EUR / USD, GBP / USD

On the key day of the week which is Wednesday, the markets once again thought over the complex puzzle about the growth of counter-dollar currencies at the beginning of the strengthening of the monetary policy tightening cycle: raising rates, reducing the balance of the Fed, and increasing the period of raising public debt. We can't agree with the widespread statement that the dollar fell because of the full readiness of the markets for the December increase. Psychological effects can't withstand a powerful trend of world demand for the American currency, including even speculative operations of the carry trade which increases the volume of transactions through the dollar due to a steadily rising rate for this currency. In its economic forecast, the Federal Reserve raised its economic growth for the coming year from 2.1% to 2.5% and confirmed its intention to raise the rate in 2018 three times. Janet Yellen said that even the Committee on Open Markets took into account the Trump tax reform in its further work and considers it a powerful engine of the economy. The market could not take into account yesterday's increase in the price rates for the reason that since December 2015, when the rate was raised for the first time, and from its last increase in June of this year, the euro rate is 900 and 600 points higher respectively. This riddle proves to be more complicated than it looks even on closer examination.

At such events, macroeconomic data becomes more important. Yesterday, investors were fueled by optimism on data on growth in industrial production in the euro area for the month of October. It increased by 0.2% against the forecast of -0.2%. The annual growth was 3.7% against the forecast of 3.5%. In the UK, the unemployment rate did not decrease from 4.3% to the expected 4.3% and remained at the same level but wage growth for October increased by 2.3% against expectations of 2.2%. In the US, the general consumer price index for November showed a projected growth of 0.4% with a 2.2% y / y vs. 2.0% y / y earlier but the base CPI added only 0.1% for the month against expectations of 0.2% and overall y / y decreased from 1.8% y / y to 1.7% y / y.

Nevertheless, the answer in yesterday's riddle "about the dollar" may be contained in today's decisions of the ECB and the World Bank on monetary policy. If nothing is expected from the ECB, with the exception of Mario Draghi's vague rhetoric, he can announce a "closer" attention of the Committee members to the curtailment of incentives. Although, more than once, plans for the fall of next year has been announced. However, the volume of redemption of corporate bonds in these plans may vary. In other words, the probability of an increase in the rate by the Bank of England exists. If at least one of the regulators takes a step toward tightening the policy, the riddle about the dollar will be solved.

If the Central Bank retains neutrality, investors will again turn to macroeconomic data. In the euro area, the December Manufacturing PMI in the preliminary estimate is expected to decrease from 60.1 to 59.8 while the forecast for Services PMI is 56.0 compared to 56.2 in November. In the UK, retail sales for November are expected to grow by 0.4%.

Retail sales in the US are projected to grow by 0.3%. The base sales, excluding transport, may increase by 0.6%. Manufacturing PMI, also for December, is expected to increase from 53.9 to 54.0 while Services PMI is projected at 54.8 points against 54.5 earlier.

Today, a two-day EU summit on the draft trade agreement with the UK and on the transition period will start.

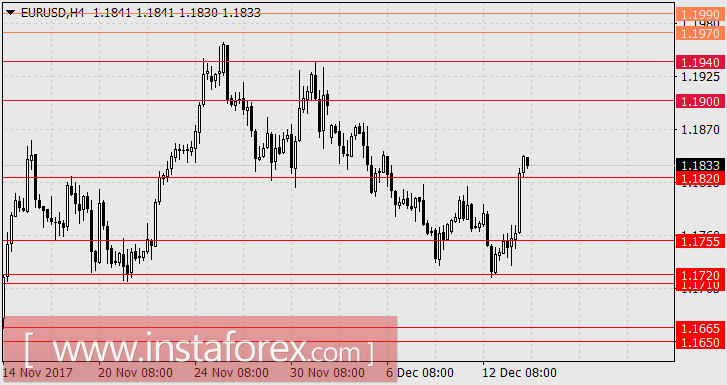

If the Bank of England does not raise the rate, it is more likely to increase verbal pressure and not without optimism on the issue of negotiations on the transition period. In general, we are waiting for the growth of the British pound to 1.3520 and in case of progress in the negotiations, a growth to 1.3645. For the euro, growth in the range of 1.1900 / 40 is likely.

AUD / USD

The Australian dollar could not help but take advantage of the mass positive changes in the market and for yesterday, it increased by 80 points. In the morning, the consumer sentiment index from Westpac for December showed an increase of 3.6%. Further growth of the US dollar pulled along the peripheral currencies. Today, the release of Chinese data has slightly cooled investors. Industrial production in November slowed down the pace from 6.2% y / y to 6.1% y / y while investment in fixed assets reduced growth from 7.3% y / y to 7.2% y / y. The volume of retail sales increased from 10.0% y / y to 10.2% y / y but the forecast was at 10.3% y / y. On Asian markets, stock indices are falling. China A50 shed -0.30%, Nikkei 225 lost -0.44%, S & P / ASX 200 dropped by -0.06%. Meanwhile, the American Dow Jones rose by 0.33% yesterday. Oil fell by 0.8% and iron ore lost 1.0% yesterday. The Australian dollar is only working out positive data on the labor market against the general background of the strengthening of the US dollar. In November, 61.6 thousand jobs were added against a 19.2 thousand forecast. The proportion of economically active population increased from 65.2% to 65.5 % which kept unemployment at the previous level of 5.4%.

We are waiting for the inertial growth of the "Australian" in the range of 0.7700 / 35.