Neither the news about the signed law on tax reform by the US President nor the good fundamental statistics from the United States did not support the US dollar, as the currency continued to decline gradually against the European currency.

As we all know, President of the United States Donald Trump signed a law on tax reform and a law on extending the financing of government spending at the end of last week.

Be mindful that under the new bill on tax reform, the corporate income tax will be reduced to the lowest level since 1939. This will also reduce taxes on household incomes.

Good data on the growth of durable good orders in the US did not support the US dollar. The growth of orders is an indicator of how much Americans believe in their economies without forcing them to think about economy and savings.

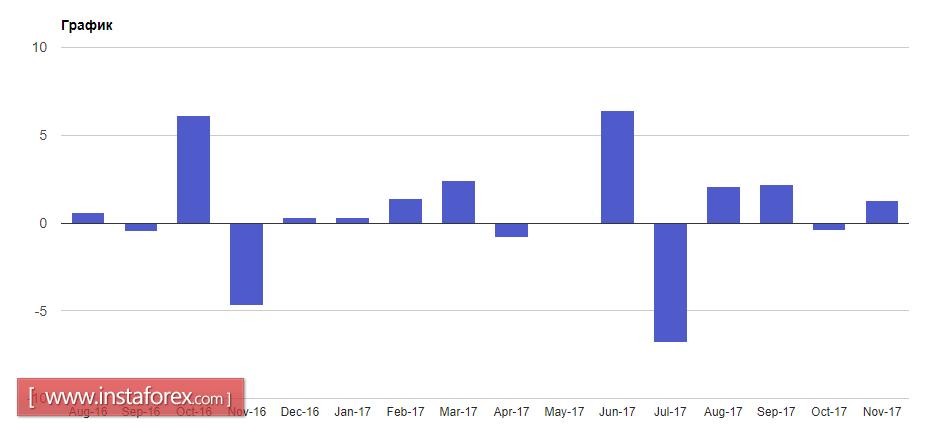

According to the report of the US Department of Commerce, orders for durable goods in November this year increased by 1.3% compared to the previous month and amounted to 241.36 billion US dollars. The leader in this growth was orders for aircraft and cars.

The statistics speak for itself, which indicate that the Americans spent more money in November 2017 and save less.

According to the report of the US Department of Commerce, spending by Americans in November rose by 0.6% compared to the previous month. The growth in savings slowed. In November, the amount of savings was 2.9% of personal income compared to 3.2% in October.

Personal incomes of Americans in November grew by 0.3% compared to the previous month. Economists expected that expenses and revenues would show a monthly growth of 0.4%.

The good condition of the property market is also a good indicator of a stable economy. According to the US Department of Commerce, sales of new homes in the US for November 2017 rose again, reaching a maximum level for more than ten years.

Thus, home sales in the primary housing market increased by 17.5% and amounted to 733,000 houses per year. While economists had expected 651,000 of homes sales a year. In comparison with the same period of the previous year, sales increased by 26.6%.

It is possible that weak data on US consumer sentiment in December could have a negative impact on the US dollar at the end of the North American session on Friday.

According to the data, the final consumer sentiment index of the University of Michigan in December 2017 was 95.9 points against the preliminary value of 96.8 points. In October, the index was 98.5 points. Economists had expected the final index in December to be 97.1.

* The presented market analysis is informative and does not constitute a guide to the transaction.