Previously, US dollar ends with noticeable losses against the basket of major currencies. After the growth at the end of 2016 on the wave of Donald Trump's victory in the presidential elections and the increase in inflationary pressure on the markets, it lead to a disappointment. This was initially supported by a drop in expectations that the U.S. president would manage to implement his new tax reform, followed by a stabilize reduction of consumer inflation.

The market actively ignored the plans of the Fed during the year in the continuation and further raising of interest rates, which were raised in 2017 and planned three times. The question arises on why the dollar against the background of rate hikes never continue to strengthen?

This can be explained by two global causes that are mutually related. The first reason is the unstable political position of the president, which almost the entire local elite has taken up arms. Constant pressure on him and the risk of impeachment against the backdrop of an inflated scandal about "Russian interference" in the presidential election campaign have frightened investors and forced them to buy government debt securities. Yet, despite the relatively low-interest rates, it still bring some revenue.

The second reason is yields on government bonds continuously remain at fairly low levels and even declined in the moment In the wake of these events, which clearly put pressure on the dollar. Moreover, the yield curve on government bonds was flattening, which is a signal of a possible reversal to the recession. In the second half of the year, economic growth in the United States revived, which supported the upward trend in yields of government bonds and the U.S. dollar moved accordingly. In turn, the dollar could return to its May 2016 value, and nothing more based on the dynamics of the dollar index.

Thus, this year showed how vulnerable the dollar is to the wave of the reasons described above, and even the adoption of the new tax code does not provide him substantial support. Assessing the situation on the market, it can be assumed that the dollar may be under pressure at the beginning of the new year due to investors' expectations of the result of the adopted tax reform.

Forecast of the day:

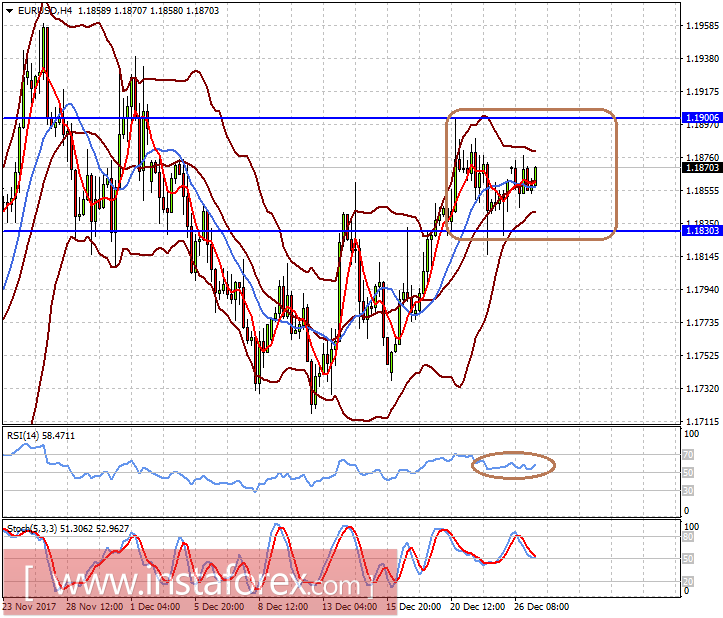

Today, the EUR / USD pair will most likely remain in the range 1.1830-1.1900 on the wave of continuation of the New Year holidays.

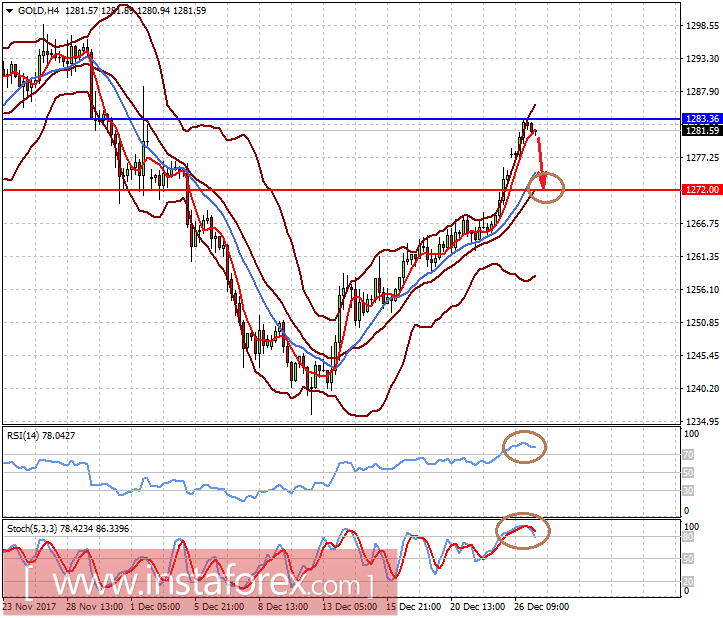

After the local growth of Gold, it can be adjusted against the background of an overbought technical signal. It can drop to 1272.00 on the current wave.