The result of the Fed meeting on monetary policy did not bring anything significantly new, which was the second reason for the weakening of the US dollar, following the consumer inflation from the U.S. came out earlier in the day.

Starting on the atai of economic statistics, the figures for consumer inflation were mixed according to the published on Wednesday afternoon. The general consumer price index (CPI), on an annualized basis, declined by 2.2% in line with expectations. There has been an increase in monthly terms by 0.4% in November against a 0.1% rise in October. Yet, all of the market's attention was drawn to the values of the indicator of basic consumer prices, cleared of volatile food and energy prices, which just came out worse than expected. In the annual terms, the growth rate fell from 1.8% to 1.7%, and added only 0.1% against the forecast of 0.2% in November.

Of course, the foreign exchange market reacted to these figures by the fall of the US dollar, which was intensified by the wave of the publication in the Fed's decision on the monetary policy against the background of J. Yellen speech at the press conference.

The final document showed that rates were raised by 0.25% but not unanimously. even members of the Fed voted "for", while two "against", which made many market players think that the regulator might not fulfill its plans for a rate hike next year. According to the promulgated decision, the bank also expects to raise the key interest rate three times in 2018 to 2.25%.

In our opinion, the market reaction to the results of the Fed's meeting was negative due to the fact that the decision has met expectations appropriately. Although looking in reality perspective, the positive news is more on a negative yet, the market is so composed that if there is nothing new, their reaction would become negative.

In general, we can say that the meeting was routine and did not say anything new, but this does not indicate that the dollar will now globally decline. Most likely, this will continue similarly as the previous move against major currencies, at least before the end of this year.

Forecast of the day:

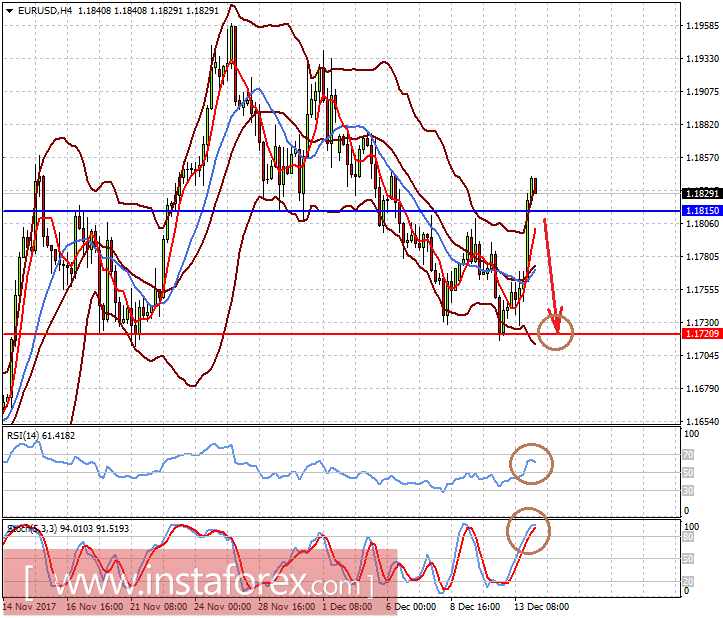

On Wednesday, the EUR/USD pair strongly grew amid a wave of weak data of the basic consumer price index which is because of the Fed meeting outcome on monetary policy. Even today, the situation may change if the ECB does not please investors with new tough statements. If this does not happen, then the pair may fall after passing the area of 1.1815 to 1.1720.

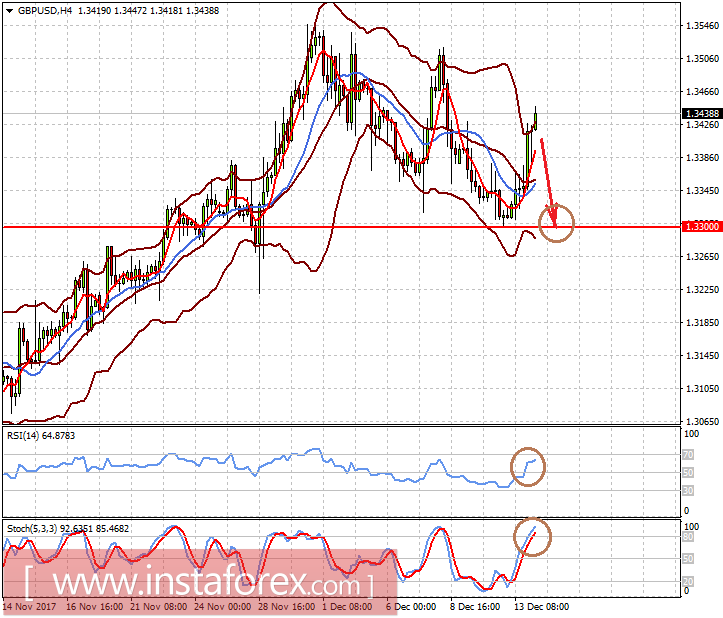

The GBP/USD pair also has the potential to decline to 1.3300 after local growth on Wednesday in the wake of the Bank of England meeting, which is likely to keep the rates unchanged at the same level concerning the economic situation against the Brexit's background.