In the first half of the day, the dollar will have to give up slightly under the pressure of inflation data from the UK, but the dollar will resume its growth in the second half of the day.

Despite the fact that tomorrow there will be a meeting of the Federal Commission for open market operations, there is no need to wait for a subdued trading for today. Firstly, the inflation data from the U.K. is expected to maintain the 3.0 percent figure, which is quite high.In addition, the growth rate in producer prices can accelerate from 2.8% to 3.0%. Such a high inflation rate amid the extremely low refinancing rate, this may force the Bank of England to reconsider its plans. At least, this is what investors expect. Therefore, the inflation data should support the pound.

Nevertheless, the growth of the pound will be short, as the data on producer prices data from the U.S. comes out towards the evening. It is expected that the growth rates will accelerate from 2.8% to 2.9%, which will remove any doubts about the future decision of the Fed at the refinancing rate.

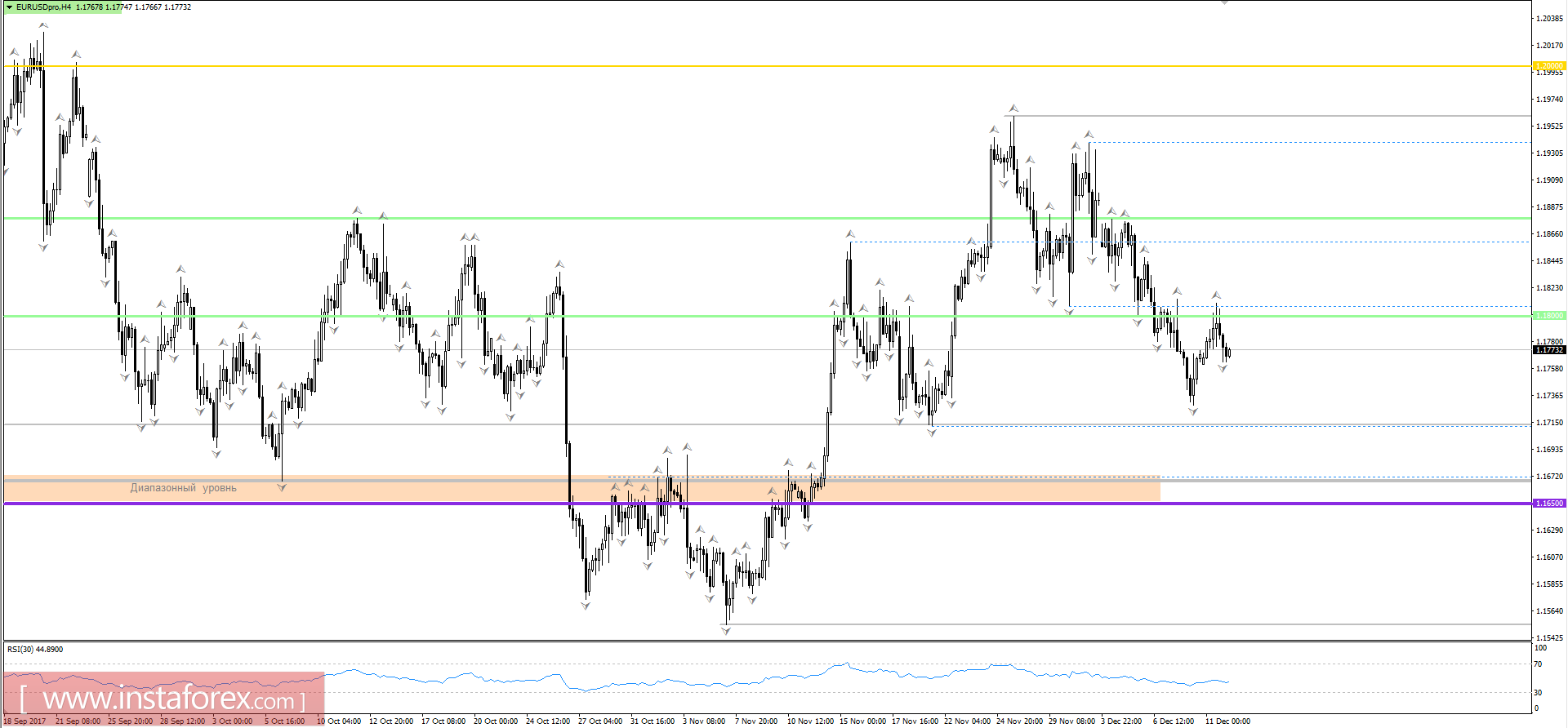

The EUR/USD pair will likely draw a timeline of fluctuations at 1.1761 / 1.1810. The main trade should be considered outside the borders: purchase above the level of 1.1815 with the prospect of moving towards the level of 1.1860 and sell below the level of 1.1760 with the prospect of moving to 1.1735.

The GBP/USD currency pair climbed to the local minimum last week, where there is a support that slowed down the movement. Probably, the area of 1.3330 will be achieved directed towards 1.3380 / 1.3400 against the background of inflation data. However, in case that of a delayed stagnation, the quotation will go down to the range of the 1.3300.