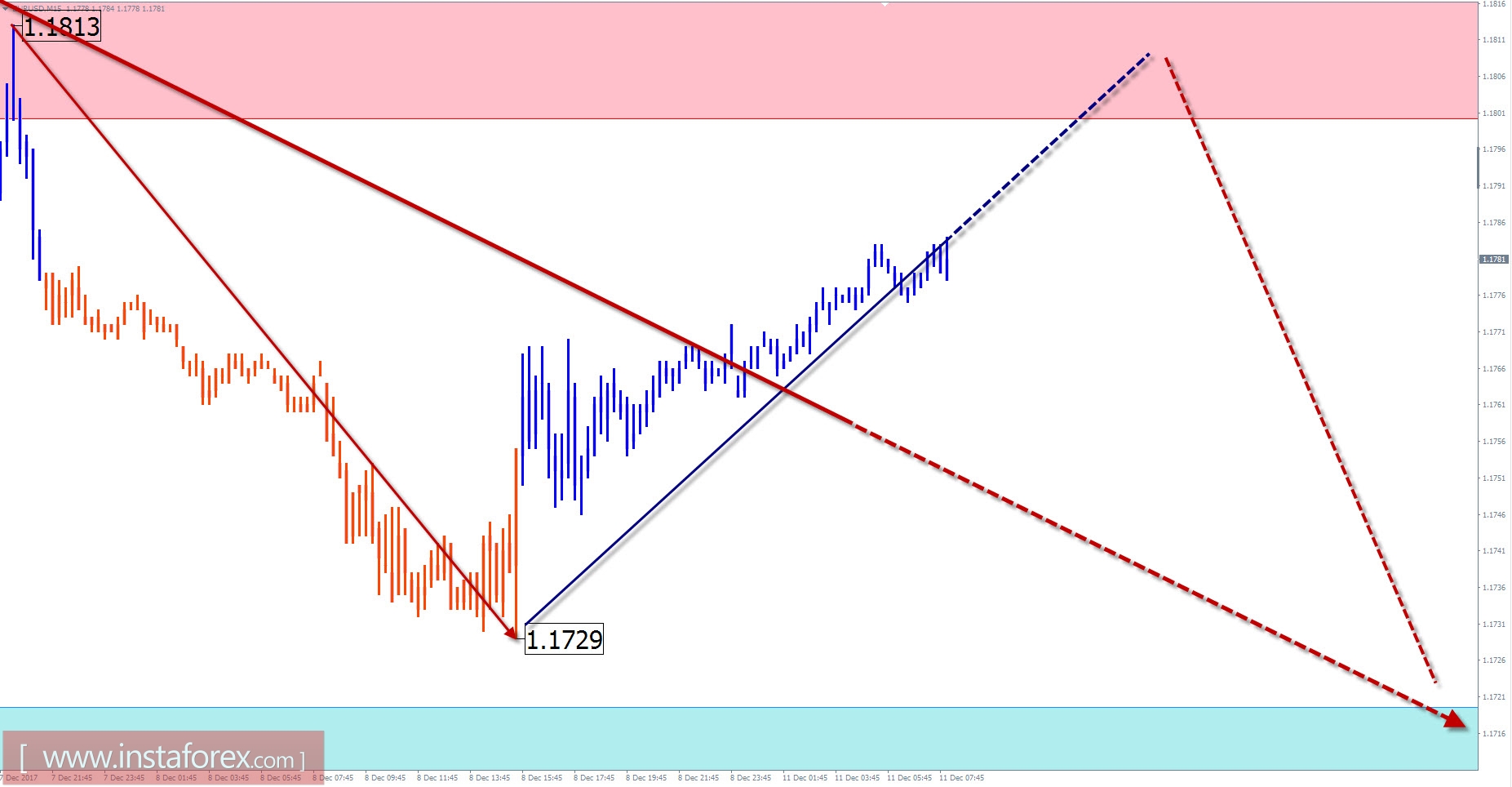

EUR / USD outlook for the current day

Since early 2015, quotations of the euro main currency pair formed a flat correction figure "stretched plane." Currently, the proportions of the parts of the wave have been met at the price of the preliminarily completed zone of completion.

A counter wave is forming in the area of the reversal zone since the end of August. The potential allows the traders to wait for the continuation of a downward trend. The correction of the last section of the main trend wave is the least expected. The analysis of the structure shows the development of the middle part of the structure.

In the first half of the day, the end of the last rolling recession is expected to end within the resistance zone. The change in the forex rate and the subsequent decline of the pair will more likely occur at the end of the day.

