EUR / USD and GBP / USD pairs

Today is the opening of post-holiday trades and the markets are in an optimistic mood regarding the prospects for the dollar. Last week, the US Congress extended the temporary budget financing without problems until January 19th. During the parliamentary elections in Catalonia Spain, the supporters of the independence of autonomy won. Despite the closure of trading floors, the most active traders sold European currencies since electronic exchanges continue to operate for 24-hours. The sales of new homes in the U.S. for November showed strong growth from 624,000 to 733,000, which has been the highest since July 2007. Personal incomes increased by 0.3%, personal expenses by 0.6%. The volume of orders for durable goods increased by 1.3%, but basic orders excluding motor vehicles fell by 0.1% against expectations of growth by 0.5%.

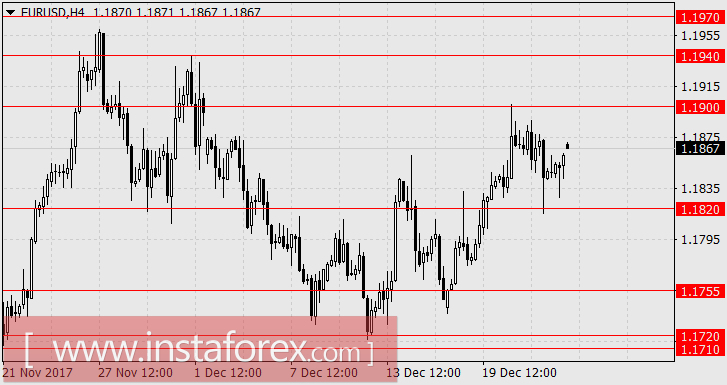

The holiday continues for today in Germany, France, Switzerland, and Great Britain. In the US, the S&P/Case-Shiller home price index will be released in 20 major cities in October, with a forecast of 6.3% y/y versus 6.2% y/y in September. The index of business activity in the manufacturing sector of Richmond in December may be reduced from 30 to 22, but business activity in the manufacturing industry in the Dallas region is projected to grow from 19 to 20. The euro is anticipated to decline at 1.1755 while the pound is falling towards the range of 1.3300/30.

USD / JPY pair

Japanese investors are optimistic about the new week, but they refrain from active actions without European and American colleagues. Today, a large block of economic indicators came out. The unemployment rate in Japan fell with an estimated value of 2.7% from 2.8% in November. Household expenses for the same month increased by 1.7% y/y from 0.0% y/y in October, with the forecast value of 0.6% y/y. The base consumer price index for the current month increased from 0.8% y/y to 0.9% y/y, with the forecast kept unchanged. The total CPI increased from 0.2% y/y to 0.6% y/y with the expected value of 0.5% y/y. Prices for corporate services increased from 0.8% y/y to 0.9% y/y.

The publication of the minutes from the last meeting of the Bank of Japan showed the mood of the board members to carry out "a powerful mitigation of monetary policy" without any additional measures. Investors were waiting for reservations about the possible strengthening of "if necessary," but with the growing indicators, it is clearly not needed. The Japanese stock index Nikkei 225 began to decline by -0.12%), while the speech of the Central Bank Head, Haruhiko Kuroda, was neutral. The Chinese Shanghai Composite adds 0.18% and the Korean Kospi SEU is 0.33%.

Tomorrow, the indicator for the volume of construction of new homes is expected to improve from -4.8% y/y to -2.5% y/y in November. On Thursday, retail sales for November could show an increase from -0.2% y/y to 1.1% y/y and the industrial production growth may reach 0.5% m/m. The rise of yen to 113.90 and a further increase in the range of 114.70/90 are anticipated.