The US dollar strengthened its positions against the euro and the pound in the afternoon on Friday and is trying to hold them against the background of good fundamental data.

According to the report, industrial production in the US in November this year has grown significantly due to the recovery of the oil and gas sector, which suffered after the autumn hurricanes in the U.S.

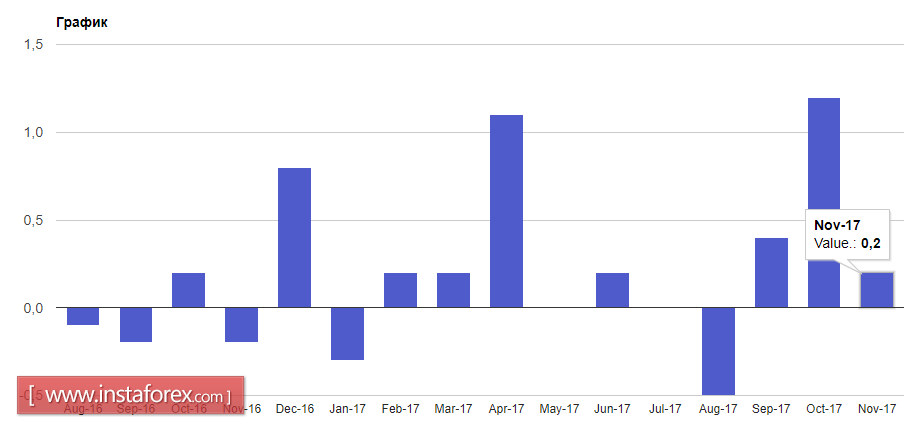

According to the Federal Reserve, industrial production in November rose by 0.2% compared with the previous month. Economists had expected that production would increase by 0.3%. It is noteworthy that the data for October were revised upward, to 1.3%, while earlier, 0.9% growth was reported. In comparison with the same period of the previous year, industrial production in November increased by 3.4%.

Production activity in the area of responsibility of the Federal Reserve Bank of New York in December declined. It happened because of the decline in employment. According to the Federal Reserve of New York, the leading production index in December 2017 was 18 points against 19.4 points in November. The data fully coincided with the forecasts of economists.

Friday evening, the officials of the Federal Reserve, Charles Evans, said that inflation in the US is too low, and this situation has been observed for some time. This leads to certain conclusions that the current process of increasing inflationary pressure will be more long-term. It should be noted that during a recent speech, the Fed Chairman said that the current low inflation is only a short-term factor, and this opinion is shared by most officials of the Federal Reserve.

It is worth mentioning that Evans opposed the Fed rate hike in December, explaining that keeping rates at the same level would better support inflation expectations.

As for the technical picture of EURUSD, further reduction of the trading instrument will be possible only after the breakthrough and consolidation below support 1.1740, which will lead to further selling with the update of new lows of the month around 1.1690 and 1.1640.

The British pound continues to remain under pressure, despite the news that last Friday the EU leaders agreed to move to the next stage of negotiations on Britain's withdrawal from the trade bloc. The concern is that the plans of the Government of Theresa May on the future trade agreement may run counter to the expectations of EU representatives. A more detailed discussion of the trade agreement should begin in March 2018.