The unexpected news that US President D. Trump about the postponement of signing the new tax code at the beginning of next year has had a local pressure on his course, which may be continued today.

The dollar declined on Wednesday, being under the negative influence not only of reports that Trump decided to postpone the official signing of the new bill, but another reason is the fixation of investors' profits. This occurred on the wave of the end of the narrative associated with the adoption of this document, which was accompanied by colorful political battles in the US establishment. The old good rule of "buying on expectations and then selling on facts" has not been canceled yet. This is the reason for seeing profit taking on the equity market in the United States, as well as the slight weakening of the dollar.

The question arises, will this process develop into something more? This might be difficult to answer, but based on opinions, this is quite real and the reason for this will not be some new fears related to the problems of the country's economy. Nevertheless, the usual desire of market players is to see how the tax reform will work and how much it will really change the situation in the economy. While the financial markets reacted positively to these expectations, which resulted in issuing a kind of carte blanche to Donald Trump and his tax reform. But, at the same time, it is necessary to take into account that the process launched will most unlikely be unambiguously positive for the economy, to the stock market and the dollar.

The reform is supposed to support economic growth through stimulation of the real sector of the economy, and the creation of new jobs, which in turn will have to start the process of increasing inflationary pressures. As a consequence, the interest rates hike of the US Federal Reserve will ultimately not only slow down the rally in the local stock market but also can roll it down. Moreover, the dollar can really get "benefit" from it and against the backdrop of sales in the public debt market and growth in government bond yields of the US Treasury.

But this is only an assumption. The real picture can be seen after the new year.

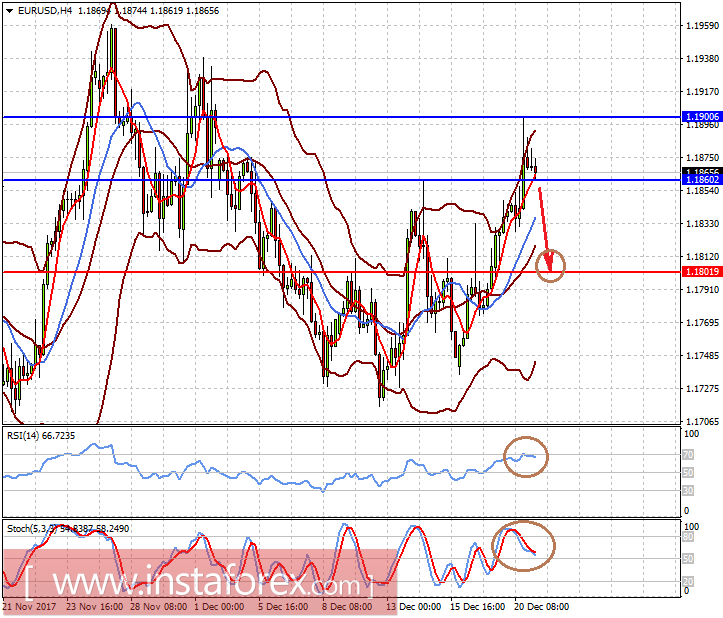

Forecast of the day:

The EUR/USD pair rose on Tuesday with a wave of news that D. Trump decided to sign a new tax code after the new year, as well as on a wave of profit-taking on the principle of "buying on expectations and then selling on facts." Most likely, the pair will adjust today to 1.1800, if it falls below the level of 1.1860.

The USD/JPY pair may continue to grow on the outcome of the Central Bank of Japan meeting on monetary policy, which demonstrates the continuation of the current "soft" rate. Against this background, the price may rise to 113.65, and then to 114.00.

* The presented market analysis is informative and does not constitute a guide to the transaction.