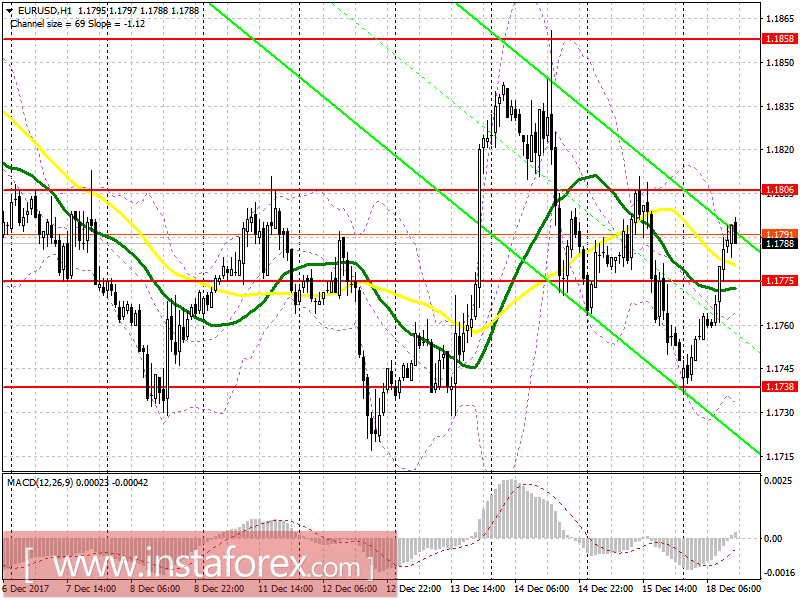

EUR/USD

To open long positions for EURUSD, it is required:

Buyers completed the first morning target for a steadying towards 1.1770 and are currently trying to reach 1.1806, where it is advised to lock in profits. You can consider new long positions after a second test and a false breakdown at 1.1775, or after a steadying above 1.1806, with the main goal of the exit at 1.1858.

To open short positions for EURUSD, it is required:

Considering short positions on the euro can be done after the formation of a false breakdown at 1.1806, with the main goal of a decline towards 1.1775. In the event of a consolidation below the level of 1.1775, it is possible to increase selling in the EUR/USD pair with expectations of renewing the weekly lows in the support area of 1.1738. A breakthrough of 1.1806 opens the way to 1.1858. Therefore, in this scenario, short positions on the euro would be best considered only after the upgrade of this level.

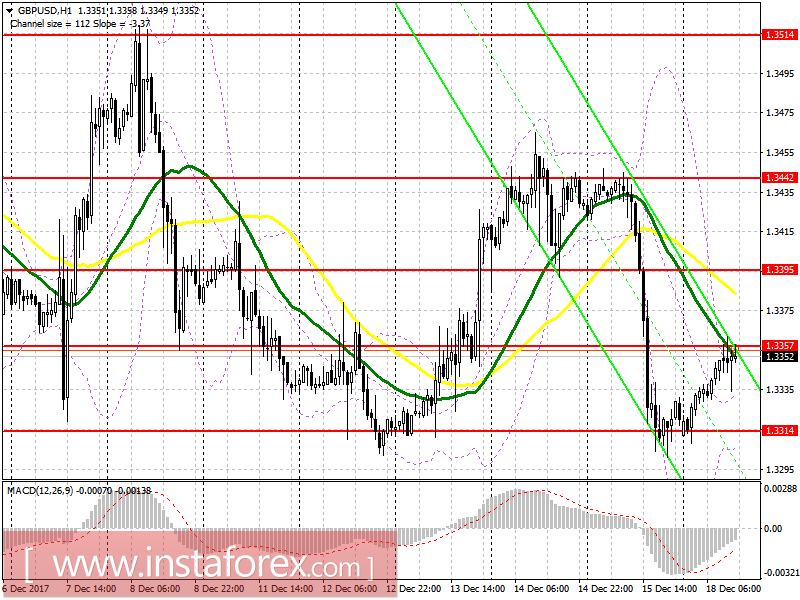

GBP/USD

To open long positions for GBP/USD, it is required:

The plan remains the same for the pound. A break and consolidation above 1.3357 would be a good signal for an increase in long positions in the pound, with the aim of rising to new weekly highs in the area of 1.3394 and the main target of the exit at 1.3442, where it is advised to lock in the profit for today. In case the GBP/USD pair declines, it would be best to consider buying the pound after a false breakdown of 1.3314 or on a rebound of 1.3267.

To open short positions for GBP/USD, it is required:

The formation of a false breakout at 1.3357 with a return to this level has not yet brought the desired result to sellers. Therefore, I do not recommend that you hasten short positions in this range. Either a re-unsuccessful steadying towards 1.3357, or you can consider new short positions after upgrading 1.3395 immediately towards a rebound.

Indicator description

- Moving Average (average sliding) 50 days - yellow

- Moving Average (average sliding) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA

- Bollinger Bands 20