Today, the attention of the markets will be turned to the Federal Reserve decision on monetary policy, as well as to the publication of consumer inflation data in the United States.

The significance of the meeting is to increase its interest rates by the next 0.25%, and also to provide the central bank's forecasts on GDP growth, interest rates, and expected inflation for the next three years, starting in 2018. The report will allow markets to conform oneself to the regulator's plans for monetary policy. It should be recognized that, for instance, when the key interest rate increase to 1.50% today, the Fed will fully implement its plan on the number of excess rates and their target level already planned in December last year.

It can be assumed that in case the plans of the Fed, for the next three years and especially for 2018, demonstrate the same motive to normalize monetary policy would serve a strong supporting condition for the US dollar.

Another important event will happen today, which is the publication of consumer inflation data that have an undeniable effect towards the dollar. It is assumed that the overall index of consumer prices in annual terms will grow by 2.2% against 2.0% a year earlier. In November, the consumer price index should grow by 0.4% against 0.1% in October. At the same time, it is expected that the base consumer price index for November grew by 0.2% against the October value of 0.2%, and remained at the same growth level of 1.8% on an annual basis.

Evaluating the strong dynamics of the labor market in November, as well as the positive values of industrial inflation indicators, trigger hopes for the increase in basic components of consumer inflation figures. In this case, it will be a good optimistic background for the Fed's meeting on monetary policy, which can present a resolution for a more positive outlook on inflation prospects and interest rates. This will certainly be another strong argument for the strengthening of the dollar.

Forecast of the day:

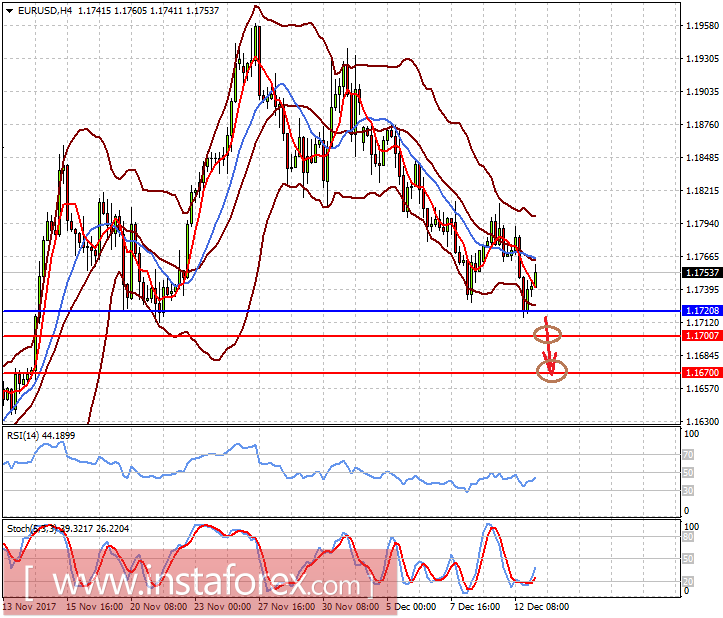

The EUR/USD pair is trading lower on the wave of higher rates expectations in the US and positive news on consumer inflation. From a technical point of view, a break below 1.1720 could be the reason to lower the price to 1.1700 initially, and then to 1.1670.

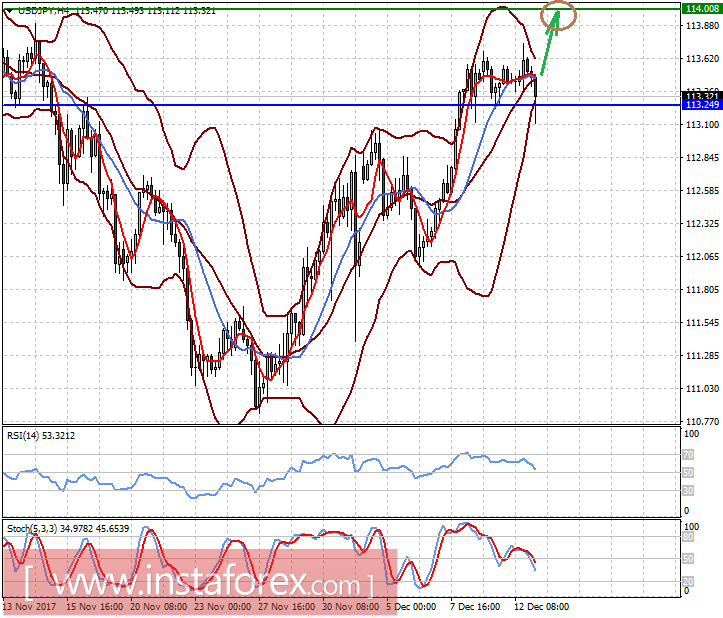

The USD/JPY pair is consolidating above the 113.25 level in anticipation of news from the US. If it will not disappoint the market, there is a possibility of continuing its growth towards the target level of 114.00.

* The presented market analysis is informative and does not constitute a guide to the transaction.