The European currency strengthened slightly against the US dollar on Monday, December 18. Some support was provided by the report on inflation in the euro area, which in annual terms, was in line with the expectations of economists. This means that the market generally remains confident that in September next year, the European Central Bank may announce the curtailment of the QE program.

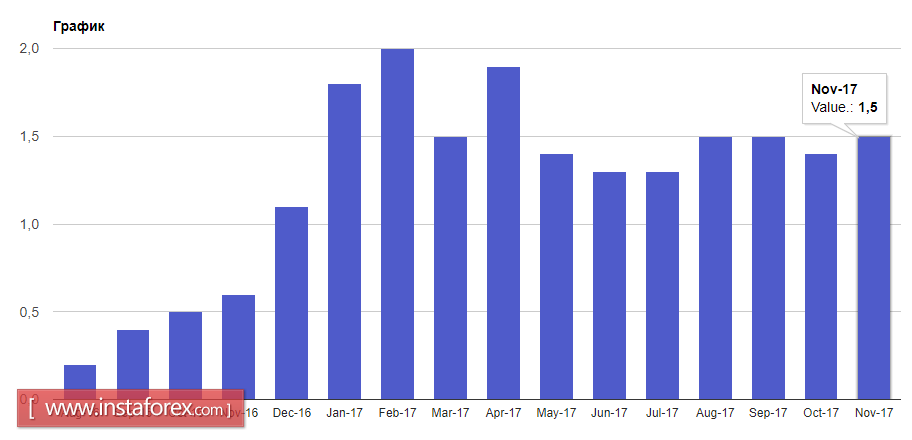

According to the report, the consumer price index of the eurozone in November this year increased by 0.1% compared with October of the same year. This data fully coincided with the expectations of experts. Compared to the same period in 2016, inflation rose by 1.5%, which generally indicates a gradual approach to the target of the ECB at the level slightly below 2.0%.

Basic inflation is not so lucky. According to the data, the basic consumer price index of the eurozone, which does not take into account the volatile categories of goods, decreased by 0.1% for the month of November compared with October. Most of the pressure on the index come from the fall in prices for tobacco products, which was offset by rising energy prices. Compared to the same period in 2016, basic inflation rose by 0.9%. The consumer price index of the eurozone excluding tobacco products in November increased by 0.1%.

Today in the market, there were talks that the European Central Bank could go on winding up the program of buying bonds in September 2018. The main possible reason for the curtailment of the program is the good economic growth of the euro region this year, which may persist in the next year. This will spur the growth of inflationary pressure which is necessary for the European Central Bank.

The US dollar ignored today's speech by the representative of the Federal Reserve Bank's Williams, who said that the US economy is entering a good momentum in 2018 and expects at least 3 increases in the Fed's key rate in 2018. In 2019, Williams also predicts a 2-3 increase in the rate, which will ensure the balance of economic growth as well as relieve the economy of overheating.

As for inflation, according to the representative of the Fed, it will start to grow and within two years and will reach the level of 2%.

As for the technical picture of the EURUSD pair, a break above the level of 1.1780 will allow the development of a bullish trend, which will lead to the renewal of the level of 1.1810 and the very predicted exit to 1.1860, where large sellers of the euro can again announce themselves in the market.