GBP / JPY

The closing in the past week turned out to be promising for players to fall. At the moment, some actions are expected from the bulls since there is a zone of strong enough supports (daytime Kijun 150.16 + week Tenkan 150.16 + daytime Senkou Span A 149.78 + daytime Fibo Kijun 149.40 + month Fibo Kijun 149.24). However, the general mood of the current week will most likely aim at overcoming the tested supports.

The players went down to the "bear" zone against the H4 cloud. As a result, a downside target was formed in the breakdown of the cloud, but a strong support zone is located along its course to fulfill the goal. Hence, it is possible to consider the target after passing the area of 150.16 - 149.24. Among the resistance today, the levels of 150.93 - 151.38 - 151.91 should be given importance. Fixing above the levels is undesirable, but in cases where there is a strong return of players to improve the situation will alter the possible outcome into a new one.

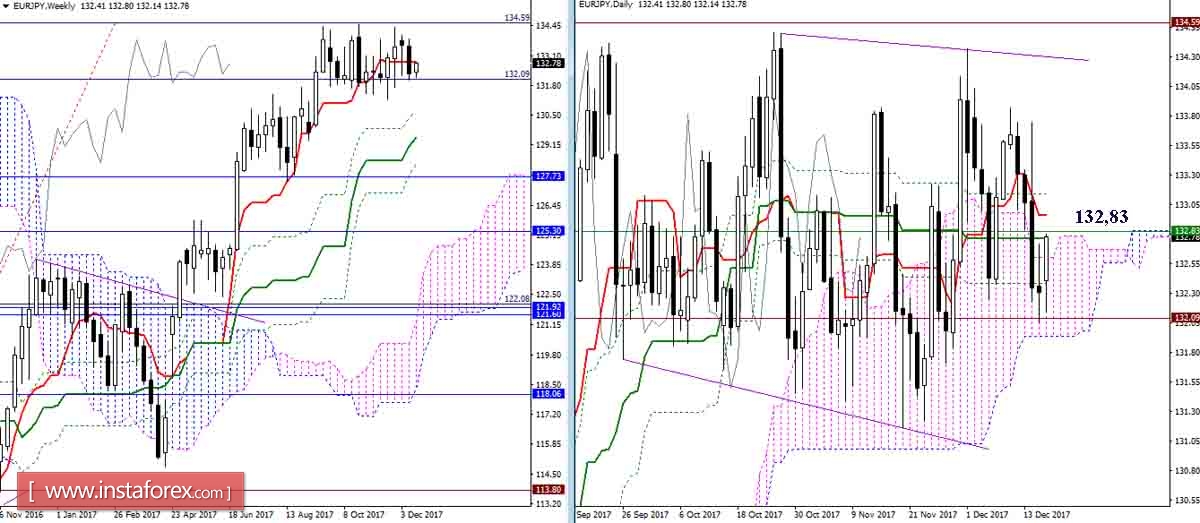

EUR / JPY

Last week, the bears closed the trading session very optimistically under the weekly Tenkan (132.83) and the day's cross. However, in case that updating the minimum and getting out of the daytime cloud (Senkou Span B 131.94), one can expect an increase in bearish sentiments with the formation of a downward target and the development of a weekly correction (Fibo Kijun 130.36 + Kijun 129.08). It should be noted that while the pair remains in the zone of weekly consolidation, the center of attraction formed by the day cross (132.76 - 133.14) and the weekly Tenkan (132.83) remain important, as of the moment.

Consolidation is seen forming at the zone of attraction of the week found at the lower halves of the resistance zone (132.76 - 133.14 + cloud H4 133.31). Settling above the zone of resistance will change the balance of power and return the advantages to the side of the bulls. This will give signals on the direction of the bears. If the bears can now retain their advantages, the main task for them will be the fulfillment of the downward target for the breakdown of the H4 cloud (131.70-97). There is currently strengthening in the lower boundary of the cloud (131.94), with the desire for a further breakdown of these supports.

Indicator parameters:

all time intervals 9 - 26 - 52

Color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chikou is gray,

clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

Color of additional lines:

support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

horizontal levels (not Ichimoku) - brown,

trend lines - purple.