Boundaries of resistance zones:

- 1.1800 / 1.1830

Boundaries of support zones:

- 1.1720 / 1.1690

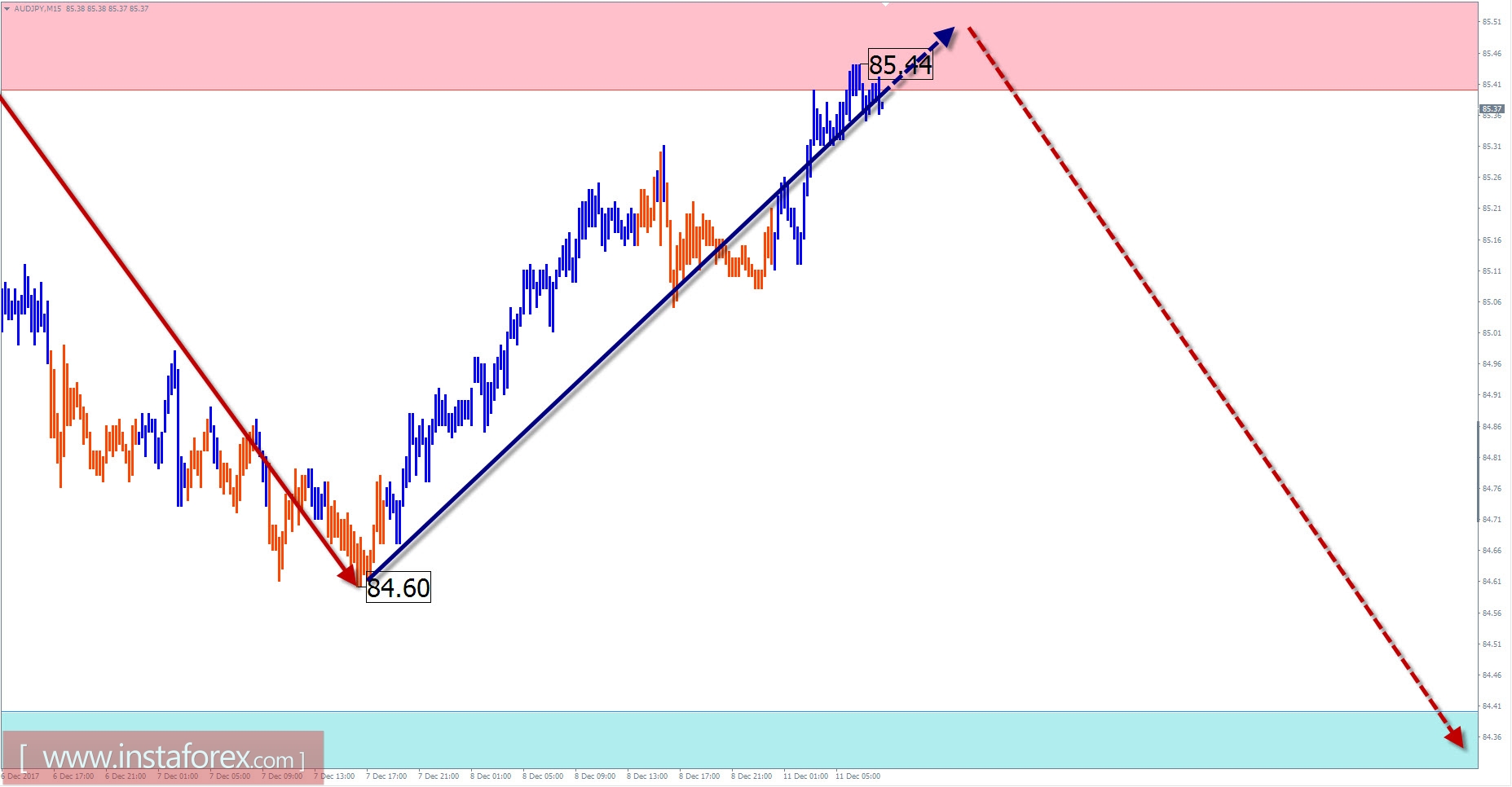

Overview of AUD / JPY with the forecast for the current day

On the daily chart scale of the cross currency Australian dollar against the Japanese yen since the end of June last year. The direction of the trend is set by the rising wave. By August, the price movement reached a zone of potential reversal on a large scale. Since then, the development of a counter wave design of a smaller size has been observed. It is not excluded that this could develop into a full-fledged correction in the end. The preliminary completion zone for the current decline is within the price figure below the current price level in the nearest potential turn area.

For the next day, a return to the downward course is expected after the end of the bullish retracement. Achieving the upper limit of the calculated completion zone is likely to happen in the upcoming days.

A downward course is expected to return the next day after the end of the bullish retracement.

Boundaries of resistance zones:

- 85.40 / 70

Boundaries of support zones:

- 84.40 / 10

Explanations to the figures:

For simplified wave analysis, a simple waveform is used that combines 3 parts namely A, B, and C. All types of correction are created and most of the impulses can be found in these waves. Every time frame is considered and the last incomplete wave is analyzed.

The areas marked on the graphs indicate the probability of a change in the direction of motion has significantly increased as calculated in the areas. Arrows indicate the wave counting following the technique used by the author. A solid background of the arrows signifying the structure has been formed while the dotted one means the expected wave motion.

Attention: The wave algorithm does not take into account the duration of the movement of tools in time. The forecast is not a trading signal! To conduct a bargain, you need to confirm the signals used by your trading systems.